Bitcoin Price Prediction: BTC remains in a vulnerable phase as technical pressure, capital flows, and macro signals converge.

Due to technical weakness, active futures trading, and fluctuating market sentiment, bitcoin remains under pressure, with its short-term outlook uncertain. On the four-hour chart, bitcoin's price remains below key resistance levels, as investors weigh the pros and cons of rising derivatives trading volume against renewed crash warnings. As a result, the market remains cautious, with traders assessing whether support levels can hold and if there is further downside risk.

Bitcoin price remains below key technical levels.

Bitcoin is trading near $86,800, reflecting its fragile structure on the four-hour chart. The price remains below the 50, 100, and 200-period exponential moving averages. Therefore, short-term momentum continues to favor sellers. The price is trending downward, with lower highs, further reinforcing a bearish to neutral market bias.

Notably, the 200-day EMA near $92,300 continues to hinder rebound attempts. Buyers are struggling to reclaim the previously supportive $89,500 to $90,000 area. This failure highlights the lack of follow-through from bulls in recent rebound attempts. Volatility has also tightened, suggesting the potential for a stronger directional move ahead.

Current resistance lies between $87,900 and $89,100, coinciding with short-term moving averages. After breaking through this resistance, the $92,300 to $94,700 range remains a key level for a broader trend reversal. On the downside, support near $86,000 remains crucial. A break below this support could see a drop to $83,800 or even $80,500.

Futures trading activity indicates increased market participation

Source: Coinglass

Source: Coinglass Throughout 2025, bitcoin futures market activity has continued to grow. Open interest has risen sharply with price fluctuations, peaking during the mid-year rally. As of December 17, open interest was close to $58.84 billions, while bitcoin was trading at around $87,783.

Related: Solana Price Prediction: SOL Faces Short-Term Pressure, Traders...

Moreover, this growth indicates increased trader participation and speculative positions. Historically, rising open interest during consolidation periods can heighten volatility risk. As a result, traders are now closely watching whether leverage will support sustained price increases or accelerate sell-offs during price swings.

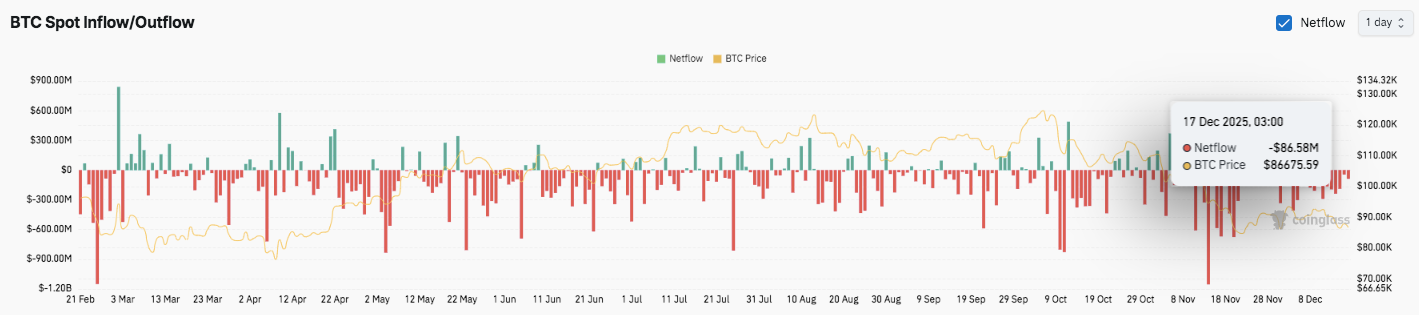

Source: Coinglass

Source: Coinglass Spot inflow and outflow data also reflect shifts in market sentiment. Positive net inflows typically coincide with price increases, while recent negative net inflows have occurred alongside price pullbacks. The large outflows in mid-December, accompanied by a price drop to around $86,675, indicate a cautious market or profit-taking activity.

Schiff issues another bitcoin crash warning

Bitcoin critic Peter Schiff has once again expressed concerns about increased downside risk for bitcoin. He pointed out that gold and silver prices have reached all-time highs, indicating a shift of funds toward traditional safe-haven assets. In addition, Schiff believes that confidence in bitcoin's safe-haven function has weakened.

He argues that investors hoping for a safe haven during times of economic stress may be disappointed. Therefore, heightened risk aversion could put pressure on bitcoin rather than support it. Although this view is not universally accepted in the market, his warning undoubtedly adds to short-term uncertainty.

Bitcoin price technical outlook

Bitcoin's key price levels remain clear, with price action narrowing on lower time frames.

Current upside resistance is at $87,900 and $89,100, followed by the psychological barrier at $90,000. If $90,000 is decisively breached, a further test of $92,300 is likely, but the 200-day EMA will limit upward momentum at this level. A decisive break above $94,700 would turn the medium-term outlook bullish.

On the downside, $86,000 remains the first line of defense, coinciding with a key Fibonacci level. A break below this area could see a drop to the $83,800 to $84,000 range, while $80,500 represents a deeper macro support and liquidity target. The technical structure shows bitcoin in a downtrend, reflecting lower highs and ongoing selling pressure.

Will bitcoin rise?

Bitcoin's near-term outlook depends on whether buyers can firmly push the price back into the $89,500 to $90,000 range. Continued declines suggest increased volatility ahead.

If upward momentum continues to strengthen and capital inflows increase, bitcoin could retest $92,300 and $94,700. However, failure to hold $86,000 could accelerate the decline to $83,800 or even $80,500. Currently, bitcoin remains at a critical turning point, with confirmation from price and volume set to determine its next major move.

Related: Shiba Inu Price Prediction: Downward Channel Remains, Regulatory Futures Bring New Volatility

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Gavin Newsom Singles Out CZ, Ross Ulbricht, Arthur Hayes as Trump's 'Criminal Cronies'

Stunning Move: Bitcoin OG Unstakes 270K ETH in Major Market Shuffle