Date: Tue, Dec 09, 2025 | 05:59 PM GMT

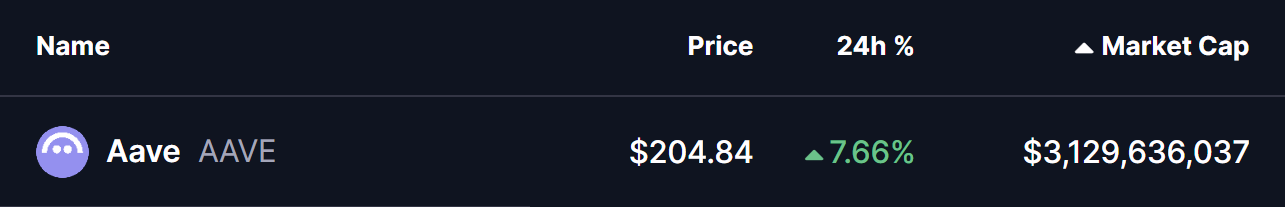

The crypto market witnessed a sharp bullish jolt in the last trading session, triggering nearly $264 million in short liquidations. Bitcoin (BTC) spiked 4%, Ethereum (ETH) rallied 8%, and the broader altcoin sector finally caught a breath of relief, including DeFi heavyweight Aave (AAVE).

The token climbed over 7% intraday, but price action alone isn’t the main story—its developing fractal is.

Source: Coinmarketcap

Source: Coinmarketcap

Fractal Setup Hints at a Bullish Continuation

AAVE continues to trade inside a broad symmetrical triangle, a high-compression structure that has governed its price behavior throughout 2025. Within this macro formation, price has repeatedly formed falling wedge patterns, each ending not in breakdown but in powerful upside breaks.

Back in April 2025, AAVE followed this exact script. After grinding along the wedge’s lower boundary, the token pushed through descending resistance, reclaimed its 100-day moving average, and delivered a clean 100% surge toward the triangle’s upper band. That rally was not impulsive chaos, but the logical expansion phase after extended compression.

AAVE Daily Chart/Coinsprobe (Source: Tradingview)

AAVE Daily Chart/Coinsprobe (Source: Tradingview)

Now, seven months later, history appears to be humming the same tune.

AAVE has once again bounced from the wedge floor and pierced through falling resistance today. The only piece missing from phase completion is a reclaim of the 100-day moving average, which currently sits around $239.04.

What’s Next for AAVE?

If the fractal rhythm holds, AAVE could be in the early stages of a new upside leg. A confirmed reclaim of the 100-day MA would serve as the technical trigger that shifts momentum fully back to buyers. In that scenario, price could begin its march toward the upper trendline of the triangle—an area aligning near $375, implying roughly 82% upside from current levels.

Yet, caution still matters. Until AAVE decisively holds above both resistance and the 100-day MA, the setup remains in less bullish condition. Fractals reflect tendencies, not promises. But even with that disclaimer, the chart speaks clearly: this is one of the most technically aligned bullish continuations forming in the DeFi sector right now.

AAVE has already shown how it behaves when compressed against its own geometry. The only question now is whether the market gives it the volume and conviction required to repeat the move.