Non-Fungible Tokens (NFTs) Explained for the Investors, the Creatives, and the Curious

A Non-Fungible Token (NFT) is a cryptographic asset on a blockchain, with each token unique and irreplaceable. In this article, let’s strip away the NFT hype and understand the simple truth about how NFTs work.

What are NFTs?

Billions of dollars have been invested in NFTs across art, real estate and gold tokenized assets. What are NFTs indeed?

Imagine there is a cryptographic asset, similar to Bitcoin, which also contains ownership details for easy identification and transfer between holders. The difference is, instead, adding a unique identifier to each unit. This means each unit of that asset is different from all the other units - this characteristic is named non-fungible.

The definition of an Non-Fungible Token (NFT), in short, is a cryptographic asset on a blockchain with each token unique and irreplaceable.

Non-fungible tokens have these properties:

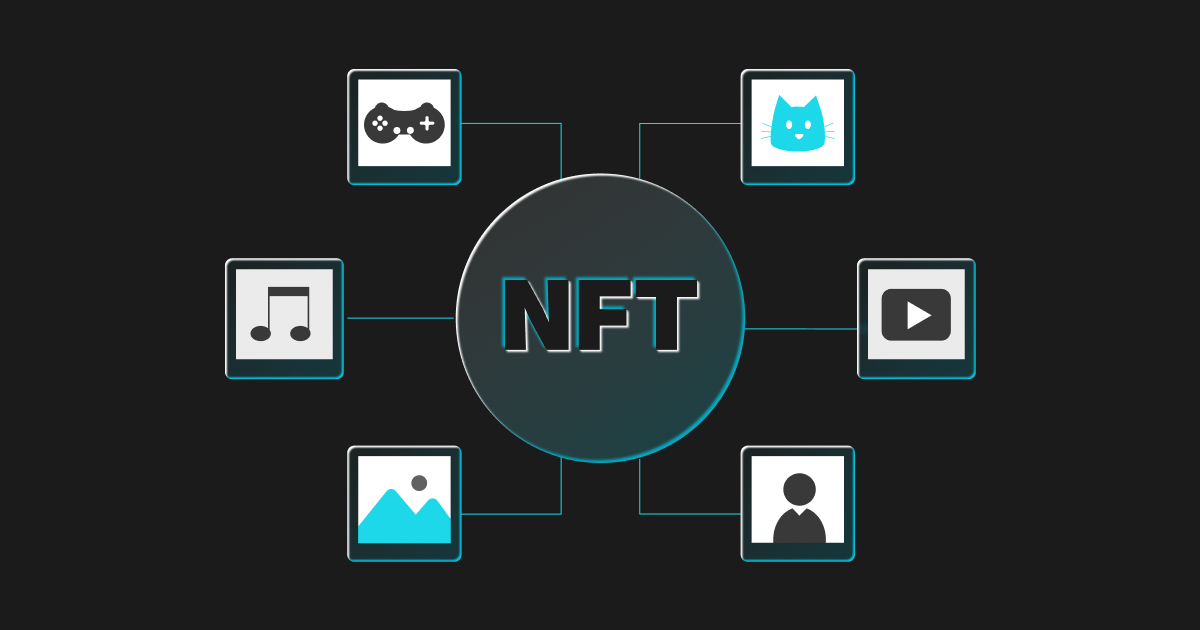

- NFTs can digitally represent any object in the real world from artworks, avatars, music, videos, in-game items, to event tickets, domain names, or even real estate.

- An NFT has one owner at a time.

- NFTs live and are secured by the Ethereum blockchain, each token minted has a unique identifier that is directly linked to an Ethereum address and this information is verifiable – that means no one can modify the record of ownership or re-create a new NFT into existence.

- Unlike Bitcoin, 1 BTC is exactly the same as another 1 BTC, NFTs are not directly interchangeable with other tokens.

The first purely digital NFT based artwork - Beeple’s ‘Everydays: The First 5,000 Days’ sold for over $69M. Source: Christie’s

Understanding NFTs

Since NFTs live on the Ethereum blockchain, you can trade NFTs in open marketplaces like SuperRare, Foundation, BakerySwap, OpenSea, etc. The real question here is, what do you actually ‘own’ when you buy NFTs?

But first, let’s talk about the ownership of an NFT.

Well, you can right-click on the above Beeple’s ‘Everydays: The First 5,000 Days’ and download the same digital file the owner paid almost $70 million for, as many times as you wish. However, NFTs are designed to give us more than just a digital file: ownership of the asset. Like the case of physical art collecting, anyone can buy a Monet print, but only one person has the ownership of the one definitive actual version.

How can they prove that ownership? Well, let’s look deeper into NFT contracts. Simply input, each NFT contract includes (1) an ID of that token, (2) an owner (a blockchain public address); and (3) the transfer function.

Examples of NFT contracts. Source: Anthony Day

NFT contracts give the ability to transfer or claim ownership of any unique piece of digital data, trackable by the public ledger - Ethereum blockchain.

So, back to the question ‘what do you actually ‘own’ when you buy NFTs?’ - the answer is: as you buy an NFT, you then own the exclusive right to edit a row in that two-column spreadsheet implemented in a smart contract on the Ethereum blockchain.

