- Virtual Protocol expands through strong fundamentals and major partnerships across AI and Web3 sectors.

- Sui Network shows fast performance supported by a loyal community and strong resilience.

- Toncoin grows through Telegram’s massive ecosystem and a thriving blockchain gaming environment.

The crypto market is always packed with noise but strong and promising projects continue to stand out. These three assets show real progress, strong fundamentals, and growing adoption across several fast-moving sectors. Each project builds value through clear utility, strong partnerships, and steady user growth. Traders who track early momentum often search for assets with this kind of structure. This guide highlights three promising picks with growing potential for long-term gains.

Virtual Protocol (VIRTUAL)

Source: Trading View

Source: Trading View

Virtual Protocol targets fast-growing areas like AI, VR, and Web3 virtual experiences. The project aims to power next-generation digital interactions through strong infrastructure support. High transaction speeds and low costs also give the network a strong edge. Scalability helps support heavy usage across several digital environments.

Partnerships strengthen growth across the broader digital space. Names like Nilion, Animoca Brands, Virtual Labs, and Aikoi.ai support large adoption goals. These partnerships help Virtual Protocol grow toward a larger role in the next phase of Web3 development. Many traders watch this trend because strong fundamentals often support long-term value.

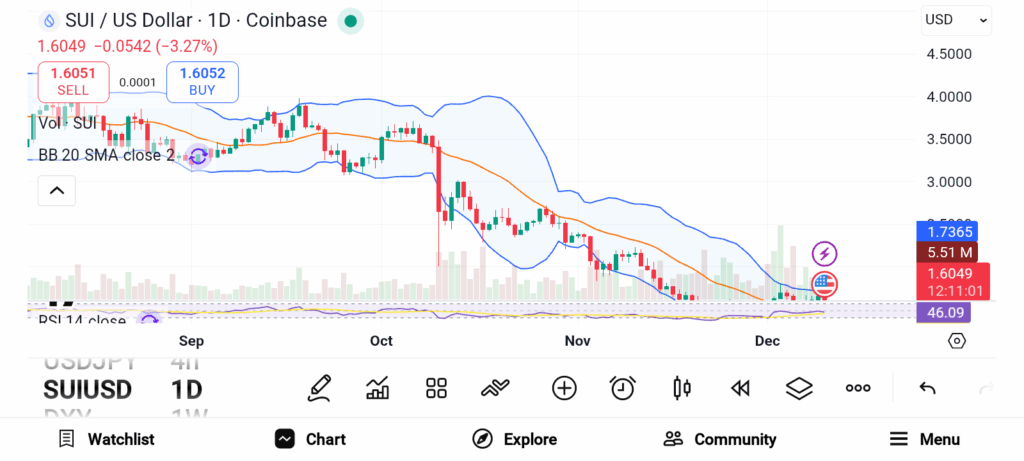

Sui Network (SUI)

Source: Trading View

Source: Trading View

Sui Network holds a strong position as one of the fastest layer 1 platforms. Many traders call the network a potential Solana rival because of its strong speed and strong technology. A large community also supports long-term growth through steady demand. SUI’s price action shows strong resilience during tough market periods.

Even during heavy sell pressure, SUI maintains a stable pattern that reflects broad support. Many long-term traders like this behavior because resilience often signals strong confidence. The network continues to attract new users who prefer fast activity and low transaction costs.

Toncoin (TON)

Source: Trading View

Source: Trading View

Toncoin powers The Open Network ecosystem, which serves Telegram and a growing base of global users. This ecosystem hosts some of the most successful blockchain games, especially tap-to-play favorites like Notcoin, Hamster Combat, Catizen, Dogs, and Goats. The wide range of games helps drive massive engagement across the entire network.

Toncoin also supports a broader mission that aims to build a decentralized system for communication and financial activity. Access to a huge user base offers a major advantage in that mission. Strong tools and strong infrastructure also support long-term growth. Many analysts see Toncoin as a potential leader in social-driven and communication-driven blockchain adoption.

Virtual Protocol grows through strong fundamentals and major partnerships across digital sectors.Sui Network delivers impressive speed supported by a loyal user community and strong resilience.Toncoin expands through Telegram’s vast ecosystem and a fast-growing gaming environment.These three assets show strong potential for long-term growth and remain top picks today.