News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Spot Gold & Silver Continue to Drop, Bitcoin Crashes; Amazon’s $200 B Capital Expenditure Raises Concerns; U.S. Job Openings Fall to 2020 Lows — Feb 6, 2026 (English Translation)2Weekend Trading Playbook: High-Impact Macro Events & Earnings for Feb 9-15, 2026 – Tech & Crypto Volatility Plays3 Is the “Perfect Storm” Here? Liquidations Explode as Bitcoin Bleeds Below $70K & DXY Rises

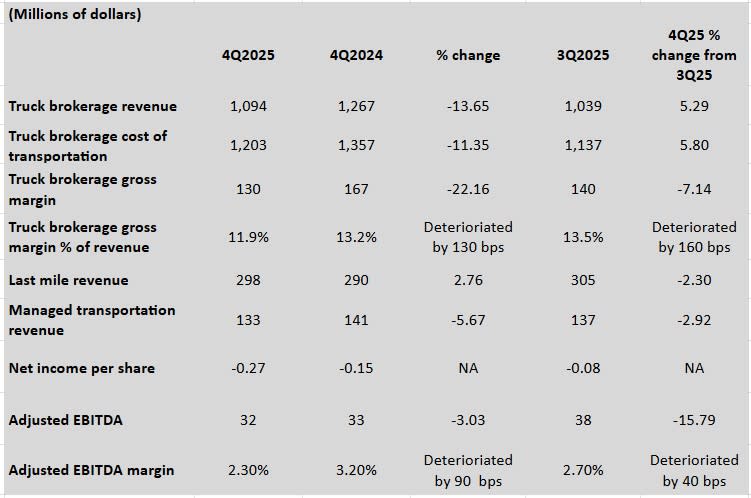

First impression: Challenging conditions for brokers reflected in RXO's fourth quarter financial results

101 finance·2026/02/06 11:51

Bitcoin Institutional Selling Warning: CryptoQuant CEO Reveals Critical One-Month Rebound Threshold

Bitcoinworld·2026/02/06 11:51

XRP Holds Near $1.12 After Sharp February Drop Shakes Market

Cryptotale·2026/02/06 11:36

Tesla Considers Increasing Solar Cell Production in New York, Arizona, and Idaho

101 finance·2026/02/06 11:30

What Price Targets Have Wall Street Analysts Set for KKR & Co. Shares?

101 finance·2026/02/06 11:30

Tesla has lost its top spot: Here’s how a Chinese rival overtook the electric vehicle leader

101 finance·2026/02/06 11:21

4 factors behind this week’s dramatic plunge in technology stocks

101 finance·2026/02/06 11:15

Biogen forecasts annual profit above estimates as Leqembi sales pick up

101 finance·2026/02/06 11:15

Amazon shares sink as Big Tech's AI spending plans worry investors

101 finance·2026/02/06 11:06

Flash

11:58

UBS warns that cryptocurrencies are not assets, while whales and Bitcoin ETF funds are exiting the marketForesight News reported, according to Fortune magazine, UBS Group Chief Economist Paul Donovan stated, "Cryptocurrencies are not assets and are only held by a very small segment of society." Jefferies analyst Andrew Moss pointed out that bitcoin whale addresses have shifted from accumulation to net selling. In addition, retail investors entering through spot bitcoin ETFs are also withdrawing funds, with the weeks of January 19 and January 26 recording the second and third largest net outflows since launch, and another large-scale net outflow occurring on February 4. Sygnum Bank Chief Investment Officer Fabian Dori stated that the market is extremely fearful.

11:56

Bank of America: Bullish on small and mid-cap stocks as tech giants become less attractiveGlonghui, February 6th|Bank of America strategists stated that as the appeal of tech giants declines, U.S. small and mid-cap stocks are the best allocation direction ahead of the midterm elections. The team led by Michael Hartnett pointed out that Trump’s “aggressive intervention” measures to lower energy, healthcare, credit, housing, and electricity prices are putting pressure on sectors such as energy giants, pharmaceutical companies, banks, and large technology firms. This makes small and mid-cap stocks the main beneficiaries of this round of “prosperity” as the midterm elections approach. Recently, investors, concerned about the impact of artificial intelligence, have accelerated the rotation out of tech stocks, seeking trading opportunities that are expected to benefit from the Trump administration’s efforts to reduce living costs. At the same time, a major category of companies that are more sensitive to improvements in economic growth prospects has also outperformed the broader market. Bank of America pointed out that the shift from “asset-light” to “asset-heavy” business models means the market dominance of the “Magnificent Seven” tech giants is facing a “significant threat.”

11:39

After the release of US employment data this week, the probability of a rate cut has risen again to 16%.BlockBeats News, February 6, this Thursday, the number of initial jobless claims in the US for the week ending January 31 was 231,000, higher than the expected 212,000. In addition, ADP research data released on Wednesday showed that the private sector added only 22,000 jobs in January, below market expectations, and the previous month's data was revised downward. The related employment data has reignited market attention on the Federal Reserve's March decision. As of press time, the probability of a rate cut in March on Polymarket has risen from 8% two days ago to 16%, while the probability of keeping rates unchanged has dropped from 91% to 82%.

News