News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Spot Gold & Silver Continue to Drop, Bitcoin Crashes; Amazon’s $200 B Capital Expenditure Raises Concerns; U.S. Job Openings Fall to 2020 Lows — Feb 6, 2026 (English Translation)2Weekend Trading Playbook: High-Impact Macro Events & Earnings for Feb 9-15, 2026 – Tech & Crypto Volatility Plays3 Is the “Perfect Storm” Here? Liquidations Explode as Bitcoin Bleeds Below $70K & DXY Rises

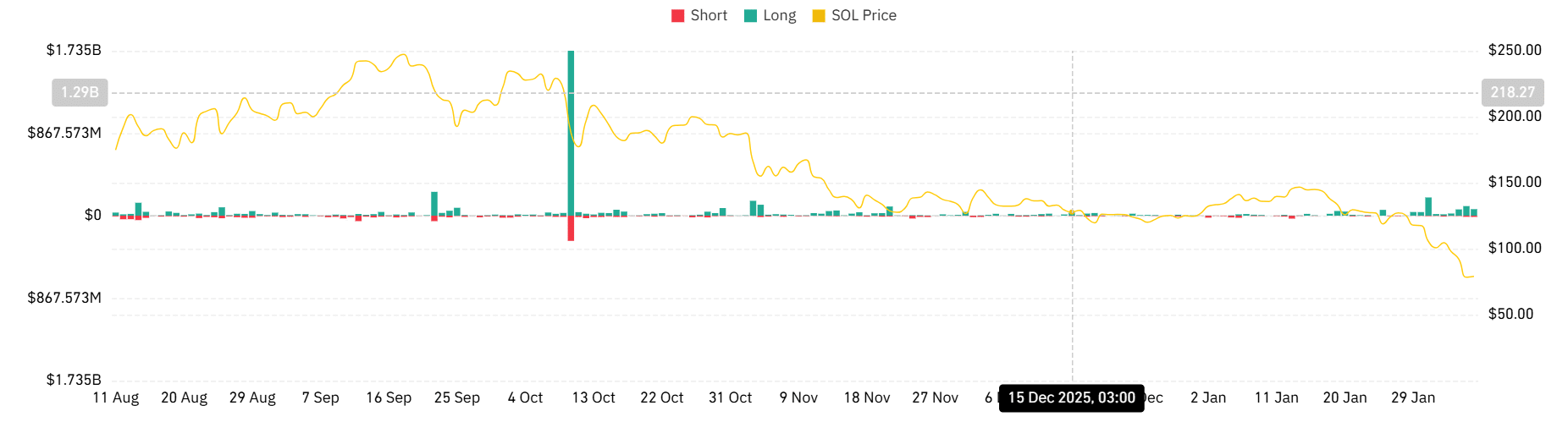

Solana drops 15%, hits 2-year low: Can SOL bulls hold $70?

AMBCrypto·2026/02/06 10:03

After Wall Street's Big Gamble on Crypto, Retail Investors Pay a "High Price"

新浪财经·2026/02/06 09:46

Wistron Executive, Nvidia Supplier: Artificial Intelligence Is Not a Bubble

新浪财经·2026/02/06 09:45

Vauxhall parent company Stellantis faces £19bn loss due to mismanaged transition to electric vehicles

101 finance·2026/02/06 09:34

U.S. House passes three cryptocurrency bills improving market structure and stablecoin regulation.

TokenTopNews·2026/02/06 09:30

Vitalik Buterin highlights creator coins' failures due to high content volume and low quality filtering.

TokenTopNews·2026/02/06 09:30

Michael Burry warns that a Bitcoin price fall could lead to a $1 billion gold sell-off.

TokenTopNews·2026/02/06 09:30

Flash

10:01

Dovey Wan: The Hong Kong crypto community is very small, and I haven't heard of any institution having issues.According to Odaily, Dovey Wan, founding partner of Primitive Ventures, commented on X regarding the rumor that "the market downturn may be due to a Hong Kong hedge fund's IBIT options trading liquidation," stating that, being part of the "Hong Kong fund" circle in Asia, she has a different perspective to share. 1. On taxation: Hong Kong does not have any capital gains tax (Cap Gains), so the so-called "tax optimization harvesting" angle is basically viewed from a US perspective and does not apply to us here. 2. On the rumor: We are conducting due diligence (DD) on the largest bitcoin options strategy fund in Hong Kong. Judging from their performance in recent months and our communications with them, there has been no drama at all since October 11. The Hong Kong circle is small, and everyone loves gossip—if something really happened, it would be impossible to keep it under wraps. For example, when the Hong Kong-based market maker Taipingshan, associated with 3AC, blew up, we knew about it almost the next day. 3. On capital flows: Even before the in-kind redemption mechanism appeared, many old-school Asian bitcoin OG whales had already swapped their assets one-way into compliant channels like IBIT (at that time, only one exchange's market maker could do this—those in the know understand). The main reasons for doing this were: easier custody; reduced operational and counterparty risk; more convenient use as collateral within the traditional finance (TradFi) system; and cleaner transfer into other traditional financial assets. 4. On trading habits: Starting from the second half of 2025, bitcoin trading activity has structurally shifted to favor US stock trading hours (especially the early session of the New York open), and the spot selling pressure on major exchanges reflects this. In recent days, a certain exchange has also seen huge spot selling pressure during these periods, which is actually a chain reaction brought about by ETF redemptions. Additionally, why would a bitcoin fund "blow up" just because it is writing options? Unless they are naked shorting, or engaging in leveraged basis trades, and then got liquidated due to an unexpected widening of the price spread between IBIT and spot. So, this is most likely a traditional finance (TradFi) fund with a cross margin mechanism, rather than a purely "old-school bitcoin believer" fund.

10:01

「Strategy Counterparty」 recorded a loss of over $31 million in a single day, and once again injected $8 million to replenish its 'ammunition'.BlockBeats News, February 6. According to Coinbob Popular Address Monitor, this morning, the "Strategy Whales" liquidated its long positions of several coins with a total value of about $175 million, resulting in a total loss of $31.13 million. This loss caused its account balance to plummet from tens of millions of dollars to less than $6 million.

Subsequently, the address transferred approximately $8.29 million to Hyperliquid to replenish the margin and maintain account operations. Currently, its total account balance has recovered to around $12.9 million. Specific position liquidation information is as follows:

Pre-liquidation ETH long position size was approximately $105 million, liquidation price was $1933, resulting in a loss of $17.83 million;

Pre-liquidation BTC long position size was approximately $41.52 million, liquidation price was $65,700, resulting in a loss of $6.3 million;

Pre-liquidation SOL long position size was approximately $15.44 million, liquidation price was $82, resulting in a loss of $3.57 million;

Pre-liquidation XRP long position size was approximately $13.88 million, liquidation price was $1.25, resulting in a loss of $3.43 million;

The address started accumulating positions in December last year, with an initial account size of around $20 million, and subsequently gradually added short positions of mainstream coins such as BTC and ETH. Because the trading direction was contrary to the publicly traded company MicroStrategy's continuous purchase of BTC, the market considered this address as its clear "on-chain opponent." It often frequently switched directions, holding billion-dollar positions.

09:58

U.S. unemployment reaches a 17-year high, sending a positive signal for bitcoin bullsAccording to a report by Bijie Network: The number of layoffs in the United States surged by 205% in January, reaching 108,435, the highest record since 2009. This indicates that the labor market is cooling down and may force the Federal Reserve to cut interest rates. Such a potential easing policy could support bitcoin, which is currently still down nearly 50% from its all-time high of over $126,000.

News