Tether Moves to Buy Juventus in Landmark Crypto Sports Deal

Tether has submitted a binding all-cash proposal to acquire a controlling stake in Juventus Football Club, committing up to €1 billion to support the 36-time Serie A champion in a landmark crypto-to-sports deal.

Tether has submitted a binding all-cash proposal to acquire Exor’s entire 65.4% stake in Juventus Football Club, the most successful club in Italian football history and a 36-time Serie A champion.

If approved by regulators and accepted by Exor, Tether said it would launch a public tender offer for the remaining shares at the same price, fully funded with its own capital. The company also committed to invest up to €1 billion to support and develop the club following completion.

What the Juventus Deal Means for Tether

The proposal, announced on December 12, marks one of the most ambitious moves yet by a crypto company into elite global sport. It signals a strategic shift for Tether from a pure stablecoin issuer to a long-term capital allocator in traditional institutions.

In the announcement, Tether CEO Paolo Ardoino described Juventus as a symbol of discipline, resilience, and continuity—values he said mirror how Tether has been built.

JUST IN: Tether wants to acquire Italian football club Juventus. Juventus is a 36-time domestic league champion, making it the most successful club in Italian football history.

— BeInCrypto (@beincrypto) December 12, 2025

From a business perspective, the acquisition would give Tether control of a globally recognised sports brand, expanding its footprint beyond financial infrastructure into media, entertainment, and global fan economies.

Unlike short-term sponsorships or fan token partnerships, ownership places Tether at the centre of governance and long-term strategy.

Tether Will Invest €1 Billion in Juvestus if the Deal Goes Through.

Tether Will Invest €1 Billion in Juvestus if the Deal Goes Through.

The move also reinforces Tether’s claim that it is operating from a position of strong balance-sheet health, able to deploy billions in capital without external financing.

Part of a Broader Expansion Strategy

The Juventus proposal follows a series of high-profile moves by Tether and USDT in recent weeks.

Tether recently secured regulatory recognition for USDT as an Accepted Fiat-Referenced Token in Abu Dhabi’s ADGM, expanding regulated use of the stablecoin across multiple blockchains.

At the same time, the company has explored tokenising its own equity, signalling openness to new corporate structures built on blockchain rails.

Beyond finance, Tether has also pushed into AI, robotics, and privacy-focused consumer technology, backing robotics firms and launching privacy-centric health and AI products.

Together, these developments point to a strategy of diversifying well beyond stablecoin issuance while

Juventus and Crypto: Not a First Connection

Juventus is no stranger to crypto involvement.

