Bitget US Stock Morning Brief | Fed’s Third Rate Cut Faces Dissent; AI Tech Valuations Hit Hard; Cannabis Stocks Soar on Policy Optimism (December 15, 2025)

I. Key News Highlights

Federal Reserve Developments

Fed Completes Third 25bp Rate Cut of the Year Amid Policy Dissent

- As anticipated, the Federal Reserve cut its benchmark interest rate by 25 basis points at this week’s policy meeting. However, two officials dissented, calling for more evidence of subdued inflation before further easing.

- Key Points: Chicago Fed President Austan Goolsbee favors waiting for data to confirm a downward inflation trend; Philadelphia Fed’s new voting member, Patrick Harker, sees higher risks in the labor market than inflation pressures and supports more room for rate cuts; Cleveland Fed’s Loretta Mester advocates maintaining restrictive policy to curb inflation.

- Market Impact: The move has bolstered economic growth expectations and prompted a rotation into cyclical stocks, but it has also heightened concerns over policy uncertainty. Treasury yields rebounded, and tech stock valuations are now under greater scrutiny.

Trump Names Top Contender to Succeed Fed Chair

- President-elect Trump publicly stated for the first time that Kevin Warsh has become his top choice to succeed as Federal Reserve Chair, with a term starting in May 2026.

- Key Points: Warsh’s policy views are closely aligned with Trump’s preference for lower rates and he has met with the latter; Chief Economic Advisor Kevin Hassett emphasized that, if appointed, Warsh would listen to the President’s views while ensuring independent decision-making.

- Market Impact: This signals a potentially more dovish policy path ahead, lifting investor optimism regarding future rates. However, it also raises concerns over the Fed’s independence, which could drive increased volatility in long-term bonds.

Global Commodities

Gold Hits Record High, Oil Prices Remain Rangebound

- Gold prices surged to a historic $4,381/oz, buoyed by a Fed-led rate cut environment, marking the best annual gain since 1979.

- Key Points: The 10-year Treasury yield rose above 4.18%, and the 30-year topped 4.85%. WTI crude hovered at $57/bbl and Brent at $61/bbl, weighed down by sluggish global demand.

- Market Impact: The commodities market showed divergent trends, with gold’s safe-haven appeal increasing, while oil’s weakness reflects uncertainty over economic recovery, potentially weighing on energy stocks.

Macroeconomic Policies

US Lifts Sanctions on Belarus Potash Sector, Paving Way for Improved Ties

- As part of a swap deal, the US lifted restrictions on Belarus’s potash sector in exchange for the release of 123 prisoners, aiming to normalize bilateral relations.

- Key Points: President Lukashenko held closed-door talks with the US envoy Col, focusing on economic cooperation; the move stems from a Trump-era shift in foreign policy.

- Market Impact: This is expected to stabilize the global fertilizer supply chain and potentially benefit agriculture stocks. However, investors should monitor any geopolitical repercussions for commodity prices.

EU Freezes Russian Central Bank Assets Indefinitely, Backs Ukraine Loan Plan

- The EU has reached an agreement to indefinitely freeze Russian central bank assets in Europe, bypassing opposition from countries like Hungary, to ensure funds are used for Ukrainian aid.

- Key Points: The measure provides guarantees for Ukraine’s “reparations loan”; Russia has filed a lawsuit against the European Clearing Bank.

- Market Impact: The move escalates geopolitical tensions, likely boosting demand for safe havens, but also injects uncertainty into Europe’s energy and financial markets. Developments are closely linked to US-Ukraine-Berlin peace talks.

SEC Commissioner Criticizes Deregulatory Trend, Warns of “Casino-Like” Markets

- Outgoing SEC Commissioner Caroline Crenshaw cautioned that the “deregulation” wave could turn financial markets into casinos, benefiting only insiders.

- Key Points: She targeted the year-long trend of looser securities regulation, emphasizing the need to protect investors' ability to accumulate wealth sustainably.

