News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Ethereum is not perfect, but it is the optimal solution.

At least four Chinese-funded financial institutions and their branches, including Guotai Junan International, have withdrawn from applying for a Hong Kong stablecoin license or have suspended related attempts in the RWA sector.

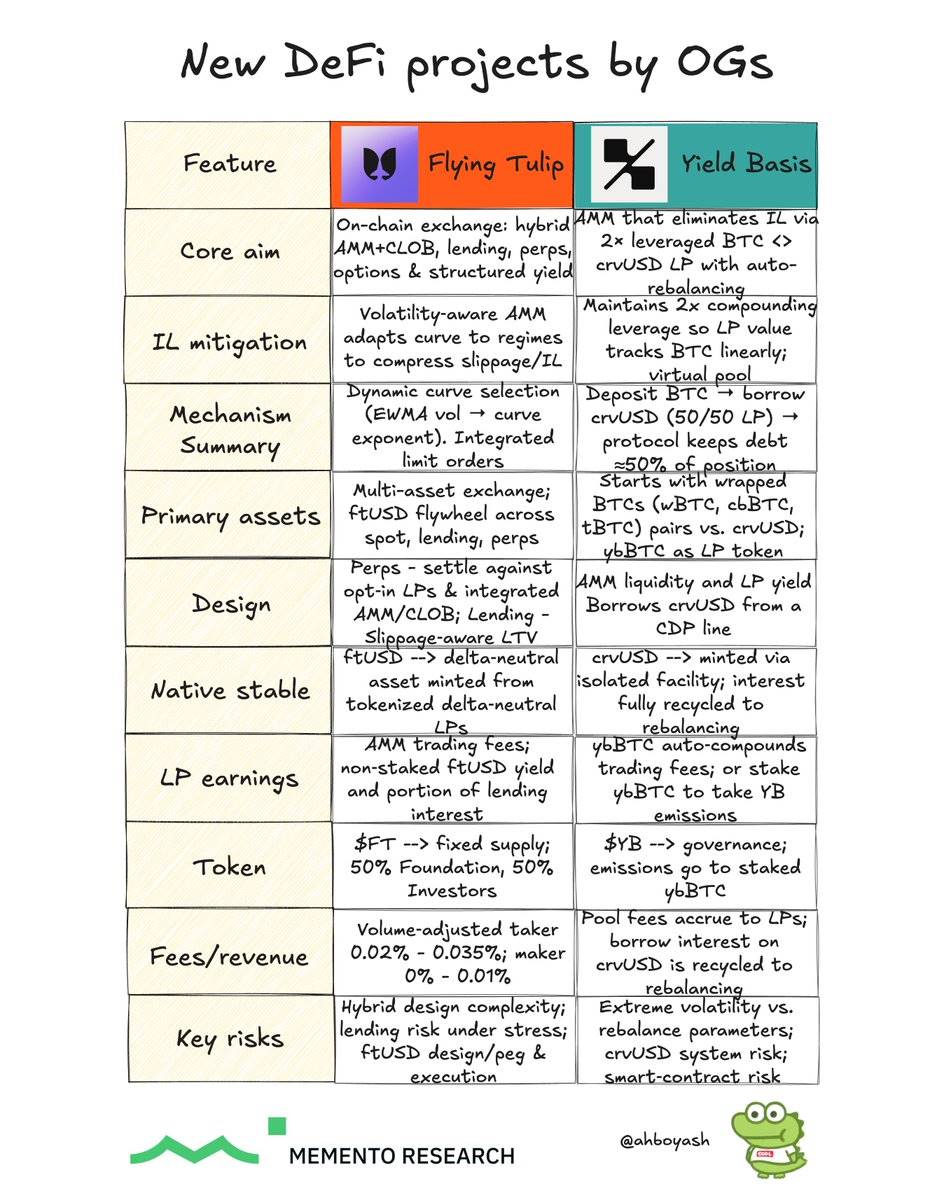

All primary market participants will have on-chain redemption rights, allowing them to burn $FT at any time and redeem up to the equivalent value of their original principal.

