News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily Report | Fed Maintains Hawkish Stance on Rates; Trump Threatens Iran Leading to Gold and Silver Pullback; Storage Sector Strong with Seagate Up Over 19% (January 29, 2026)2Bitcoin companies keep buying as AI pulls capital away – Inside ABTC’s move3DePIN startups raise $1B, generate $72M in onchain revenue in 2025

Kazakhstan is cracking down on capital flight through crypto

Cointelegraph·2026/01/29 10:15

Bitcoin Challenges Traditional Catalysts: Dismantling the Dollar Myth

Cointurk·2026/01/29 10:06

Why Gold’s Boom May Not Signal the End for Bitcoin

CoinEdition·2026/01/29 09:51

Boston Scientific Shares: Expert Forecasts & Evaluations

101 finance·2026/01/29 09:48

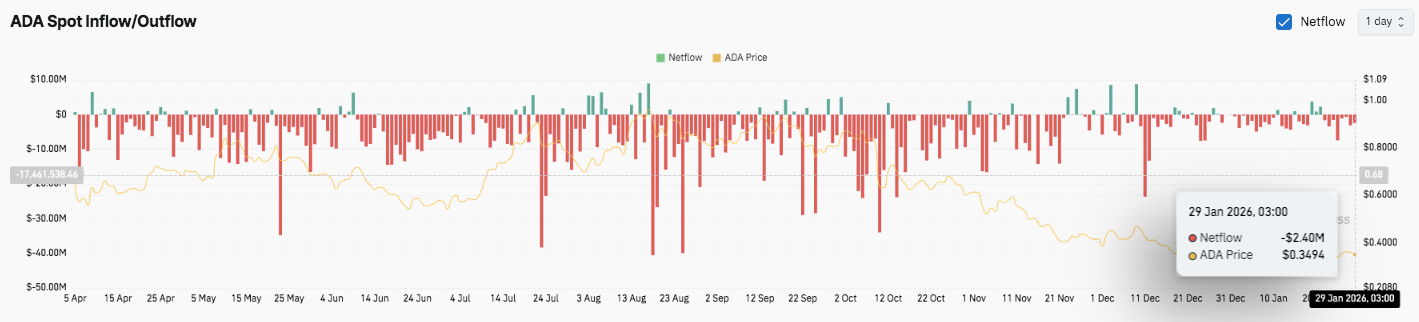

Cardano Price Prediction: ADA Holds Fragile Ground as Sellers Retain Control

CoinEdition·2026/01/29 09:42

Bitcoin Seizure Hack: South Korean Prosecutors Lose $28.8M in Stunning 14-Minute Breach

Bitcoinworld·2026/01/29 09:36

Bitcoin OG’s Staggering $46M Loss Reveals the Perilous Reality of Massive Crypto Long Positions