- Market Impact: Crenshaw’s comments highlight splits within regulatory circles, potentially curbing short-term speculation in high-risk assets, but supporting healthy market development over the long term. This contrasts with the current dovish Fed policy stance.

II. US Market Recap

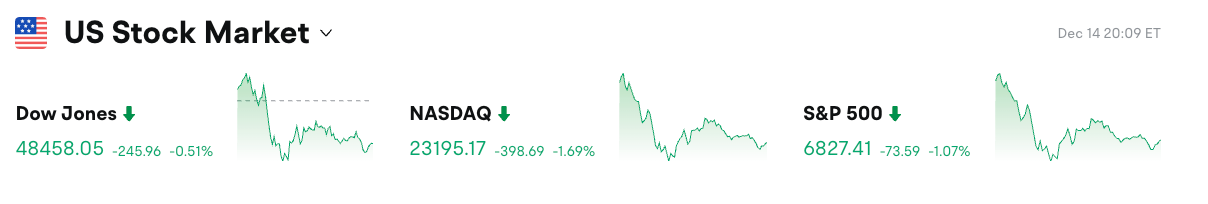

Index Performance

- Dow Jones: -0.51% (up 1% for the week), supported by value stock rotation and Fed rate-cut optimism.

- S&P 500: -1.07% (down 0.63% for the week), retreating from record levels as technology sector weakness weighed.

- Nasdaq: -1.69% (down 1.62% for the week), pressured by tech valuation concerns and rising fears of an AI bubble.

Tech Giants

- Nvidia: -3%, as increasing uncertainty over AI returns led to revised chip demand forecasts.

- Google: -1%+, despite launching its AI voice interpretation feature, tech sector overall underperformed.

- Microsoft: -1%+, with cloud growth expectations hit by AI infrastructure delays.

- Amazon: -1%+, as both e-commerce and cloud businesses faced valuation resets.

- Meta: -1%+, with slowing social platform growth tied to fluctuations in the ad market.

- Tesla: +2%+, as renewed EV demand helped offset tech sector weakness.

- Apple: Flat, little movement but still influenced by the AI narrative.

Overall, most “Magnificent Seven” names declined, primarily due to weaker-than-expected AI-related spending during earnings season, prompting a rotation from growth to value stocks.

Sector Highlights

Semiconductors Lead Declines

- Names: Broadcom down 11%, Micron down over 6%.

- Drivers: Earnings showed robust AI orders but margin pressures and doubts about infrastructure buildout pace.

Storage Stocks Under Pressure

- Names: SanDisk -15%, Western Digital also lower.

- Drivers: AI-fueled storage demand triggered a rally, but short-term overvaluation led to profit-taking.

Cannabis Stocks Surge

- Names: Tilray +44%, Canopy Growth +54%.

- Drivers: Reports of potential cannabis rescheduling under the Trump administration boosted policy optimism.

Auto Manufacturers Advance

- Names: Rivian +17%, Polestar +19%+.

- Drivers: New autonomous driving features and subscription services enhanced competitiveness.

Nuclear & Crypto Miners Drop

- Names: Oklo -15%+, Hut 8 -12%+.

- Drivers: Energy demand swings and Bitcoin’s pullback, coupled with fresh regulatory uncertainty.

III. In-Depth Stock Analysis

Broadcom – Beat on Earnings, Disappointing AI Guidance

Summary:

Broadcom reported a record $19.1 billion in quarterly sales, topping analyst estimates of $18.5 billion. However, its AI revenue guidance fell short of lofty Wall Street projections, and margins narrowed to 76.9% from 79% y/y. AI backlog stood at $73 billion, to be delivered over six quarters. An $11 billion server deal with Anthropic featured lower margins, sinking shares 11%.

Market View:

While JPMorgan and others see AI spend breaking new records in 2026, near-term visibility is lacking. Broadcom’s chip design strength is noted, but temporary margin pressure is a risk.

Investment Takeaway:

Volatility may persist in the short term. Long-term AI demand remains a key support; value investors should monitor for further pullbacks.

