How to Do Futures Copy Trading on Bitget? – Website Guide

[Estimated Reading Time: 5 minutes]

This article provides a detailed guide on how to start Futures Copy Trading on the Bitget website. Futures Copy Trading enables users to replicate the trades of elite traders, providing an opportunity to benefit from their strategies while minimizing hands-on effort.

What is Futures Copy Trading?

Futures Copy Trading allows you to automatically replicate the trades of experienced futures traders on Bitget. By copying a trader, their positions are mirrored in your account, helping you engage in the futures market even without advanced trading knowledge.

Bitget offers two copy trading modes designed for different user needs:

1. Diverse Follow

-

Copy every trade made by an elite trader with a fixed amount (margin) or multiplier

-

Positions from multiple elite traders share the same capital pool, distributing risk collectively

-

No need to prepare a separate investment pool in advance for each elite trader

-

Copy different elite traders using just one fund pool

2. Smart Copy

-

Set up a dedicated capital pool for each elite trader you copy

-

Mirror their trades and learn from their strategies

-

Based on a certain proportion to elite traders' funds

-

Investment amount and risk for every copy trade are aligned with elite traders' investment

-

Copiers can calculate each elite trader's risk control level and confidence based on the percentage

How to Access Futures Copy Trading on Bitget?

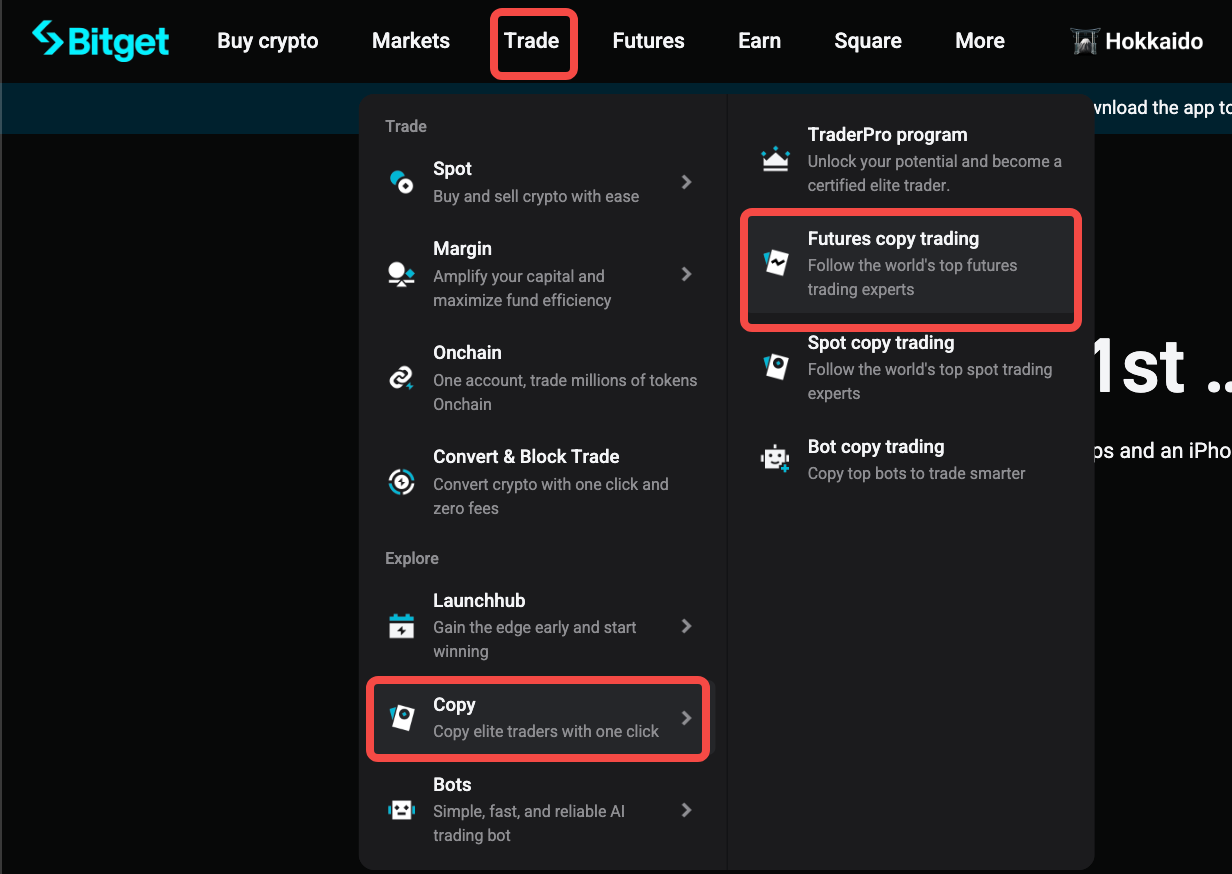

Step 1: Navigate to the Copy Trading Section

1. Locate the Trade tab in the main menu.

2. Select Futures Copy Trading from the dropdown options.

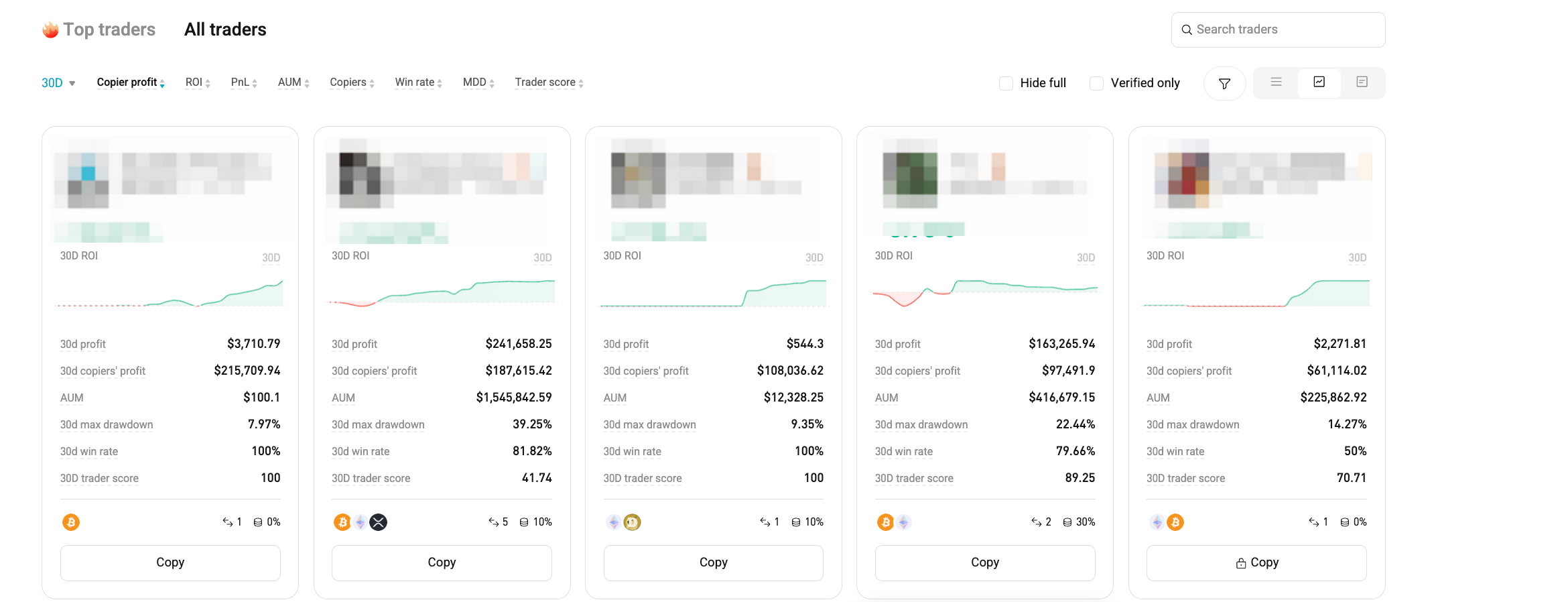

Step 2: Choose a Trader to Copy

1. Browse the list of professional traders on the Futures Copy Trading page.

2. Review key metrics, including Win Rate, ROI, and Followers’ Profits.

3. Click on a trader’s profile to view detailed statistics and trading history.

4. Once you’ve selected a trader, click Copy.

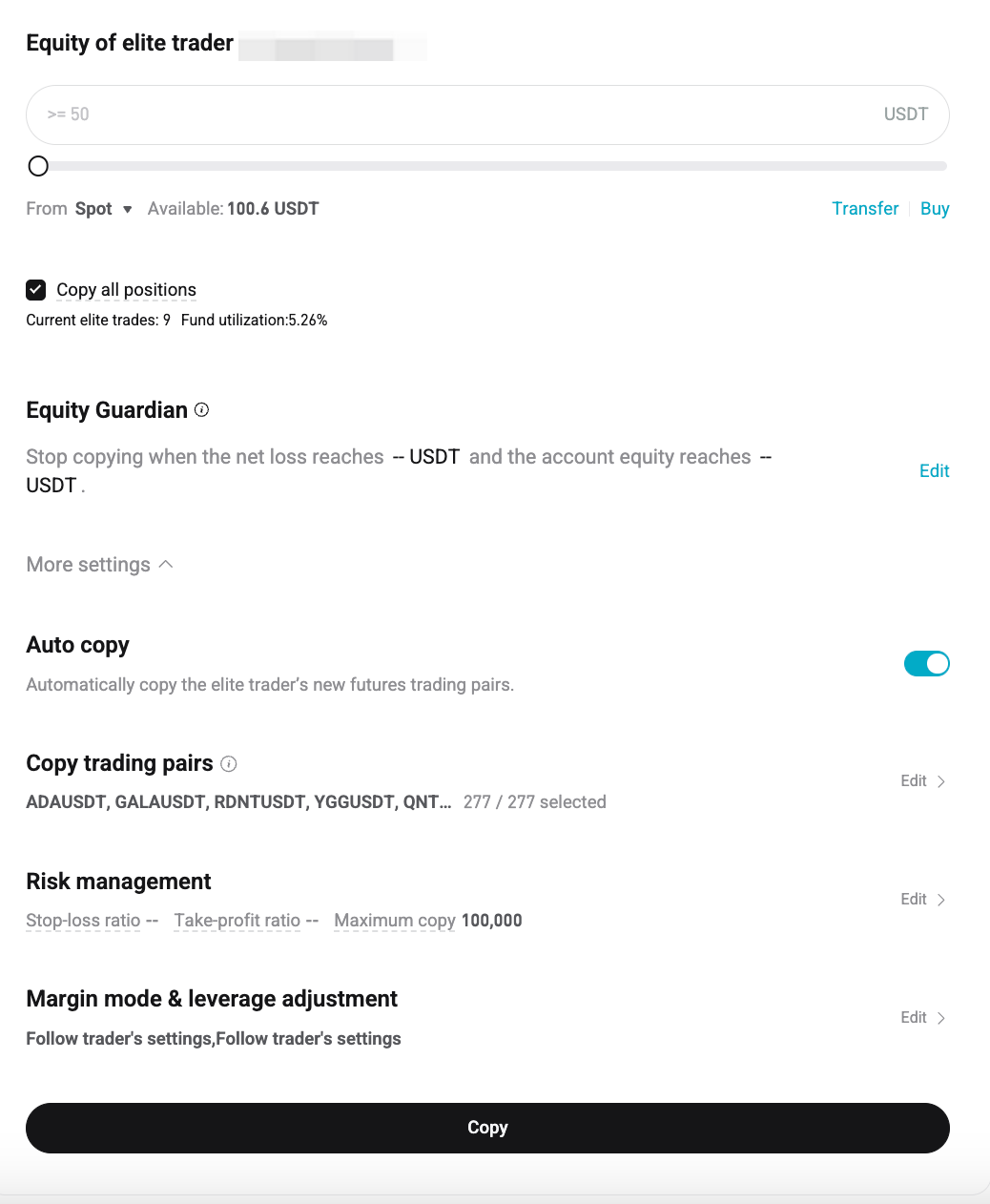

Step 3: Configure copy trading settings

1. Set equity allocation

-

Set the amount of USDT to allocate for copying the elite trader (minimum 50 USDT).