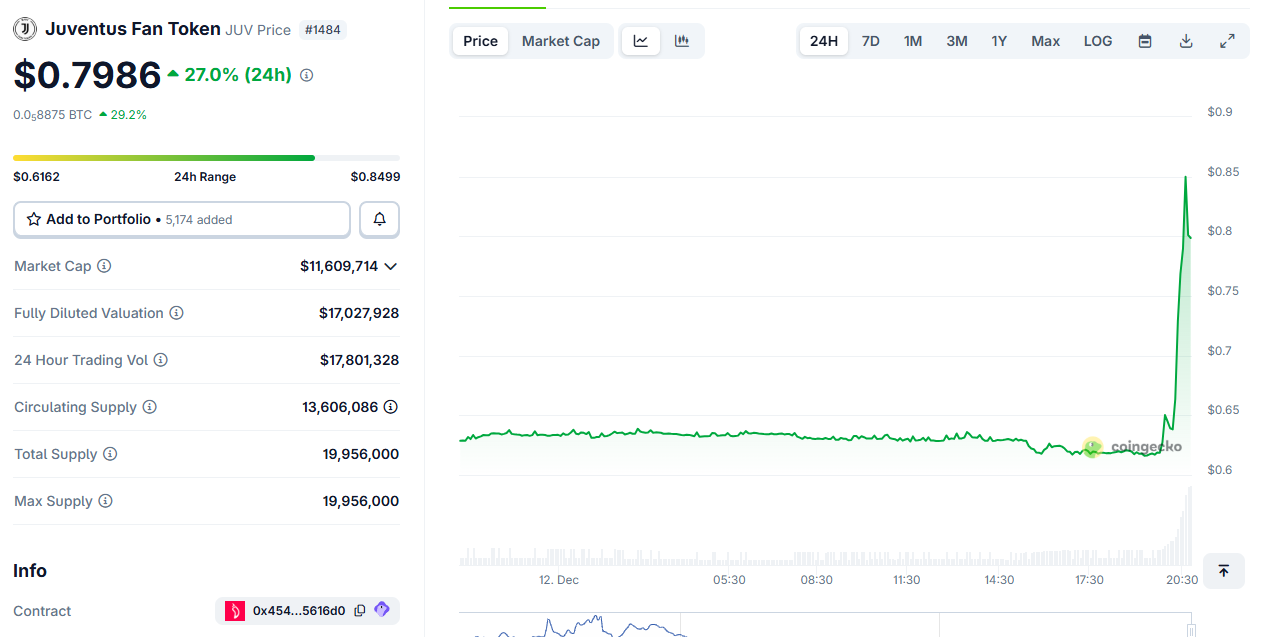

The club previously launched the $JUV fan token on the Chiliz and Socios platform, allowing fans to participate in polls and engagement initiatives. Juventus has also partnered with crypto companies as sponsors, including exchange-led branding deals in recent seasons.

JUV Fan Token Surges After Tether Announcement. Source:

JUV Fan Token Surges After Tether Announcement. Source:

However, Tether’s proposal goes far beyond past crypto partnerships. If completed, it would represent full operational control by a digital asset firm—an unprecedented step for a club of Juventus’ stature.

The transaction remains subject to Exor’s acceptance, definitive legal agreements, and regulatory approvals. If those conditions are met, Tether plans to proceed with a public tender offer for remaining shares.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The PENGU USDT Sell Alert: Is This a Turning Point for Stablecoin Approaches?

- PENGU/USDT's 2025 collapse triggered a $128M liquidity shortfall, exposing algorithmic stablecoin fragility and accelerating market shift to regulated alternatives. - USDC's market cap surged to $77.6B by 2025, while MiCA-compliant euro-stablecoins gained $680M in cross-border adoption amid regulatory clarity. - DeFi protocols adopted oracle validation and reserve-backed models post-PENGU, reducing exploit losses by 90% since 2020 through institutional-grade security upgrades. - Regulators now prioritize

Emerging Prospects in EdTech and AI-Powered Learning Systems: Ways Educational Institutions Are Transforming Programs and Enhancing Student Achievement

- AI is transforming education by reshaping curricula, enhancing student engagement, and optimizing institutional efficiency. - Universities like Florida and ASU integrate AI literacy across disciplines, offering microcredentials and fostering innovation. - AI tools like Georgia Tech’s Jill Watson and Sydney’s Smart Sparrow boost performance and engagement through personalized learning. - AI streamlines administrative tasks but faces challenges like ethical misuse and skill gaps, requiring structured train

Anthropological Perspectives on Technology and Their Impact on Education and Workforce Preparedness for the Future

- Interdisciplinary STEM/STEAM education integrates technology tools like AI and VR to bridge theory and real-world skills, driven by $163B global edtech growth. - U.S. faces 411,500 STEM teacher shortages and 28% female workforce representation gaps, prompting equity-focused programs like Girls Who Code. - STEM occupations earn $103K median wages (vs. $48K non-STEM), with 10.4% job growth projected through 2033, driving investor opportunities in edtech and workforce alignment. - Strategic investments in t

The Revival of Educational Technology in Higher Education After the Pandemic

- Global EdTech market grows to $7.3T by 2025, driven by hybrid learning and AI/AR/VR adoption in higher education. - Institutions like MIT and Harvard integrate AI across disciplines, boosting enrollment and workforce alignment through $350M-$500M investments. - EdTech platforms enabling personalized learning and immersive experiences see rising demand, with 45% annual growth in AI-related programs since 2020. - Undervalued EdTech stocks offer investment opportunities as $16B+ VC funding accelerates innov