News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Trump Ends Government Shutdown; Software Stocks Hit by AI Tools; Nvidia Plans Massive Investment in OpenAI (February 4, 2026)2BitMine adds 41,000 ETH to its balance sheet, while its unrealized losses amount to $6B3XRP price prediction: What the loss of the $1.77 swing low means for you

Cognizant: Q4 Financial Results Overview

101 finance·2026/02/04 11:51

Raytheon secures deal to build thousands of missiles for the US, including Tomahawks

101 finance·2026/02/04 11:45

GE HealthCare: Fourth Quarter Earnings Overview

101 finance·2026/02/04 11:42

Bob Iger brought Disney back to life, yet obstacles still persist

101 finance·2026/02/04 11:18

Amazon's physical grocery push deepens its fight against rival Walmart

101 finance·2026/02/04 11:15

Musk's mega-merger of SpaceX and xAI bets on sci-fi future of data centers in space

101 finance·2026/02/04 11:09

Anti-Strategy ETFs Climb as MSTR Stock Hits Multi-Year Low

Coinspeaker·2026/02/04 11:06

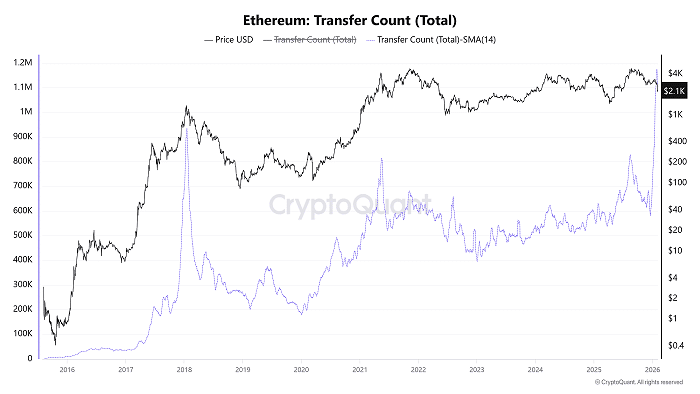

ETH ETFs Back with Inflows after 3 Days amid Dip Buys and Transfer Count Surge

Coinspeaker·2026/02/04 11:06

Flash

11:53

Hong Kong accelerates stablecoin regulation, HKMA aims to issue first batch of licenses by MarchBlockBeats News, February 4, according to Beijing Business Today, Hong Kong's stablecoin regulation has seen new progress. Eddie Yue, Chief Executive of the Hong Kong Monetary Authority, stated that 36 applications for stablecoin issuer licenses have been received so far, and the relevant assessment work is being expedited. The aim is to issue the first batch of stablecoin licenses in March, but the number will be kept prudent, with only a small number issued. Eddie Yue emphasized that one of the key focuses of the review is risk management capability, including stablecoin application scenarios, reserve asset allocation, and cross-border compliance arrangements. In the future, if cross-border business involves Mainland China, Singapore, London, or ASEAN, relevant institutions must also comply with local regulatory requirements. Industry insiders pointed out that the issuance of the first batch of licenses is expected to promote the development of a compliant stablecoin ecosystem in Hong Kong, drive financial innovation such as tokenized assets and cross-border payments, and further consolidate Hong Kong's international position in the field of digital finance. However, the Monetary Authority has made it clear that it will adhere to a "stability-first" regulatory approach, believing that stablecoin business should be strictly regulated and advanced steadily, with rules gradually optimized based on practical experience. Regulators also reminded the public to be alert to illegal financial activities using "stablecoin" as a gimmick. Industry experts advise investors to stay away from unlicensed stablecoin products, and cross-border participation in Hong Kong-licensed stablecoin-related businesses must also comply with Mainland China's foreign exchange and cross-border regulatory requirements to guard against market speculation risks.

11:44

Institutions: Software stocks may continue to face pressure in the short termGlonghui, February 4th|Kathleen Brooks from XTB stated in a report that software stocks may continue to be under pressure in the short term. She pointed out that investors are becoming more selective, only supporting certain companies. Entering 2026, AI-related trades are showing significant differentiation, and in the short term, individual stock performance is still mainly driven by company-specific factors. This situation may put pressure on the Nasdaq Index, as investors, influenced by various factors, prefer small-cap stocks over tech giants. However, she also mentioned that the AI supply chain is not without highlights. “Memory and chip manufacturers will be essential to support Anthropic’s latest tools and other future products.”

11:43

Arbitrum, Optimism, and Base respond to Vitalik: L2s need to move towards specializationForesight News reported, according to Cointelegraph, that Ethereum co-founder Vitalik Buterin tweeted that the original vision of L2 as the main scaling engine is no longer applicable, and called for a shift towards specialization.Optimism co-founder Karl Floersch responded by welcoming the construction of modular L2 stacks, but pointed out that Stage 2 is not yet ready, withdrawal windows are long, and cross-chain tools are insufficient, expressing support for native rollup precompiled contracts. Arbitrum co-founder Steven Goldfeder emphasized that scaling remains the core value of L2, noting that during periods of high activity, Arbitrum and Base process over 1000 TPS, far exceeding Ethereum, and warned that if Ethereum becomes unfriendly to rollups, institutions may turn to independent L1s.Base lead Jesse Pollak stated that L1 scaling benefits the ecosystem, and L2 should not be just a "cheaper Ethereum." Base focuses on user onboarding and applications, account abstraction, privacy, and other specializations. StarkWare CEO Eli Ben-Sasson hinted that Starknet already meets the criteria for specialization.

News