News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Trump's Remarks Boost Gold Prices; S&P Hits Record High; Storage Stocks Shine in Earnings (January 28, 2026)2Crypto products on CME reached record activity at the end of 20253Bitcoin Achieves Remarkable Stability as a Macro Asset, New Analysis Reveals

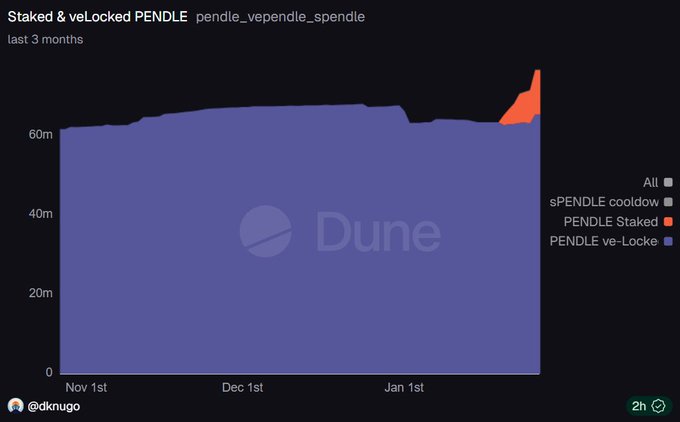

Whale adds 1.5 mln PENDLE: Is the token reversing after a 65% dip?

AMBCrypto·2026/01/28 18:03

UXLINK Partners With 4AI to Accelerate AI-Powered Social Experiences on BNB Chain

BlockchainReporter·2026/01/28 18:00

Strive clears Semler debt off books, buys more bitcoin after $225 million preferred stock sale

101 finance·2026/01/28 17:36

Have Brett and Popcat Peaked? Analysts Say DOGEBALL Is the Top Crypto Presale for 2026

BlockchainReporter·2026/01/28 17:30

Is the US Dollar Poised for a Significant Shift Following Trump’s Support for a Weaker Currency?

101 finance·2026/01/28 17:27

Crypto Struggles to Compete With The Momentum Of AI And Robotics

Cointribune·2026/01/28 17:24

Euro’s surge threatens ECB inflation targets as officials weigh rate cuts

Cointelegraph·2026/01/28 17:21

Oobit Launches Plug and Pay to Enable Instant Crypto Spending Integration for Wallet Providers

Nftgators·2026/01/28 17:21

Bitcoin’s Stunning Edge: Former PayPal CEO Declares Digital Currency Superior to Gold for Storing Value

Bitcoinworld·2026/01/28 17:21

SEC Crypto Policies Face Alarming Pushback from JP Morgan and Citadel Over Economic Stability Fears

Bitcoinworld·2026/01/28 17:21

Flash

17:53

Trump again hints he will not nominate Hassett to lead the Federal ReserveJinse Finance reported that U.S. President Trump once again stated that he is not very willing to nominate National Economic Council Director Hassett to head the Federal Reserve, saying, "I don't want to lose him." Trump said today: "My only problem is, I don't want to lose him. I can tell you, he was at a disadvantage from the start because I don't want to lose him. He is just too outstanding." As the announcement of the Federal Reserve Chairman is imminent, this is the second time in recent weeks that Trump has expressed concerns about Hassett leaving the White House. Due to his close relationship with Trump, Hassett has long been considered a frontrunner for the position. However, Trump is also considering three other candidates and stated that he appreciates Hassett's ability to defend him publicly as a member of the economic team.

17:46

Top 5 Cryptocurrencies Worth Investing in for 2026: Expert PicksAccording to a report by Bijie Network: Despite recent market volatility, experts continue to highlight five cryptocurrencies with significant potential in 2026: Ethereum (ETH), with its developer community and leading position in decentralized finance (DeFi), remains a top choice for long-term investment. Solana (SOL), known for its high speed and low costs, is a major competitor to Ethereum. Aave (AAVE) is highly recognized for its benchmark status in institutional-grade DeFi lending. SUI, a scalable Layer 1 blockchain utilizing innovative technology, is gaining increasing attention. Ondo (ONDO) is a leader in real-world asset tokenization, offering blockchain-based traditional securities.

17:39

Mizuho Bank raises outlook for Circle stock, citing Polymarket's use of USDC for settlements.According to CoinWorld, Mizuho Securities has upgraded Circle Internet Group (NYSE: CRCL) to "Neutral" and raised its target price to $77, reversing its previous downgrade. Analysts pointed out that the growing popularity of the prediction market Polymarket is a key factor driving the increase in demand and market capitalization for USDC. All transactions on Polymarket are settled in Circle's stablecoin USDC. Analysts also noted that the supply of USDC is expected to grow from about $30 billion at the beginning of 2024 to about $75 billion by the end of 2025, partly due to Polymarket's expansion. On Wednesday, Circle's stock price rose more than 3.5%, closing at around $72.50.

News