Okay… but what does it mean to the creator and the investor of an NFT?

As the creator of an NFT, you can easily prove you're the creator. You determine the scarcity of that NFT and can earn royalties every time it's sold.

As the collector, you can easily prove you own an NFT as a way to support your favorite artists and projects. You can resell it at a higher price, or you can choose to hold it forever, resting comfortably knowing your asset is secured by your blockchain wallet.

Non-fungible tokens are just like cryptocurrencies, in which you buy them and hope that the value goes up one day. As the investor, you need to do your own research. Among many NFTs art and collectibles projects popping up today, you should go through a couple of questions such as ‘Do you really like it?’, ‘Is the team behind the project trustworthy?’, ‘What about its rarity?’ before investing your money in NFTs.

What are NFTs used for?

The ideal scope for NFTs is anything unique that needs provable ownership. Though the NFT ecosystem is quite new, there are some good use cases below, and it’s quite likely that there are many upcoming exciting innovations with this promising technology.

Maximizing earnings for content creators

Perhaps, the biggest use case of NFTs lies in the digital content realm. In today's internet age, content creators see their rights and profits swallowed by platforms and the copy/paste issues. The more digital content is exposed and used the more value it gains. However, platforms, such as music streaming services, retain the majority of profits from sales, and the creators get exposure in return, but the exposure normally isn't enough to pay the bills.

NFTs come and power a new fairer economy where creators handle their ownership baked into the content itself. When they sell their content, profits go directly to them. Even when the new owner then sells the NFT, the original creator can automatically receive royalties.

Boosting mutually-beneficial business model in the gaming industry

When applied in the gaming industry, NFTs can also be used to issue unique digital items and crypto-collectibles through DApps (decentralized applications). NFTs allow records of ownership for in-game items, fuel in-game economies, and bring a host of benefits to the players.

What does this mean for the game developers and the players?

For game developers (a.k.a the creators of the NFT), they can earn a royalty every time an item is resold by players.

For players, unlike the regular gaming items, if a game is no longer maintained by its developers, the NFT items you have collected still truly remain yours. This could also mean that you can make a profit by selling it when you are done with the game or when that item becomes more desirable.

NFTs x DeFi - A potent force for changes

Another most obvious benefit of NFTs is making the current finance systems more efficient. NFTs when placed in the DeFi background can reinvent the whole current infrastructure. Since NFTs represent the digital different asset types, ranging from real estate to lending contracts to artwork on a blockchain, removing the need for intermediaries and sophisticated finance systems.

For example, you collateralise 5 ETH so you can borrow 1000 USDT. This guarantees that the lender gets paid back – if the borrower doesn't pay back the USDT, thanks to the smart contract function, the collateral will be automatically sent to the lender.

Another example in the investing realm, considering a piece of land parceled out into multiple divisions, each of which is unique, located and priced differently, and represented with an NFT. A virtual reality platform on Ethereum - Decentraland has already developed new markets and forms of real estate investment solutions for its clients.

Bonus: Well-known NFT projects and platforms

Now that we understand the basics, let’s dive into some of the most well-known players in the NFTs world.

OpenSea - The world’s first and largest decentralized digital marketplace for crypto collectibles NFTs

Launched in 2017, with over 600,000 users, the house of over 6,600 collections and has processed over $10 billion worth of NFTs are some impressive highlights of OpenSea. You can find almost any NFTs category on OpenSea, from art, domain names, collectibles, music, you name it.

CryptoPunks - The first Ethereum-based NFT experiment

Built by Larva Labs and recently acquired by Yuga Labs, CryptoPunks is the collection of 10,000 unique 24x24 pixel art images, generated algorithmically. Most of the punks are punky-looking guys and girls, but there are also a few other types like odd-looking Aliens, Apes, and Zombies. With the limited supply and strong branding among the early adopters, it seems to be one of the best candidates for true digital antiques. CryptoPunks also owns one of the most expensive NFTs in history - Punk #5822, which sold for 8,000ETH worth close to $23.7 million at the time.

CryptoKitties - The project taking NFTs to the mainstream

The NFT’s history can be divided into two main phases: ‘before CryptoKitties’ and ‘after the Birth of CryptoKitties’ - CryptoKitties is one of the world’s first blockchain games. While some gaming players later labeled CryptoKitties not a real game, its story was cute, chill, and shareable at the time — who does not like the idea of buying a $1,000 digital cat and breeding it into a new cat of varying rarity?

Decentraland- The virtual world’s one-stop-shop for the digital assets on Ethereum

Though the Cryptokitties and CryptoPunks may sound trivial, there are some more serious business implications, and Decentraland is a good example.

Decentraland is a decentralized virtual reality world where its users can develop and exchange digital assets such as pieces of virtual land, artwork, and NFTs. They are the pioneer in applying NFTs for land ownership and in-world assets. In 2018, their LAND NFTs saw more trading volume than any other NFT, led to a fund-raise of $25M, and kicked off a $10M land sale for parcels in their virtual reality metaverse.

Disclaimer: All products and projects listed on this article are not endorsements, and are provided for informational purposes only.