News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Macro headwinds test Bitcoin price as $70K crumbles amid US market volatility2Trump filling Democratic seats at SEC, CFTC could advance crypto bill talks, TD Cowen says3Bitcoin price ignores $168M Strategy buy, and falls as Iran tensions escalate

Glaukos: Fourth Quarter Financial Highlights

101 finance·2026/02/17 21:45

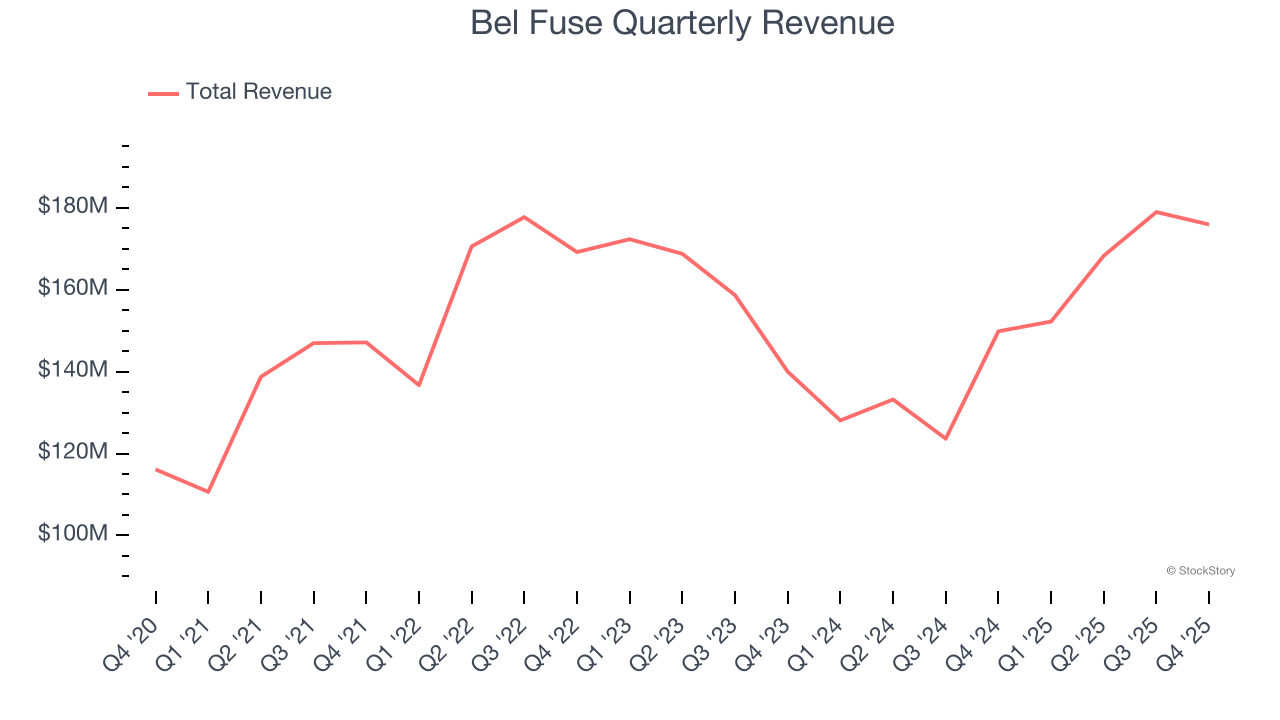

Bel Fuse (NASDAQ:BELFA) Posts Better-Than-Expected Sales In Q4 CY2025

Finviz·2026/02/17 21:45

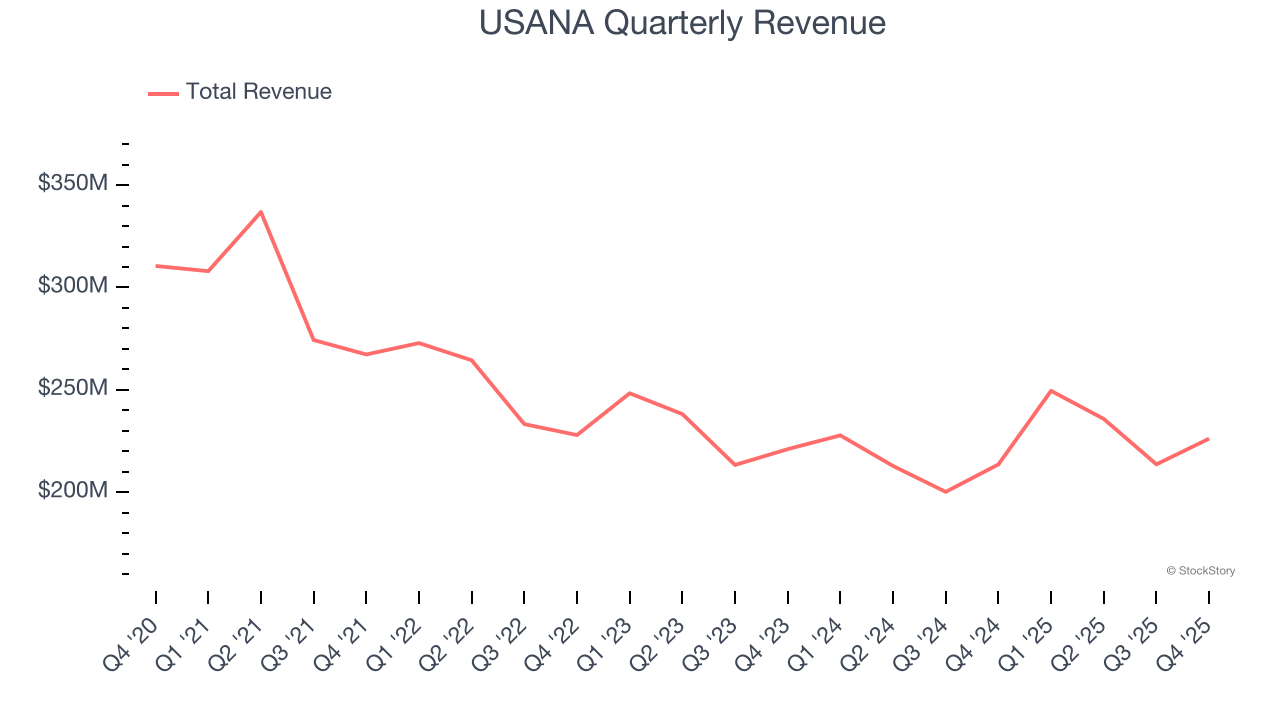

USANA's (NYSE:USNA) Q4 CY2025 Earnings Results: Revenue In Line With Expectations

Finviz·2026/02/17 21:42

Prediction Market ETFs? Roundhill Files For 6 Political Funds For 2026, 2028 Elections

Finviz·2026/02/17 21:42

AtriCure: Fourth Quarter Earnings Overview

101 finance·2026/02/17 21:39

Palo Alto Networks (NASDAQ:PANW) Reports Q4 CY2025 In Line With Expectations But Stock Drops

Finviz·2026/02/17 21:39

Bakkt Announces Partnership with Nexo

Finviz·2026/02/17 21:33

Bitcoin: Corporations rush to secure BTC – So why is price still falling?

AMBCrypto·2026/02/17 21:33

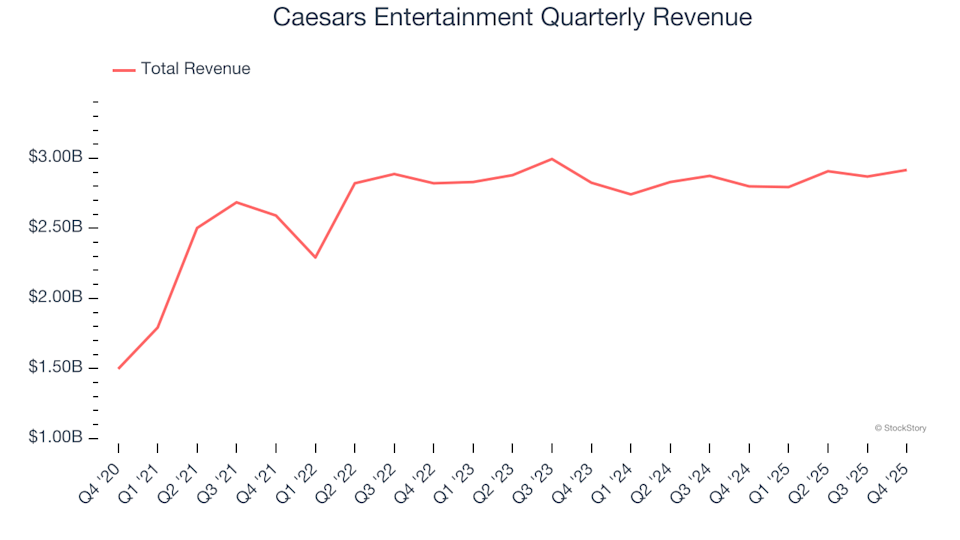

Caesars Entertainment (NASDAQ:CZR) Exceeds Q4 2025 Sales Expectations

101 finance·2026/02/17 21:30

US, Nippon Steel to reline Gary Works blast furnace this year

101 finance·2026/02/17 21:30

Flash

21:45

Daly: Productivity gains will drive up the neutral interest rate, but the short-term impact is limitedChainCatcher news, according to Golden Ten Data, Federal Reserve's Daly stated that models show productivity improvements will drive the neutral interest rate, and the labor market is showing less liquidity and vitality, making it unlikely to affect the neutral interest rate in the short term. Despite steady growth, companies have mentioned uncertainty in demand.

21:39

Daly: U.S. companies hold a cautiously optimistic outlook on the labor marketAccording to Golden Ten Data, ChainCatcher reported that Federal Reserve's Daly stated that companies are now seeing a buyer's market in the labor sector. For U.S. businesses, the recent uncertainty in demand has shifted to cautious optimism.

21:30

Most major US asset class ETFs declined, with gold ETFs closing down over 3.1%, while real estate ETFs rose more than 0.9%.Russell 2000 Index ETF and Soybean Fund both closed up at least 0.03%, Dow Jones ETF, S&P 500 ETF, and US Treasury 20+ Year ETF all rose at least 0.12%, Long US Dollar Index increased by 0.34%, and US Real Estate ETF rose by 0.95%.

News