All primary market participants will have on-chain redemption rights, allowing them to burn $FT at any time and redeem up to the equivalent of the original principal.

Aiming to address the challenges of on-chain liquidity.

- 12:41The hardcore bearish whale's 20x leveraged BTC short position is now floating a profit of over $18 million.According to ChainCatcher, as the market experienced a short-term decline, the hardcore bearish whale (0x5D2...9bb7), who had previously shorted BTC four times in a row, now has an unrealized profit of $18.151 million on a 20x leveraged Bitcoin short position. This whale currently holds about 820 BTC in this position, with an average entry price of $111,499.3 and a current liquidation price of $102,440.7.

- 12:33Next Week's Key Insights: US to Announce November Non-Farm Payrolls (Seasonally Adjusted); Aster Phase 3 Airdrop Claim BeginsChainCatcher News: According to the RootData calendar page, next week will feature several major events including project updates, macroeconomic news, token unlocks, incentive activities, and presale events. Details are as follows: December 15: Yala promises to provide a follow-up plan for YU depegging by December 15; The third phase of Aster airdrop claim will begin on December 15; A certain exchange wallet will stop supporting ARC-20 assets; CYBER will unlock 3.5272 million tokens, valued at $2.8421 million, accounting for 6.427% of the circulating supply; Taiko Season 6 Trailblazers will end on December 15; Federal Reserve Governor Milan will deliver a speech; FOMC permanent voting member and New York Fed President Williams will speak on the economic outlook. December 16: ARB will unlock 123.5278 million tokens, valued at $26.4556 million, accounting for 2.197% of the circulating supply; Daylight announces the official launch of GRID Games, with DayFi pre-deposit opening on December 16 (1pm UTC); VANA will unlock 1.6195 million tokens, valued at $4.6479 million, accounting for 5.263% of the circulating supply; US November unemployment rate; US November non-farm payrolls (seasonally adjusted, in ten thousands). December 17: A certain exchange may release an important announcement on December 17; ZK will unlock 173.1447 million tokens, valued at $5.3789 million, accounting for 2.020% of the circulating supply; Eurozone November CPI annual final value. December 18: QAI will unlock 250,000 tokens, valued at $22.6625 million, accounting for 204.655% of the circulating supply; Eurozone deposit facility rate as of December 18; Eurozone main refinancing rate as of December 18; US November unadjusted CPI annual rate; US November seasonally adjusted CPI monthly rate; US November seasonally adjusted core CPI monthly rate; US November unadjusted core CPI annual rate. December 19: ZKJ will unlock 18.0556 million tokens, valued at $795,000, accounting for 4.496% of the circulating supply; Japan November core CPI annual rate; Bank of Japan target interest rate as of December 19; US December one-year inflation expectation final value; Bank of Japan announces interest rate decision; Bank of Japan Governor Kazuo Ueda holds a monetary policy press conference. December 20 ZRO will unlock 25.7083 million tokens, valued at $39.0767 million, accounting for 12.659% of the circulating supply; KAITO will unlock 2.8583 million tokens, valued at $1.7466 million, accounting for 1.184% of the circulating supply. In addition, there is a button at the top of the RootData calendar page to generate and share images, allowing users to select important events for sharing.

- 12:16Bitwise advisor: Bitcoin OG whales are still selling, which may be unfavorable for price increasesChainCatcher news, Bitwise advisor Jeff Park stated in an article, "The current market structure is fundamentally not conducive to a substantial price increase for bitcoin. The reason is that, on one hand, bitcoin OG holders are still continuously selling, while on the other hand, demand from ETF and DAT is simultaneously slowing down. For bitcoin to break out of its current trend, it must return to a significantly higher level of implied volatility in a sustained manner, especially upward volatility. Back in November, I said 'volatility or death,' and shared the first abnormal breakout signal at that time, and finally saw volatility start to pick up again, reigniting some hope. Unfortunately, over the past two weeks, implied volatility has once again been comprehensively suppressed. From a peak of 63% in late November, it has now fallen back to 44%."