Beginner's guide

The Complete Guide to USDC-Margined Futures on Bitget

Beginner

2022-11-17 | 5m

If you’re looking to get into the world of

futures trading, Bitget stablecoin-settled futures is one of the best entry points when it comes to crypto derivatives. We currently support two stablecoins for our perpetual contracts, including USDT and USDC. In the article below, we’ll explain everything you need to know about Bitget USDC-Ⓜ Futures and how to get started.

Learn everything about Bitge t USDT-Ⓜ Futures here:

The Complete Guide to USDT-Margined Futures on Bitget

What is Margin Trading?

Before diving into Bitget’s USDC-Ⓜ Futures, you’ll first have to understand how

margin trading works. Margin trading is essentially the practice of investing money or cryptocurrencies with a borrowed sum (from a bank or broker). You’ll have to first make a deposit that’ll act as collateral, and the lending party will then provide the rest of the amount you wish to invest with. The arrangement gives investors more buying power that’ll allow amplified profits without requiring a lot of cash on hand. It’s also possible that your trading platform will take note of the collateral and turn on the margin function for you, i.e. no extra real cash is provided but the system is designed to increase your buying power limit accordingly. However, it’s also important to note that while potential profits can be amplified, so will potential losses.

Important terms

Margin types

There are five main types of margins: Initial Margin, Maintenance Margin, Variation Margin, Available Margin and Risk Margin. The first kind describes the initial deposit in equity required for investors to open any position, while the second category determines how much equity you’ll need to keep in your account in order to keep those options open. Variation Margin is calculated as the difference between your Initial Margin and the current margin balance of the account and is most important to determine when margin calls must take place (where your balance falls below the Maintenance Margin), and the Available Margin is what you can use in your account to open more positions with. Finally, Risk Margin is determined by the maximum level of risk taken on by an investor, providing a clearer picture of exactly what delivery obligations an investor has.

Margin modes

In addition to the five types of margins, there are also two different modes that margins can be in. On the one hand we have the isolated margin mode, and the other is the cross margin mode. The former allows the allocation of a specific margin to each position you have open, while the latter has one joint margin pool across all your positions. Practically, isolated margins are better suited for highly speculative positions as your losses will be limited, whereas cross margins can provide greater flexibility if you’re not looking to reassess and manage your positions frequently.

Margin calls

While investing with margin can be profitable, you’ll also need to be aware of any margin calls coming your way. This occurs when your account balance falls below a required amount, and you’ll have to make up for the uncovered exposure within a limited time or the exchange can close out your open positions until the account balance meets that minimum value once again. Aside from injecting more equity, you can also meet this minimum requirement by closing less favourable positions you’re holding at the time.

Futures and Perpetual Contracts

With margins out of the way, we can now turn our focus towards futures. The OG futures contracts allow investors to purchase a predetermined amount of an asset at a predetermined price in a specified time in the future. This way, investors can participate in the market without actually holding onto any of the underlying assets.

Unlike conventional futures contracts, however,

cryptocurrency futures are often perpetual, meaning they do not actually have a specified expiry date. This means investors can open positions for a se t price and close when a particular currency reaches that price, regardless of the time it takes. Perpetual contracts inherit futures contracts’ convenience of not having to actually hold the underlying assets.

Funding Fees

It’s important to note, however, that during the time your positions remain open, there will be funding fees that are paid peer-to-peer. Since perpetual contracts do not have an expiry date, funding fees are necessary to keep futures contracts close in price with the spot price of a cryptocurrency by calculating a trader’s profits and losses every eight hours. Funds will then be transferred from losing accounts to winning accounts. Therefore, while you can keep a perpetual contract open for as long as you desire, you’ll also have to take into account any funding fees during this period.

Trading USDC-Margined Futures on Bitget

Currently, Bitget supports both

Bitcoin and

Ethereum perpetual contracts as our USDC-Ⓜ Futures trading pairs. For the former, you’ll be able to access leverage of up to 125X, with the latter pair offered at up to 100X. All profits and losses as well as fees will naturally be settled in USDC.