2. Copy all positions

-

Enable this option to copy all open positions from the selected elite trader.

3. Equity Guardian (optional)

-

This safety feature helps limit losses.

-

Set thresholds to stop copying automatically when:

-

Your net loss reaches a specific USDT amount.

-

Your account equity drops below a set amount.

-

4. Auto copy

-

Keep this enabled to automatically copy new futures trading pairs added by the trader.

5. Copy trading pairs

- Review and customize the list of selected pairs you want to copy.

6. Risk management

-

Configure:

-

Stop-loss ratio: When the loss exceeds the stop loss ratio, copy trade orders will be automatically closed. For example, if your stop loss ratio is 10%, any orders that exceed a 10% loss will be automatically closed at the market price.

-

Take-profit ratio: When the profit exceeds the take profit ratio, copy trade orders will be automatically closed. For example, if your take profit ratio is 10%, any orders that exceed a 10% profit will be automatically closed at the market price.

-

Maximum copy amount: The maximum margin limit in USDT for each trading pair. Copy trading will stop when the margin of the current trade reaches this limit. Once the position is closed and the used margin reduces, copy trading will resume.

-

Slippage limit: When slippage exceeds the set ratio, opening positions of elite trader's copy trade will not be executed.

-

7. Margin mode & leverage adjustment

-

Configure

-

Follow trader’s settings

-

Cross margin mode

-

Isolated margin mode

-

8. Leverage options

-

Configure

-

Follow trader’s settings: Use the same leverage level as the elite trader.

-

Fixed leverage: Set one leverage level for all trades (e.g., 10x).

-

Customize leverage: Set different leverage levels for each trading pair manually.

