Best Crypto to Buy Now? Chainlink Price Prediction, New Crypto Coins

Chainlink’s price stayed within a narrow range this week as market demand softened, despite the project’s solid fundamentals. The $LINK token was trading near $12, down significantly from its year-to-date peak of $27.83.

Due to its innovative decentralized oracle network, Chainlink price prediction has become a key topic for crypto enthusiasts navigating a volatile market.

For investors searching for the best crypto to buy now, could Chainlink be a top contender given its strong use cases and extensive integration across DeFi projects?

Summary

Chainlink’s Role in Blockchain Infrastructure and Investor Perception

Chainlink has recently experienced significant market movements, reflecting both bullish breakouts and bearish pressures. Early December saw a notable price surge, followed by a period of consolidation as broader market sentiment influenced trading activity.

Although $LINK’s price remains unstable, Chainlink’s fundamental narrative has attracted renewed attention this week. Lark Davis highlighted $LINK as a stronger long-term asset than XRP, noting its role as blockchain infrastructure rather than a closed payment system.

The discussion focuses on interoperability. Chainlink’s CCIP framework is positioning the network as a vital bridge between blockchains, which is becoming increasingly important as tokenized assets, regulated access, and cross-chain settlements continue to grow.

Davis also noted recent token buyback programs, signaling a shift toward more tangible value capture for $LINK holders. After years of prioritizing adoption and network utility, this approach is beginning to reshape long-term investor perception.

This distinction is significant. While XRP still draws institutional inflows via ETFs, questions around its daily utility and broader adoption persist. Chainlink’s strength lies in infrastructure demand rather than speculative trading.

Source – Cilinix Crypto YouTube Channel

Chainlink Price Prediction

Chainlink’s price prediction indicates potential stabilization around the $12.5 to $13 range, supported by strong historical trend lines and key support levels.

Recent price action shows that despite bearish pressure, some bottoming signs are emerging, suggesting that Chainlink may find a base before attempting upward movement.

Short-term volatility is possible, including potential dips below the support level to capture liquidity, but these are likely temporary. If support holds, a recovery toward $15.7 could be achievable, representing the next significant target for the token.

Chainlink On-Chain Data Shows Strong Accumulation Despite Price Struggles

Despite recent price struggles, on-chain metrics reveal a different trend. As of a Dec. 16 X post from Santiment, the largest 100 Chainlink wallets have accumulated 20.46 million $LINK since early November, valued at approximately $263 million at current market prices.

Meanwhile, $LINK holdings on exchanges have dropped to their lowest point this year, suggesting ongoing transfers into private wallets and reducing overall selling pressure.

Institutional activity has remained strong as well, with Grayscale’s LINK exchange-traded fund, launched on Dec. 2, seeing only inflows and totaling $56 million in cumulative net contributions so far.

Investors Look Past Chainlink in Search of the Best Crypto to Buy Now

While Chainlink has solid use cases in DeFi and smart contracts, some market participants are growing cautious due to recent volatility and the occasional slow pace of new integrations. These concerns have prompted many to explore the best crypto to buy now beyond established tokens.

