News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitcoin’s post-quantum plan BIP-360 gains traction, but will it reverse market sell-off?2Bitcoin holders are being tested as inflation fades: Pompliano3 Bitcoin Price Bottom Not In Yet? Data Signals More Pain Ahead

ChimpX AI Leverages BNB Chain Resilience: Final Pre-Sale Round Opens on AlphaMind Ahead of Massive Ecosystem Push

BlockchainReporter·2026/02/16 14:27

Bitcoin, Ethereum Slip 3% As XRP, Dogecoin Fall Over 6% On Holiday-Thinned Trading

Finviz·2026/02/16 14:24

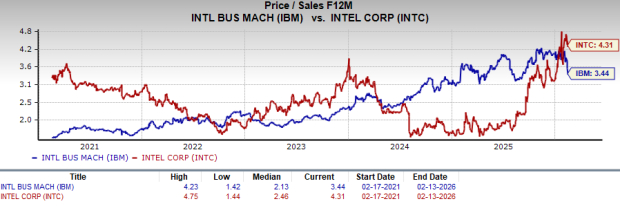

IBM vs. Intel: Which AI-Focused Stock is the Better Buy Today?

Finviz·2026/02/16 14:21

What Price Targets Have Wall Street Analysts Set for Biogen Shares?

101 finance·2026/02/16 14:21

The ‘Sell America’ trend has caused ‘permanent harm’ to the U.S. dollar, according to ING

101 finance·2026/02/16 14:12

Curvance Defies Attack: DeFi Protocol’s Swift Action Thwarts Major Front-End Hack, Zero Funds Lost

Bitcoinworld·2026/02/16 14:06

Japanese economic figures fall short, pushing the yen down, as the US dollar steadies across wider markets

101 finance·2026/02/16 14:03

5 Stocks With Recent Price Strength Amid Wall Street Volatility

Finviz·2026/02/16 13:57

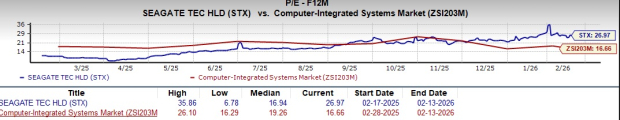

STX Stock Soars 31% in a Month: Should You Add It to Your Portfolio?

Finviz·2026/02/16 13:57

Flash

14:35

Multi-chain Lending Protocol ZeroLend Announces Gradual Shutdown, Advises Users to Withdraw Funds PromptlyBlockBeats News, February 16th, the cross-chain lending protocol ZeroLend officially announced:

After three years of building and operating the protocol, the team has made a difficult decision: to gradually cease operations. Despite the team's continuous efforts, the current state of the protocol is no longer sustainable.

Over the past period, several chains early supported by ZeroLend have become inactive or experienced a significant decrease in liquidity. In some cases, oracle providers have also stopped their support, making it increasingly difficult to reliably operate the markets or generate sustainable income. Meanwhile, as the protocol has scaled, it has attracted more attention from malicious actors, including hackers and scammers. Combined with the protocol's thin profit margin and high-risk nature, this has resulted in the protocol being in a long-term loss-making state.

The team's current top priority is to ensure that users can safely withdraw their assets. It is highly recommended that all users withdraw any remaining funds from the platform as soon as possible.

14:32

U.S. banks may face new mortgage capital requirements under Basel regulationsPANews, February 16 – According to Jinse Finance, as the Federal Reserve is about to announce a highly anticipated bank capital proposal related to Basel III, U.S. lending institutions may face new mortgage requirements. Michelle Bowman, the Federal Reserve's chief banking regulator, stated that this new measure related to residential real estate will consider increasing the “risk sensitivity” of capital requirements for mortgages on banks’ balance sheets. One approach is to use the loan-to-value ratio to determine the applicable risk weight for residential real estate exposures, instead of adopting a uniform risk weight. “This change could better align capital requirements with actual risks, support on-balance-sheet lending by banks, and potentially reverse the trend of mortgage activity shifting to non-bank institutions over the past 15 years,” Bowman said.

14:07

Metaplanet Annual Financial Report: HODLing Results in $6.658 Billion Loss, but Balance Sheet Still "Strong"BlockBeats News, February 16th, Bitcoin treasury company Metaplanet released its 2025 fiscal year financial report on Monday, reporting a net loss of 95 billion yen (approximately $6.19 billion) for the year ended December 31st, compared to a net profit of 4.44 billion yen (approximately $28.9 million) in the 2024 fiscal year, shifting from profit to loss.

The financial report indicates that this loss was mainly due to a 102.2 billion yen (approximately $6.658 billion) valuation loss on its held Bitcoin. The company categorizes this loss as a non-operating expense, stating that it has no impact on cash flow or operating activities.

Despite the significant swing in net profit, the company emphasized the resilience of its capital structure. Metaplanet noted that its balance sheet remains "robust," with its liabilities and preferred shares fully covered even in an "86% drop in Bitcoin price" scenario, thanks to its high equity ratio of 90.7%.

As of December 31st, the company reported liabilities of 46.7 billion yen (approximately $304.2 million), net assets of 458.5 billion yen (approximately $2.99 billion), and a Bitcoin holding value of 481.5 billion yen (approximately $3.1 billion).

Operationally, Metaplanet's revenue for the 2025 fiscal year reached 8.91 billion yen (approximately $58 million), a 738% increase from the previous year's 1.06 billion yen (approximately $6.9 million); meanwhile, operating profit surged from 350 million yen (approximately $2.28 million) to 6.29 billion yen (approximately $41 million), a remarkable 1695% increase.

The company stated that its Bitcoin-related business generated revenue of 8.47 billion yen (approximately $55.2 million) and operating income of 7.19 billion yen (approximately $46.8 million), with this growth primarily driven by premium income from Bitcoin options trading.

News