-

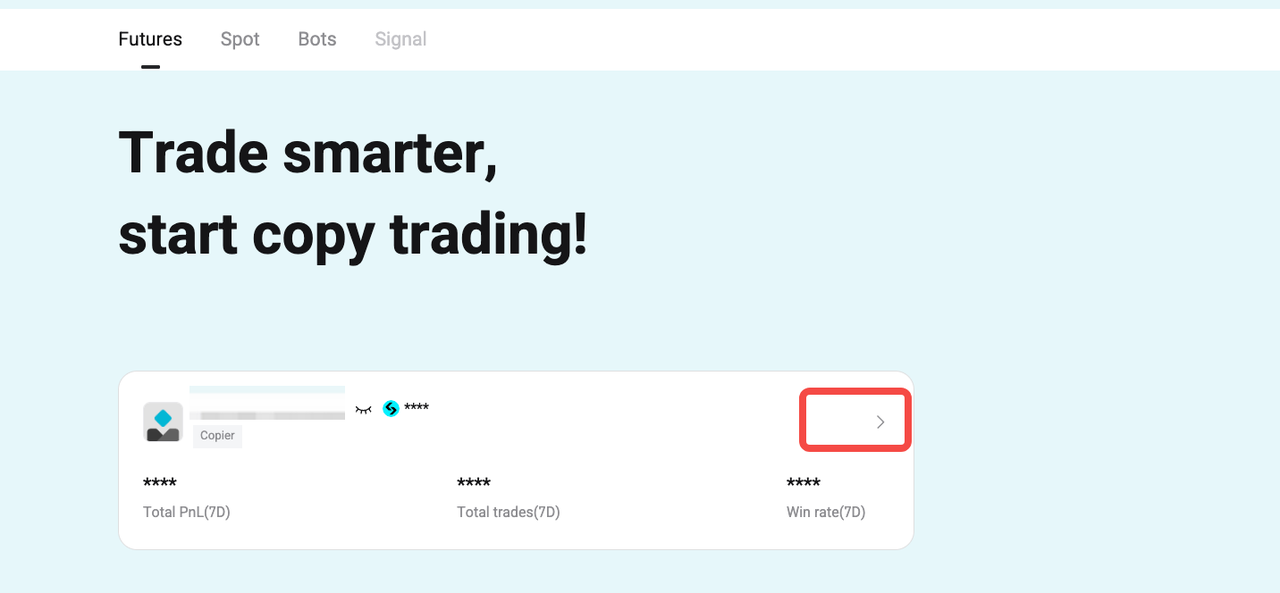

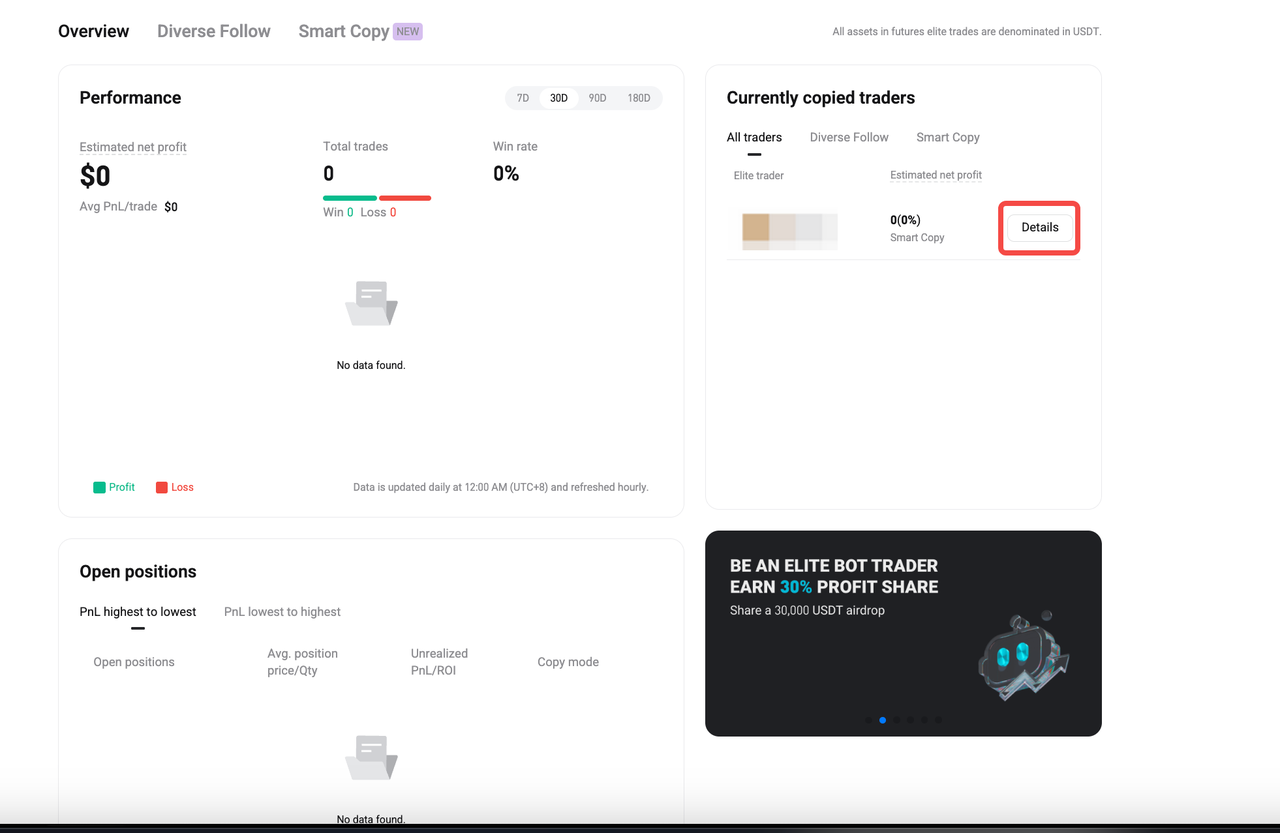

Step 5: Monitor Your Trades

1. Go to Copy Trading > Futures

2. Click the arrow ( > ) to view performance details.

3. Check your stats like profit/loss, win rate, and open positions.

4. Click “Details” to manage each trader.

5. Use the menu to:

-

Add funds

-

Withdraw assets

-

Stop copying

6. Click Edit to change risk settings, leverage, or copy pairs.

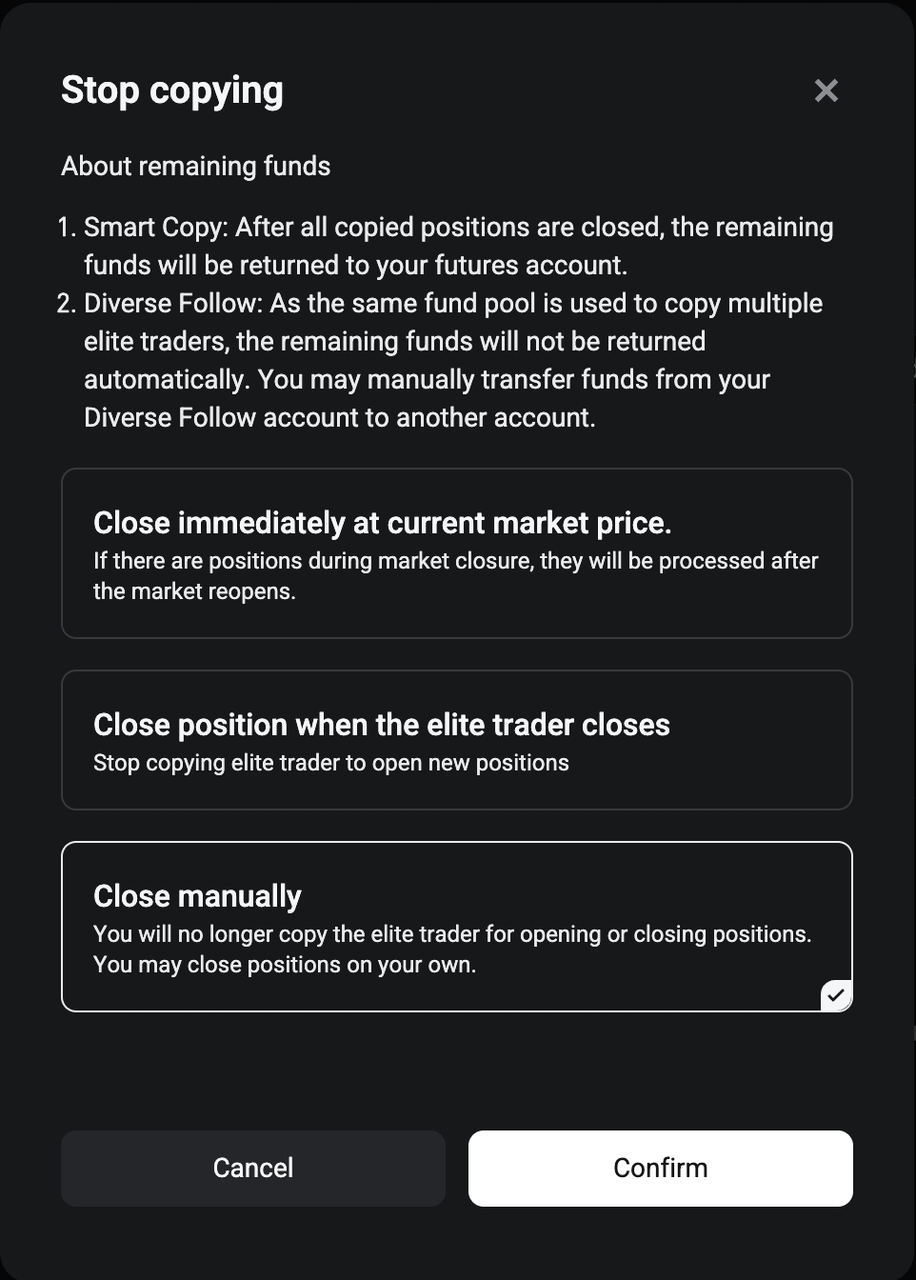

How to Stop Copying an Elite Trader?

When you choose to stop copying, the options vary depending on whether you have open positions:

If you have open positions

You’ll see three options to handle them:

1. Close immediately at current market price

-

All copied positions will close right away.

-

If the market is closed, they’ll close once it reopens.

2. Close position when the elite trader closes

-

You stop copying new trades, but current ones will close only when the trader exits them.

3. Close manually

-

You stop copying entirely.

-

Open positions stay active—you must manage and close them yourself.

After choosing an option, click Confirm to proceed.

About remaining funds:

-

Smart Copy: Funds are returned to your futures account automatically after closing all positions.

-

Diverse Follow: Funds aren’t returned automatically—you’ll need to transfer them manually.

Tips for Managing Your Futures Copy Trading

1. Monitor Your Trades

-

