Terra (LUNA) Surges Over 55%: Here’s What’s Driving the Rally

Terra (LUNA) has emerged as one of the top gainers in the cryptocurrency market today, having recorded a strong double-digit price surge. The sharp rally coincides with the sentencing of founder Do Kwon, scheduled for today, and recent ecosystem updates that have drawn attention to the network. Why is Terra (LUNA) Token’s Price Surging? The

Terra (LUNA) has emerged as one of the top gainers in the cryptocurrency market today, having recorded a strong double-digit price surge.

The sharp rally coincides with the sentencing of founder Do Kwon, scheduled for today, and recent ecosystem updates that have drawn attention to the network.

Why is Terra (LUNA) Token’s Price Surging?

The altcoin began rallying late last week, with momentum accelerating on Monday following the v2.18.0 network upgrade. Major exchanges such as and supported the update, temporarily suspending deposits and withdrawals to ensure a smooth transition for users.

This contributed to a noticeable boost in market sentiment. In fact, the token surged to a 7-month high yesterday. The uptrend has continued today as well.

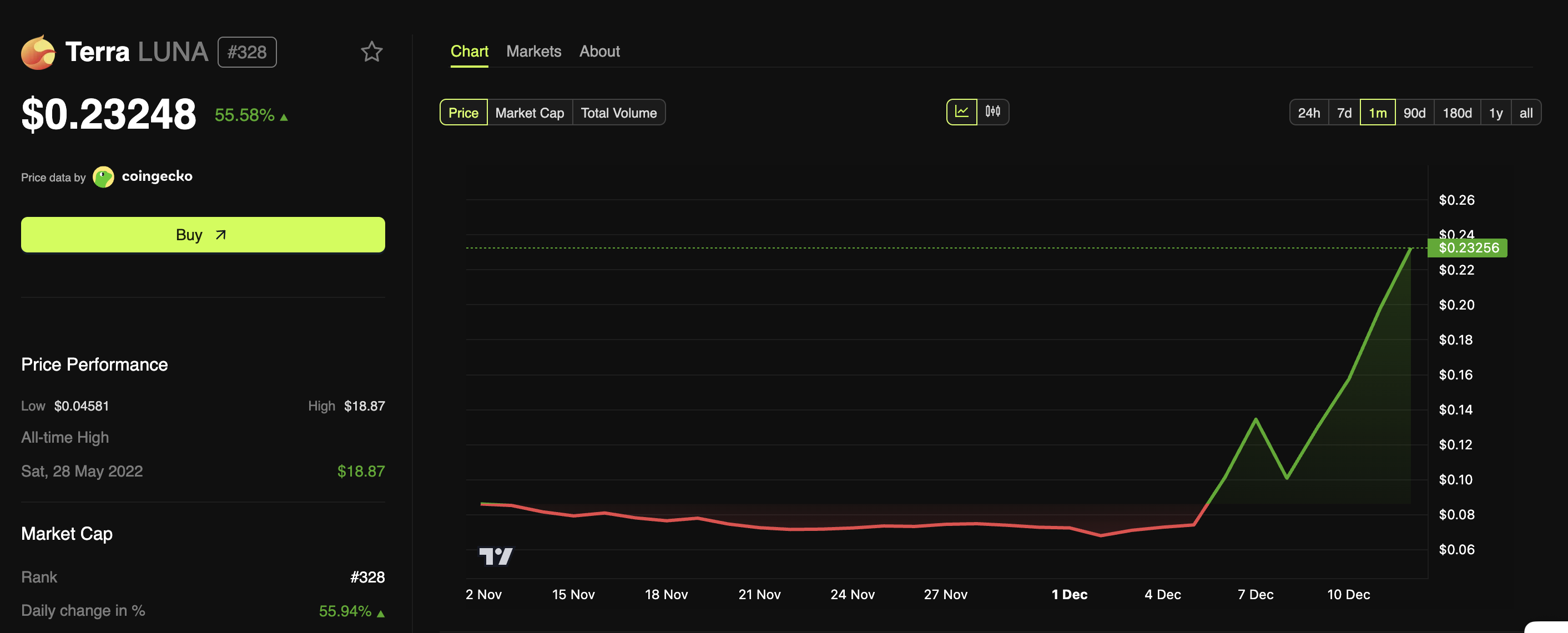

BeInCrypto Markets data showed that LUNA’s price has appreciated by 55.58% over the past 24 hours. At the time of writing, the altcoin was trading at $0.232.