Oracle – Data Center Buildout Delay

Summary:

Oracle faces potential delays in completing certain OpenAI data centers, pushing timelines from 2027 to 2028 due to labor and material shortages. Previous earnings already missed forecasts, pushing shares down another 6% and 45% off September highs. The company denied any broad-based delays, but market concerns over AI infrastructure bottlenecks have grown.

Market View:

Opinions are mixed: some see this as a supply chain challenge, while JPMorgan still likes Oracle as a top cloud and AI play, expecting over $400 billion in spending.

Investment Takeaway:

With AI enthusiasm in its fourth year, Oracle needs to prove execution capability. Investors should track supply chain improvements and avoid short-term chasing.

Lululemon – Strong Q3 Results

Summary:

Lululemon posted Q3 diluted EPS of $2.59 (vs. $2.22 estimated), with revenue up 7% year-on-year to $2.6 billion. International sales surged 18%. Q4 revenue guidance: $3.5–3.58 billion; full-year: $10.96–11.0 billion. CEO to leave by end of January, interim co-chiefs named, stock jumped 9%.

Market View:

Analysts applaud its international expansion and year-on-year recovery, but CEO transition is a watch point. Most institutions raised their price targets and see it as a consumer standout.

Investment Takeaway:

Rebounding demand is positive for the medium/long term. Monitor CEO succession for potential brand impacts.

Rivian – Launches Autonomous Driving Upgrade

Summary:

Rivian introduced its $2,500 Autonomy+ subscription (or $49.99/month), with new AI chips enabling hands-free driving in early 2026. The move boosts competitive positioning, with shares up 17%.

Market View:

Analysts see Rivian challenging Tesla’s dominance and expect market share gains, but note adoption rates will be key.

Investment Takeaway:

Innovation is a powerful growth lever. Track vehicle sales and the broader electric transition as positive short-term catalysts.

SpaceX – Eyes 2026 IPO

Summary:

SpaceX told employees it is preparing for a potential 2026 IPO, with internal shares priced at $421 and a valuation doubling to $800 billion in six months. The CFO stressed the timeline is uncertain, but new funds will support expansion.

Market View:

Analysts consider SpaceX an IPO bellwether, alongside Anthropic ($350B) and OpenAI ($500B), and are optimistic on the aerospace-AI nexus.

Investment Takeaway:

High valuations translate to higher risks, but long-term space economy upside is substantial. Liquidity merits attention post-listing.

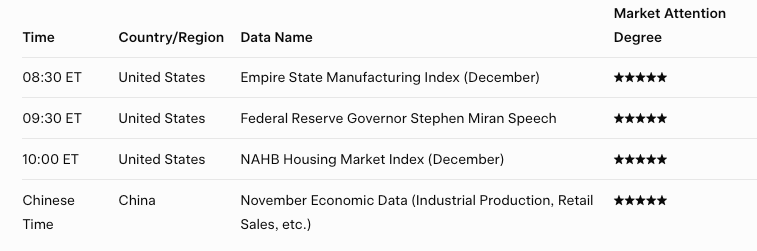

IV. Today’s Market Calendar

Key Data Releases & Events

- Fed Governor Speech: 09:30 ET – Focus on latest monetary policy views and economic assessment regarding inflation and employment.

Disclaimer: The above content is AI-researched and human-curated for publication purposes only. This does not constitute investment advice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Passkey Wallet: The “Tesla Moment” for Crypto Wallets

The real transformation lies not in better protecting keys, but in making them impossible to steal. Welcome to the era of Passkey wallets.

The market is not driven by individuals, but dominated by emotions: how trading psychology determines price trends

Crypto Coins Surge: Major Unlocks Impact Short-Term Market Dynamics

In Brief Crypto market anticipates large-scale unlocks, exceeding $309 million in total market value. Significant cliff-type unlocks involve ZK and ZRO, impacting market dynamics. RAIN, SOL, TRUMP, and WLD highlight notable linear unlocks within the same period.

Bitcoin Stable But Fragile Ahead Of BoJ Decision