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

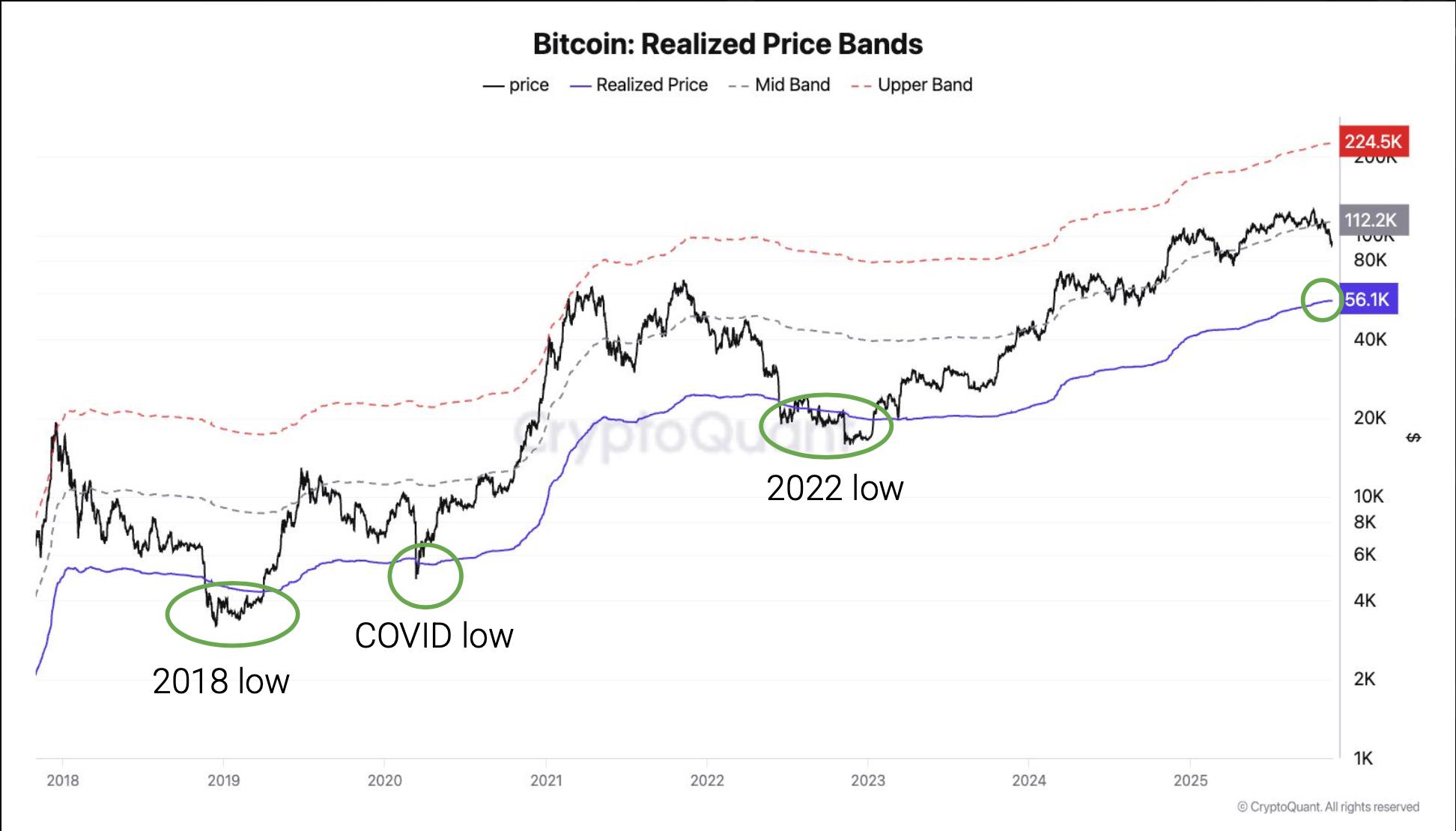

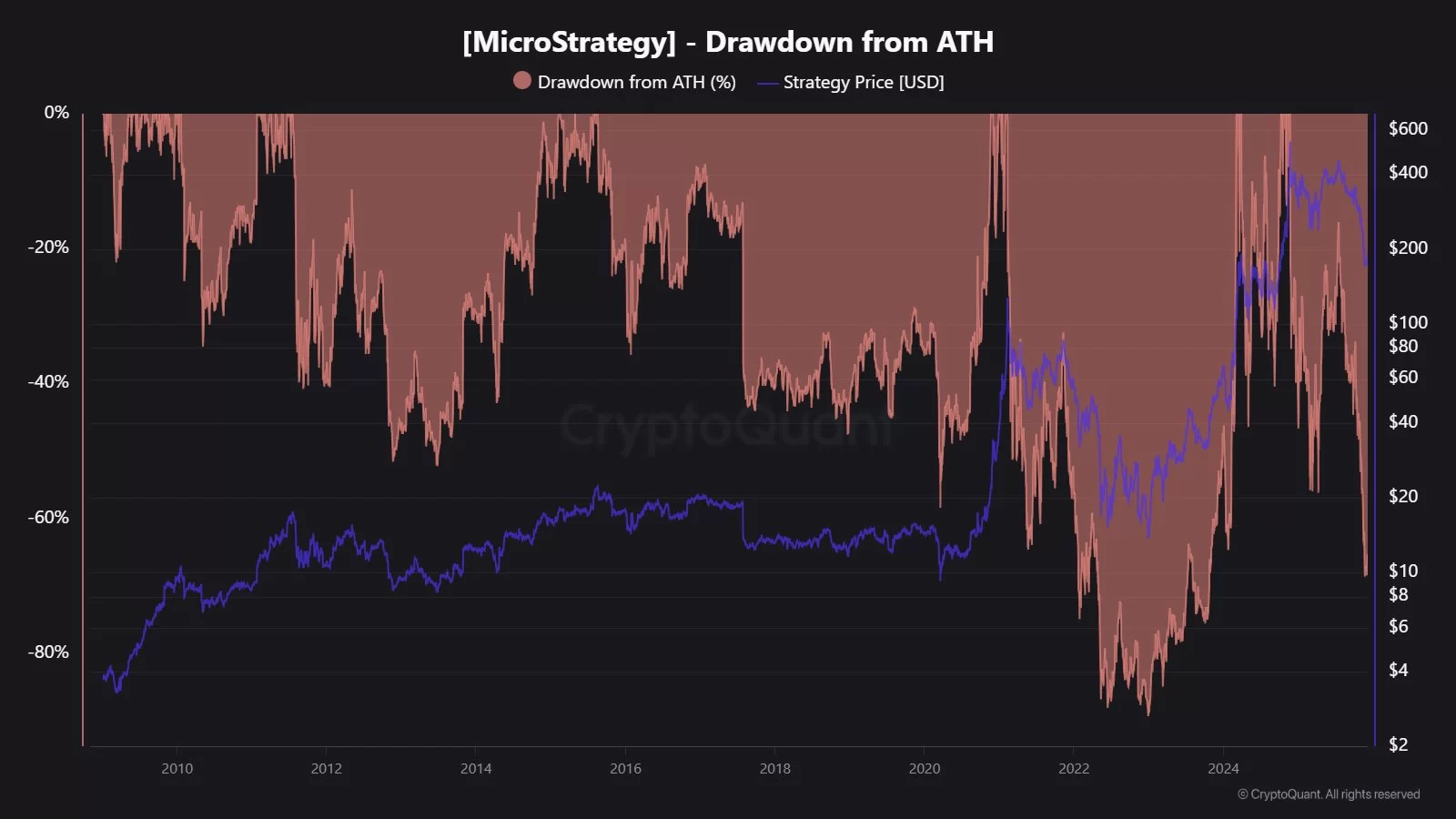

CryptoQuant says bear market has started, sees bitcoin downside risk to $70,000

Bitcoin Poised to Rise to $1.4 Million by 2035, Analysts Say—Or Much Higher

Cryptocurrencies Face Turbulent Times as Market Shifts Intensify

Crypto's Capitol Hill champion Sen. Lummis says she won't seek re-election