Litecoin Is Being Ignored by Retail — While Institutions Quietly Accumulate 3.7 Million LTC

Litecoin (LTC) has not escaped the shadow of its long downtrend since 2021. Its weak price performance has caused many retail investors to overlook this “legacy” altcoin. However, new reports reveal quietly growing positive signals. These signals form the basis for analysts to predict that the price may soon break above $100. Institutions Accumulate 3.7

Litecoin (LTC) has not escaped the shadow of its long downtrend since 2021. Its weak price performance has caused many retail investors to overlook this “legacy” altcoin.

However, new reports reveal quietly growing positive signals. These signals form the basis for analysts to predict that the price may soon break above $100.

Institutions Accumulate 3.7 Million LTC Despite Falling Prices

This year, as companies and institutions expand their digital-asset reserves and launch crypto ETFs, Litecoin has also joined this trend.

According to data from Litecoin Register, by the end of 2025, Treasuries and ETFs held nearly 3.7 million LTC. The total value exceeded $296 million.

Total Treasury & ETF Holdings (LTC). Source:

Litecoin Register

Total Treasury & ETF Holdings (LTC). Source:

Litecoin Register

“There are now over 3.7 million Litecoin being held in 10 public companies and investment funds. An increase of one million LTC since August 2025,” the Litecoin Foundation commented.

The chart illustrates a persistent accumulation over the past year. This trend continued even though LTC has not set a new high in 2025.

Notable holders include Grayscale, Lite Strategy, and Luxxfolio Holdings. Luxxfolio Holdings aims to accumulate 1 million LTC by 2026.

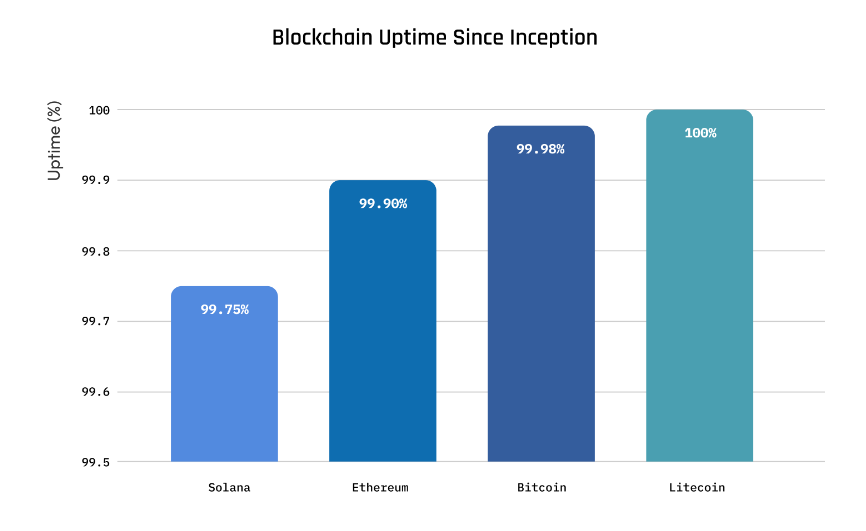

In addition, the “Silver Standard” report from LitVM highlights Litecoin as the blockchain with the highest uptime among legacy networks. It has maintained 100% uptime for the past 12 years.

Blockchain Uptime Since Inception. Source:

LitVM

Blockchain Uptime Since Inception. Source:

LitVM

Uptime measures the duration of a network’s continuous operation without interruption. A blockchain with high uptime demonstrates system stability, security, and reliability in processing transactions without technical failures.

“Institutions want sound money. They want LTC’s 12-year reliability,” investor Creed stated.

Fundamental data does not always create an immediate short-term impact. However, the short-term outlook from derivatives markets appears highly positive.

Binance top traders are rapidly increasing their $LTC long positions.

— CW (@CW8900) December 12, 2025

Top traders on Binance rapidly increased long LTC positions in the second week of December. Their behavior signals strong bullish expectations.

These factors may explain why several long-time investors continue to trust LTC. A crypto investor active since 2015, Lucky, believes that LTC will recover soon.

“I don’t see $LTC staying below $100 for much longer,” Lucky predicted.

Litecoin price recovery scenario. Source:

Lucky

Litecoin price recovery scenario. Source:

Lucky

LTC’s situation resembles that of several altcoins with strong fundamentals but slow price action, such as XRP, XLM, LINK, and INJ.

Experts also argue that only altcoins supported by liquidity from DATs and ETFs can survive and grow sustainably in the new phase of the market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The PENGU USDT Sell Alert: Is This a Turning Point for Stablecoin Approaches?

- PENGU/USDT's 2025 collapse triggered a $128M liquidity shortfall, exposing algorithmic stablecoin fragility and accelerating market shift to regulated alternatives. - USDC's market cap surged to $77.6B by 2025, while MiCA-compliant euro-stablecoins gained $680M in cross-border adoption amid regulatory clarity. - DeFi protocols adopted oracle validation and reserve-backed models post-PENGU, reducing exploit losses by 90% since 2020 through institutional-grade security upgrades. - Regulators now prioritize

Emerging Prospects in EdTech and AI-Powered Learning Systems: Ways Educational Institutions Are Transforming Programs and Enhancing Student Achievement

- AI is transforming education by reshaping curricula, enhancing student engagement, and optimizing institutional efficiency. - Universities like Florida and ASU integrate AI literacy across disciplines, offering microcredentials and fostering innovation. - AI tools like Georgia Tech’s Jill Watson and Sydney’s Smart Sparrow boost performance and engagement through personalized learning. - AI streamlines administrative tasks but faces challenges like ethical misuse and skill gaps, requiring structured train

Anthropological Perspectives on Technology and Their Impact on Education and Workforce Preparedness for the Future

- Interdisciplinary STEM/STEAM education integrates technology tools like AI and VR to bridge theory and real-world skills, driven by $163B global edtech growth. - U.S. faces 411,500 STEM teacher shortages and 28% female workforce representation gaps, prompting equity-focused programs like Girls Who Code. - STEM occupations earn $103K median wages (vs. $48K non-STEM), with 10.4% job growth projected through 2033, driving investor opportunities in edtech and workforce alignment. - Strategic investments in t

The Revival of Educational Technology in Higher Education After the Pandemic

- Global EdTech market grows to $7.3T by 2025, driven by hybrid learning and AI/AR/VR adoption in higher education. - Institutions like MIT and Harvard integrate AI across disciplines, boosting enrollment and workforce alignment through $350M-$500M investments. - EdTech platforms enabling personalized learning and immersive experiences see rising demand, with 45% annual growth in AI-related programs since 2020. - Undervalued EdTech stocks offer investment opportunities as $16B+ VC funding accelerates innov