New ETF Proposal Targets Bitcoin’s Overnight Returns as Outflows Hit Record Levels

Tidal Trust II has filed with the US Securities and Exchange Commission (SEC) for a Bitcoin exchange-traded fund (ETF) designed to provide exposure when US markets are closed. The filing comes as spot BTC ETFs posted their weakest month on record, marked by heavy outflows and rising concerns about potential price manipulation during the US

Tidal Trust II has filed with the US Securities and Exchange Commission (SEC) for a Bitcoin exchange-traded fund (ETF) designed to provide exposure when US markets are closed.

The filing comes as spot BTC ETFs posted their weakest month on record, marked by heavy outflows and rising concerns about potential price manipulation during the US market open.

SEC Filing Reveals ETF That Seeks to Bet on Bitcoin After Hours

The Form N-1A, submitted on Tuesday, proposes to add two ETFs to the existing fund. These include Nicholas Bitcoin and Treasuries AfterDark ETF and Nicholas Bitcoin Tail ETF.

According to the registration statement, the AfterDark ETF will not hold BTC directly. Instead, it will gain exposure through investments in Bitcoin futures, Bitcoin options, and Bitcoin ETFs or ETPs listed in the US.

It may utilize a Cayman Islands subsidiary to manage its positions. The objective is to pursue long-term capital appreciation through a systematic approach that targets Bitcoin’s overnight return profile. Meanwhile, the fund will hold short-term US Treasuries and cash equivalents during the daytime trading period.

“When utilizing Bitcoin Futures, the Fund trades these instruments during US overnight hours and closes them out shortly after the US market opens each trading day. When utilizing Bitcoin Underlying Funds, the Fund purchases a security at US market close, and then sells the position around US market open….When utilizing Bitcoin Options, the Fund typically enters into options positions that establish a synthetic long bitcoin position near the close of regular US trading hours. These positions are typically closed or unwound near the following market open, however, the Fund may hold these synthetic long positions longer term and offset them during US daytime trading hours by entering into a synthetic short position,,” the document reads.