Bitcoinworld·2026/01/29 09:36

WLD Price Jumps 27% on OpenAI Integration Market Rumors

CoinEdition·2026/01/29 09:27

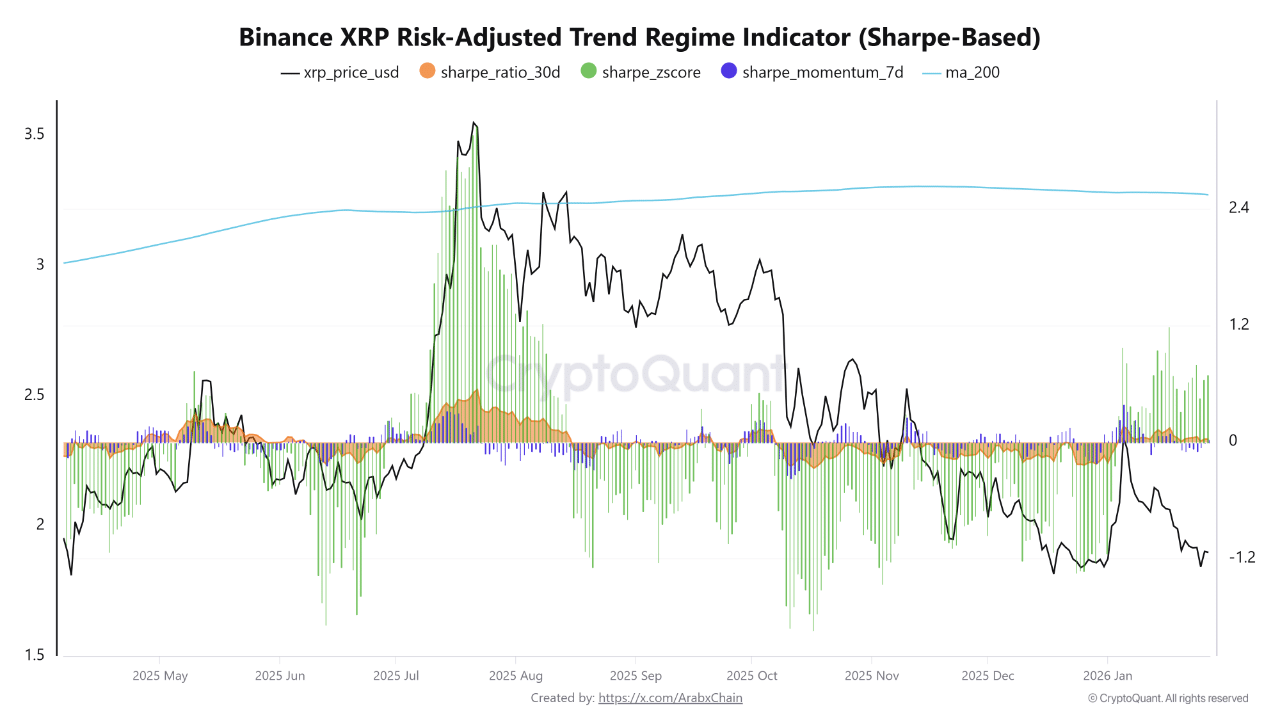

XRP in Consolidation Around $1.88, Analysts Watch $2.50 Breakout

Coinspeaker·2026/01/29 09:21

Trump pushes for legislative ‘compromise’ on crypto bill: Here’s how

AMBCrypto·2026/01/29 09:03

Flash

10:21

Main 24h Trend: More large BTC limit buy orders, totaling $1.049 billionsAccording to the PRO major order list, the total trading data of major players in BTC and ETH over the past 24 hours is as follows: BTC: total trading volume reached $1.049 billions, with buy trades totaling $567 millions and sell trades totaling $482 millions, resulting in a trading difference of $84.986 millions. ETH: total trading volume reached $1.426 billions, with buy trades totaling $722 millions and sell trades totaling $704 millions, resulting in a trading difference of $17.9553 millions. The latest data shows that major players are still positioning at key price levels: BTC net order difference is $16.1913 millions, with the largest single order amount reaching $22.0339 millions; ETH net order difference is $121 millions, with the largest single order amount at $89.9454 millions. Specific key levels for large order bets can be obtained through the PRO "Major Order Tracking" indicator. The data is for reference only and does not constitute any investment advice.

10:20

Cryptocurrencies in TroubleAccording to a report by Bijie Network: Due to investors shifting their interest to soaring precious metals, cryptocurrencies have underperformed, and Bitcoin is struggling to hold the key support level near $86,600. Analysts point out that the market is turning to defensive strategies, while Tether has disclosed that it holds $23 billion worth of gold, making it one of the largest private gold holders. Fidelity plans to launch an Ethereum-based stablecoin, and Ripple has introduced a fund management platform for managing both digital and traditional assets.

10:19

About 63% of bitcoin investors have a cost basis above $88,000Approximately 63% of bitcoin investments have a cost basis above $88,000. On-chain data shows that bitcoin supply is concentrated between $85,000 and $90,000, with relatively weak support below $80,000.

News