Navigate to the My Trades section under Copy Trading to monitor your active trades and track performance in real time.

2. Stop Copy Trading

-

You can stop copying a trader at any time by selecting the Stop Copying option. This allows you to reassess your strategy or switch to a different trader.

3. Adjust Parameters

-

Regularly review and modify your investment amount, copy ratio, or risk management settings (e.g., stop-loss and take-profit thresholds) based on market conditions and personal preferences.

4. Choose Traders Wisely

-

Analyze trader performance metrics such as ROI, trade frequency, and risk level before selecting whom to copy. Look for consistency and strategies that align with your goals.

5. Diversify Your Portfolio

-

Follow multiple traders with different strategies to spread risk and balance your portfolio. Diversification can improve long-term results by mitigating individual trader risks.

6. Use Risk Management Tools

-

Always set Stop-Loss and Take-Profit limits to protect your investments and manage potential losses effectively.

FAQs

1. Where can I access the Futures Copy Trading feature on Bitget?

You can find it under the Trade tab in the main menu. Select Futures Copy Trading from the dropdown list to start.

2. How do I choose a trader to copy?

Browse the list of elite traders on the Futures Copy Trading page. Check key metrics like Win Rate, ROI, and Followers’ Profits. Click on a trader’s profile to see their detailed performance and trade history before selecting "Copy."

3. What is the minimum amount needed to start copy trading?

You need to allocate at least 50 USDT to begin copying a trader.

4. What is the Equity Guardian feature?

Equity Guardian is an optional risk control tool. It automatically stops copying if:

-

Your net loss reaches a specified USDT amount, or

-

Your account equity falls below a set threshold.

5. Can I customize which trading pairs I copy from a trader?

Yes. You can manually select or deselect trading pairs during setup in the Copy trading pairs section.

6. How does the risk management feature work in copy trading?

You can set:

-

Stop-loss ratio: Automatically closes trades that exceed a loss threshold.

-

Take-profit ratio: Locks in profits at a preset percentage.

-

Maximum copy amount: Limits margin per trading pair.

-

Slippage limit: Prevents copy orders when price slippage exceeds your set limit.

Disclaimer and Risk Warning

All trading tutorials provided by Bitget are for educational purposes only and should not be considered financial advice. The strategies and examples shared are for illustrative purposes and may not reflect actual market conditions. Cryptocurrency trading involves significant risks, including the potential loss of your funds. Past performance does not guarantee future results. Always conduct thorough research, understand the risks involved. Bitget is not responsible for any trading decisions made by users.

Join Bitget, the World's Leading Crypto Exchange and Web3 Company

Share