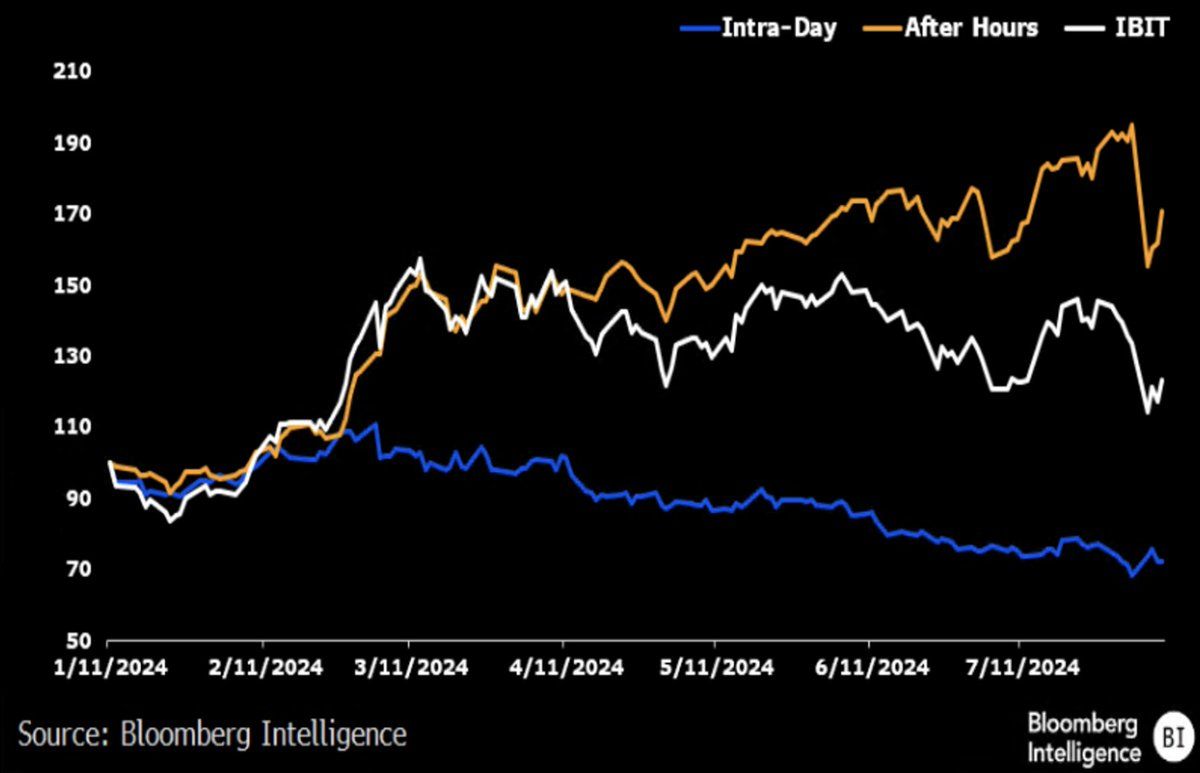

Bloomberg senior ETF analyst Eric Balchunas discussed the strategy in a recent X (formerly Twitter) post. He noted that internal research conducted last year showed a significant share of Bitcoin’s gains occurring during after-hours trading.

“Doesn’t mean the ETFs aren’t having impact. Some of this is positioning bc of the ETFs etc or derivatives based on flows etc etc. But yeah, bitcoin After Dark ETF could put up better returns, we’ll see tho,” Balchunas wrote.

Bitcoin After-Hours Returns. Source:

Bitcoin After-Hours Returns. Source:

This filing appears as industry watchers highlight alleged price manipulation during US daytime trading hours. Analysts have identified a recurring pattern of Bitcoin price drops around the market’s opening.

Bitcoin ETF Flows and Investor Sentiment Shift

Meanwhile, spot Bitcoin ETFs have been under significant pressure in the fourth quarter. Data from SoSoValue showed that monthly outflows reached a record $3.48 billion in November. BlackRock’s iShares Bitcoin ETF accounted for the largest share, recording $2.34 billion in outflows.

The heavy withdrawals coincided with a steep decline in Bitcoin’s price, which fell 17.4% in November, its worst monthly performance of the year. This has impacted investor confidence and contributed to renewed caution across digital asset markets.

Outflows extended into December, with another $87.77 million leaving spot Bitcoin ETFs in the first week of the month. Still, the trend showed some signs of stabilizing. On December 9, the funds posted a notable rebound, drawing $151.74 million in inflows.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Federal Reserve Strategies and the Rising Worth of Solana: How Changes in Monetary Policy Propel Institutions Toward High-Performance Blockchain Adoption

- Fed's 2025 rate cuts and QT halt injected $72.35B liquidity, coinciding with a 3.01% Solana price surge. - Institutional capital shifted toward Solana due to infrastructure upgrades and accommodative monetary policy. - Regulatory frameworks like MiCA and GENIUS Act boosted Solana's institutional appeal despite macroeconomic volatility. - Fed's policy normalization accelerated blockchain adoption, positioning Solana as a long-term investment amid uncertainty.

ICP Caffeine AI's Rapid Growth and What It Means for Cryptocurrency Markets Powered by AI

- DFINITY's ICP Caffeine AI (launched July 2025) merges AI app development with low-code/no-code accessibility via chain-of-chains architecture. - Platform's $237B TVL by Q3 2025 signals institutional confidence in financial sector applications despite 22.4% dApp activity decline. - Token price volatility (11% drop by 2025) and reverse-gas mechanism raise concerns about adoption sustainability and valuation stability. - Analysts project $4.4-$20.2 price range for ICP in 2025, emphasizing need for $6.50+ pr

SOL Price Forecast for Early 2025: Network Enhancements and Growing Institutional Interest Transform Solana’s Core Dynamics

- Solana's 2025 advancements in scalability (65k TPS) and sub-150ms finality position it as a leading blockchain for institutional finance. - Institutional adoption by Franklin Templeton, Securitize, and Société Générale accelerates asset tokenization and cross-border payment solutions. - Marinade Select's $436M TVL and Bitwise/Grayscale ETFs drive institutional capital inflows, supporting bullish SOL price forecasts ($150–$300 in 2025). - Regulatory clarity and partnerships with Visa/Coinbase reinforce So

Reddit is currently experimenting with verification badges