Terra (LUNA) Price Performance. Source:

Terra (LUNA) Price Performance. Source:

Notably, today’s surge positioned LUNA as the second-largest daily gainer on . Trading activity has also increased, with daily volume surging 192.10% to exceed $700 million.

Beyond the network upgrade, another major catalyst driving heightened attention is the sentencing of Terraform Labs founder Do Kwon.

Kwon is set to appear before Judge Engelmayer in the Southern District of New York today. The Department of Justice is seeking a 12-year prison sentence.

However, an analyst noted that sentences can differ from requests. Sam Bankman-Fried received 25 years while prosecutors had asked for 40-50 years. Alex Mashinsky received a 12-year sentence, despite a 20-year request.

“I’m not gonna speculate on the amount of time he will get to be exact, but it would be naive to think he gets 12+ years, especially when considering time served,” Camol posted.

Nonetheless, Toknex has raised concerns about LUNA’s price rally, warning traders not to view the surge as a genuine recovery.

“This is not a comeback. This is not fundamentals. It is just community driven trading pressure. The real Terra ecosystem died in 2022. This new LUNA has no narrative and no lasting value. It only moves when traders feel like gambling on volatility,” Toknex wrote.

As the sentencing approaches, the community has shown heightened interest in not only LUNA but also Terra Luna Classic (LUNC). The renewed attention has pushed both tokens to the top of CoinGecko’s trending list today.

BeInCrypto reported last week that LUNC’s price surged 100% after a journalist wore a vintage Terra Luna t-shirt at the Binance Blockchain Week in Dubai.

Thus, as both LUNA and LUNC move back into the spotlight, market participants remain divided on whether the latest upswing represents genuine revitalization or simply another volatility-driven breakout.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hyperliquid (HYPE) Price Rally: Key Factors Behind Institutional Embrace in 2025

- Hyperliquid's HIP-3 upgrade enabled permissionless perpetual markets, driving $400B+ trading volume and 32% blockchain revenue share in 2025. - Institutional adoption accelerated via 90% fee reductions, TVL of $2.15B, and partnerships with Anchorage Digital and Circle's CCTP V2. - HYPE's deflationary model (97% fees fund buybacks) and $1.3B buyback fund fueled price surges, mirroring MicroStrategy's Bitcoin strategy. - Regulatory alignment with GENIUS Act/MiCAR and USDH stablecoin compliance strengthened

HYPE Token's Unpredictable Rise: Analyzing Altcoin Hype After the 2025 Market Overhaul

- HYPE token's 2025 volatility surged with Hyperliquid's $47B weekly trading volume, driven by whale accumulation and $340M buybacks. - Institutional support via HIP-3 protocol upgrades boosted open interest to $15B, but technical indicators signaled short-term fragility. - Regulatory shifts in UAE and Fed policy amplified risks, while social media FOMO triggered extreme price swings between $41.28 and $27.43. - Market share erosion to <20% and $11M liquidations exposed structural weaknesses despite instit

The Value of Including CFTC-Approved Clean Energy Marketplaces in Contemporary Investment Portfolios

- CFTC-approved clean energy platforms like CleanTrade enable institutional investors to hedge risks, diversify portfolios, and align with ESG goals through renewable energy derivatives. - CleanTrade's $16B in two-month notional value highlights urgent demand for scalable, transparent infrastructure to access low-carbon assets with real-time analytics and risk tools. - These platforms reduce market fragmentation by standardizing VPPAs, PPAs, and RECs, offering verifiable decarbonization pathways and dynami

The Influence of Educational Institutions on the Development of AI-Powered Industries

- Farmingdale State College (FSC) invests $75M in AI infrastructure , doubling tech enrollment and launching an AI Management degree blending technical and business skills. - Industry partnerships with Tesla and cybersecurity firms, plus 80% graduate employment rates, highlight FSC's success in aligning education with AI-driven workforce demands. - FSC's RAM mentorship program and NSF-funded AI ethics research foster interdisciplinary innovation, addressing supply chain and healthcare challenges through ap