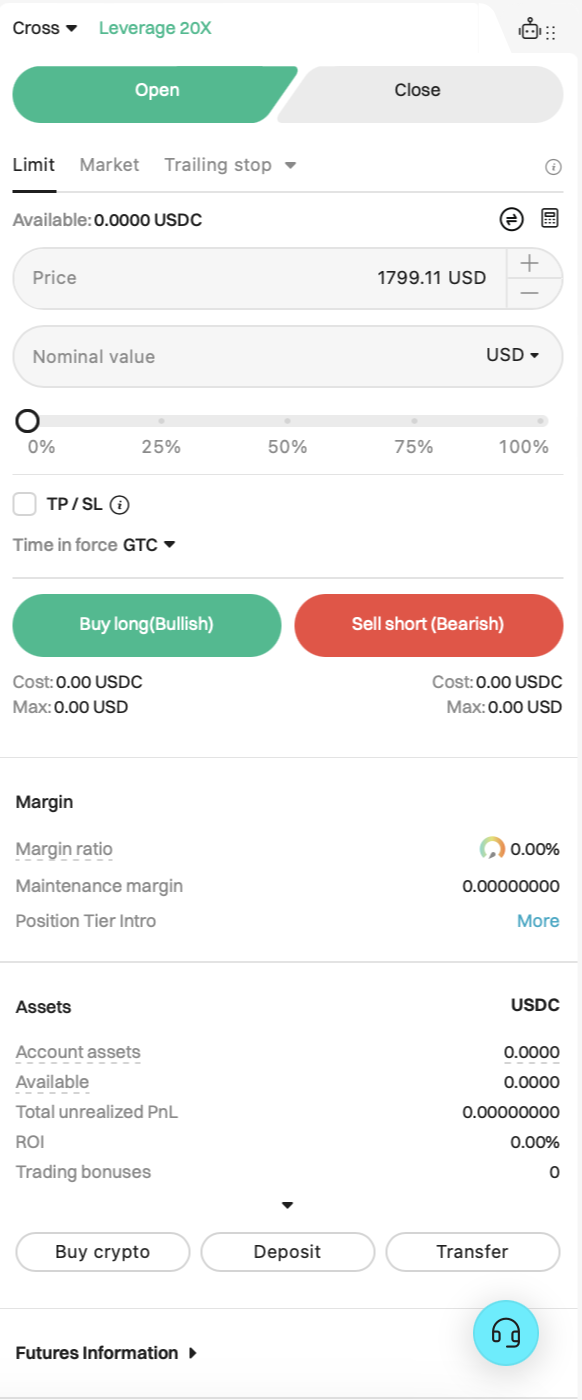

Step-by-Step Guide

Trading USDC-Ⓜ Futures is quick and simple on Bitget, and you can get started through the following steps.

1. Go to the USDC-M Futures page and log in with your Bitget account. Not yet a Bitget user? Sign up now!

2. Click on 'Transfer' under the 'Assets' page to transfer funds from your Spot account to your USDC-M Futures account. No fees will be charged for this step.

3. To start trading, open a new position. Here, you’ll be able to choose your desired trading pair, the mode of margin and level of leverage, as well as the price, number and direction (long/short) of contracts.

Once your orders are processed, you will be able to monitor and manage them in the [Open Orders] section. You can adjust your leverage or close any open positions depending on your P/L, which will be categorised under realised and unrealised P/L. Stats for closed positions will be displayed under [Order Details]. You can also close positions manually. Closing orders can be revoked before transactions are completed.

Leverage and Risk Management

As with any other form of investment, there is an inherent risk in USDC-Ⓜ Futures, and Bitget advises users to trade responsibly and mindfully with the help of risk management strategies. Because profits and losses are settled on a real-time basis, users on Bitget will receive the latest and most accurate information based on current market conditions.

You’ll also be able to manage your risk better by changing between margin modes, as mentioned above, in order to reduce the chances of your positions being liquidated. When a margin call is issued, traders will have to meet the initial margin requirements within a limited time frame in order to maintain any open positions. You’ll be able to do this by either injecting new equity into your account or by closing some of your open positions.

In the case of isolated margin, a position will be forced into liquidation at 100% margin ratio if the sum of isolated account balance and the unrealised P/L in that position are below the maintenance margin. In the case of cross margin, positions will be forced into liquidation at 100% margin ratio when the sum of the overall account balance (excluding those of isolated margin modes) and the unrealised P/L of those positions fall below the maintenance margin.

In the unfortunate scenario where you are met with a margin call, users will be able to choose from three strategies to minimise their losses. First of all, you can cancel your orders, which will automatically stop all orders for opening and closing positions. Then you can remove the hedge position order of al l trading pairs or deleverage by reducing two leverage levels. Note that the latter two options do not affect positions held under an isolated margin mode.

While risk mitigation strategies are being applied, other operations will be suspended until the treatment is completed.

Why Choose Bitget for USDC-Margined Futures?

Officially recognised as a leader in the cryptocurrency derivatives market in terms of both liquidity and global open interest, Bitget focuses on lowering barriers to entry to the world of crypto as well as the threshold to contract trading. Perfecting customer experience is the key to our product design philosophy, and our devotion has brought more than 20 million loyal users spanning 100 different countries. With a derivatives trading volume of US$10 billion, our platform has received 12 A+ ratings from SSL Labs and earned a Top 10 ranking for exchange cybersecurity from

Crypto Exchange Ranks. We offer industry-leading security via a built-in DPI active defence system, a self-developed wallet warning system, and backups from leading security firms, including Suntwin Technology, Armors, HEAP, and more.

If you have any questions for us, Bitget also provides 24/7 multilingual customer support.

Feeling ready?

Sign up

for a Bitget Futures trading account and begin your crypto derivatives journey now!

Share

How to buy BTCBitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade nowRecommended

We offer all of your favorite coins!

Buy, hold, and sell popular cryptocurrencies such as BTC, ETH, SOL, DOGE, SHIB, PEPE, the list goes on. Register and trade to receive a 6200 USDT new user gift package!

Trade now