Analyst Shares Comprehensive Technical Analysis of Bitcoin Price—Target Price Revealed Here

A cryptocurrency analyst has shared his latest research findings.Bitcoin price predictionThe report points out that the economy may experience a downturn. His analysis delves into technical indicators and macroeconomic data to forecast key trends for the coming months and years. The report outlines...several bearish targetsfor Bitcoin, suggesting that traders should avoid overly bullish expectations, especially when signs of a bear market phase emerge.

Bitcoin Price May Fall Below $55,000

A cryptocurrency analyst who goes by the name "Mr. Wall Street" stated on Xposteda comprehensive technical analysis of Bitcoin, providing insights into market and psychological factors, and predicting that Bitcoin will plummet to new lows. He emphasized that the bullish momentum earlier this year has collapsed, which signals a...shift to a bear market.

Key technical indicators used to understand Bitcoin's market position and direction show that a bear market phase is imminent. Experts highlight that the 50-period Exponential Moving Average (EMA50), the Moving Average Convergence Divergence (MACD) monthly crossover, and theRelative Strength Index (RSI) bearish divergenceare all now pointing downward.

Given this weakness, Mr. Wall Street predicts that Bitcoin may first retest the...weekly EMA50before the next drop, with a target price close to $100,000. The analyst stated that traders may be planning...short positionsHe predicts that Bitcoin's price will fluctuate between $104,000 and $98,000, and could fall to $74,000 to $68,000. Looking ahead, he forecasts that Bitcoin's price could further plunge to between $54,000 and $60,000 by Q4 2026.

To support his bearish prediction, the analyst pointed out that declines and pressures in financial markets outside of cryptocurrency are also contributing to the overall market downturn. He also mentioned that theBank of Japan's plan to raise interest ratesis exacerbating current pressures, along with market makers who went bankrupt during the pandemic.The flash crash on October 10They are waiting to liquidate billions of dollars in spot assets.

Mr. Wall Street refuted common bullish arguments, such as the potential for a...restart of quantitative easingHe explained that the Federal Reserve's small-scale balance sheet operations do not signal a full quantitative easing cycle. He emphasized that macroeconomic optimism is not a reason to ignore short- and medium-term risks. In addition, he warned that those who ignore the possibility of a bear market will regret not shorting the $100,000 to $125,000 range that was retested a year later.

Looking beyond expectations and into the future.Bear market cycleWall Street insiders believe that Bitcoin could eventually rebound to around $89,000 in 2027. After that, he expects the cryptocurrency to accelerate upward to $110,000, eventually reaching $160,000.

Macroeconomic Factors Lead to Market Downturn

Mr. Wall Street also links his pessimistic outlook for Bitcoin to the current situation.Weak macroeconomic conditionsHe emphasized that Bitcoin's predicament is closely related to the decisions of central banks, especially the Federal Reserve.

The analyst stated that theU.S. economybegan to show signs of deterioration in early 2025. He claimed that key indicators, such as worsening employment data and misleading inflation data, have been ignored. In addition, he emphasized the Federal Reserve's inaction anddelayed rate cutshave hindered the necessary economic easing, making markets and cryptocurrencies like Bitcoin vulnerable to corrections.

BTC daily chart shows a price of $86,217 | Source: BTCUSDT Tradingview.com

BTC daily chart shows a price of $86,217 | Source: BTCUSDT Tradingview.com Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Treasury KindlyMD faces Nasdaq delisting, stock price drops 99%.

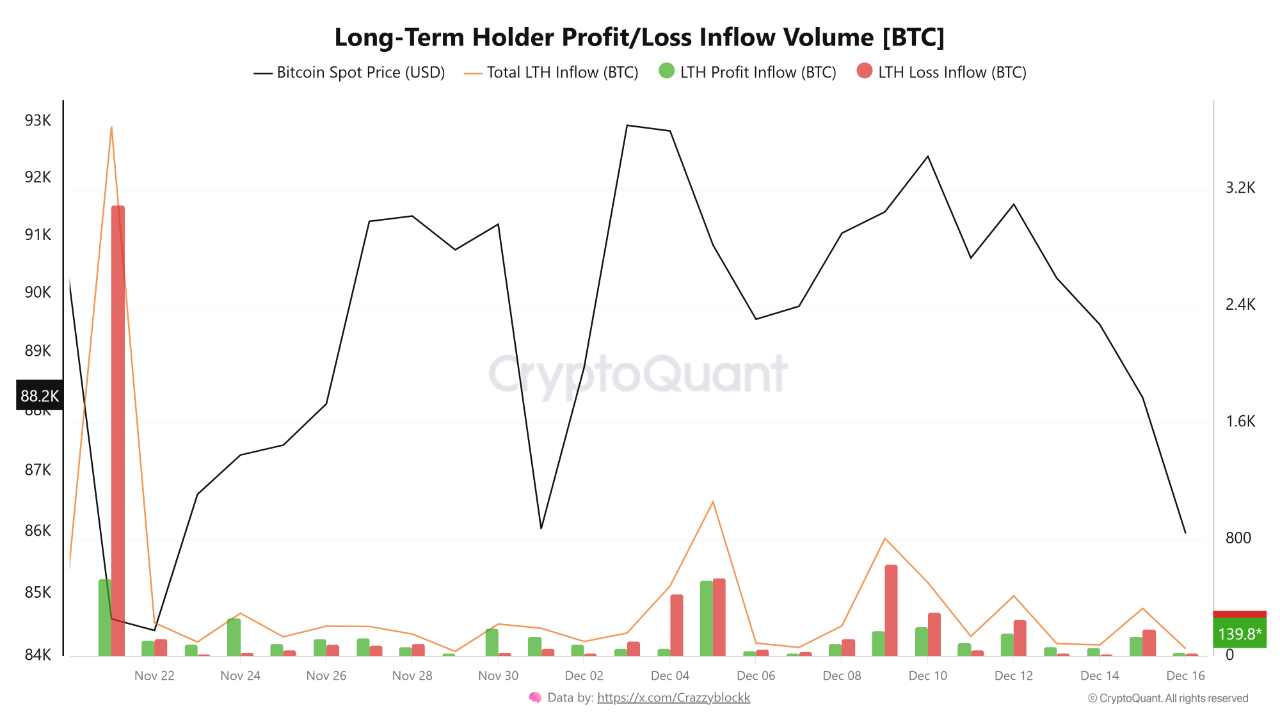

Who are the real dip sellers? On-chain data reveals the true sellers of bitcoin

Ethereum Faces Pressure After Failing to Hold $3,400—What Happens Next?

Elizabeth Warren Sounds Alarm on Trump's Crypto Dealings, PancakeSwap

Source:

Source: