News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Spot Gold & Silver Continue to Drop, Bitcoin Crashes; Amazon’s $200 B Capital Expenditure Raises Concerns; U.S. Job Openings Fall to 2020 Lows — Feb 6, 2026 (English Translation)2Weekend Trading Playbook: High-Impact Macro Events & Earnings for Feb 9-15, 2026 – Tech & Crypto Volatility Plays3 Is the “Perfect Storm” Here? Liquidations Explode as Bitcoin Bleeds Below $70K & DXY Rises

Japan's cryptocurrency sector encounters a pivotal challenge as the snap election approaches

101 finance·2026/02/07 14:15

WLFI Drops 8% as Bearish Trend Deepens: What Comes Next?

Cryptotale·2026/02/07 13:27

XRP Ledger DeFi Roadmap Shows Expanding Role in Financial Infrastructure

CoinEdition·2026/02/07 12:36

Ethereum Rebounds Above 2000 as BitMine Stock Jumps Today

Cryptotale·2026/02/07 12:18

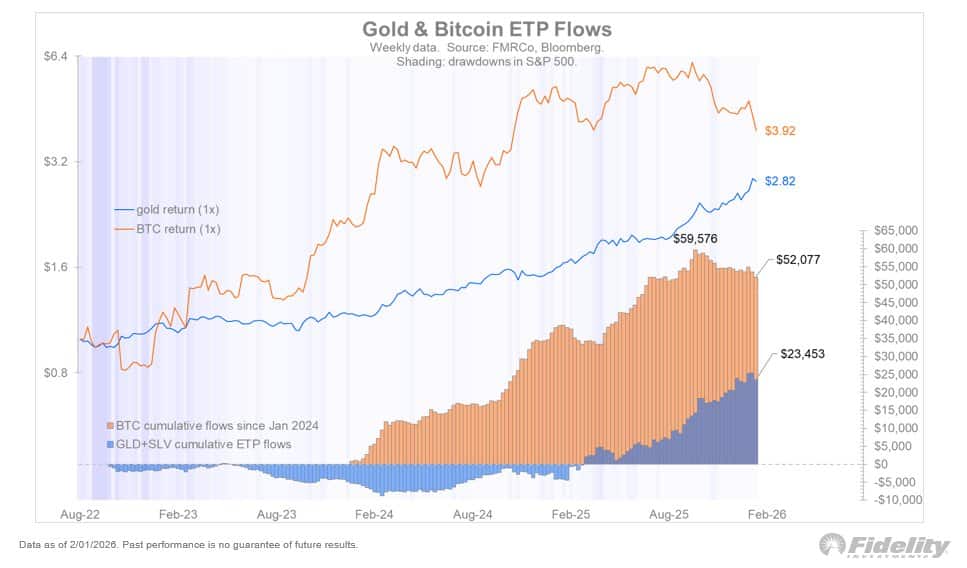

Bitcoin: Why Fidelity calls $65K an ‘attractive entry point’

AMBCrypto·2026/02/07 12:18

Here's What Traders Anticipate for Coca-Cola Stock Movement Following Tuesday's Earnings Report

101 finance·2026/02/07 12:09

5 Best Crypto Presales as Bitcoin Breaks Above $70K: Moonshot Entries for Degens (2026)

BlockchainReporter·2026/02/07 11:42

Zcash Slides 60% as Treasury Buying Pauses and Cypherpunk’s Losses Mount

Cointribune·2026/02/07 11:33

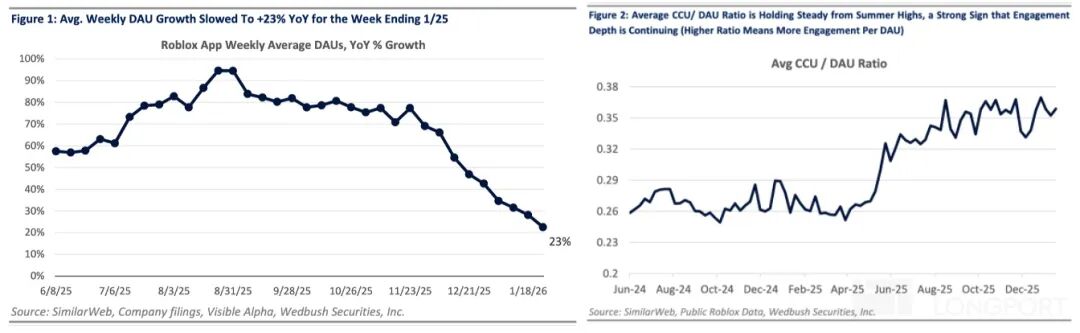

Software crash together? Roblox: There is an ecosystem loop, Genie can't break it

海豚投研·2026/02/07 11:30

Strategy shrugs off Q4 loss: ‘Bitcoin must hit $8K to force a sale’

AMBCrypto·2026/02/07 11:03

Flash

14:03

EY says wallets will become the core interface of global financeEY Digital Assets leaders Mark Nichols and Rebecca Carvatt stated that wallets are no longer just crypto tools, but have become the primary strategic interface for the next generation of global finance. They believe that wallet infrastructure, rather than just tokenization, will determine the market winners. Although tokenization is reshaping the infrastructure of financial markets, the real transformation lies in capital efficiency and programmable transaction chains. As regulation gradually improves and wallet adoption accelerates, EY emphasizes that financial enterprises need to take action as soon as possible.

14:00

Bitcoin mining company Bitfarms announces relocation of headquarters to the United States and rebranding as Keel InfrastructurePANews, February 7 — According to Globenewswire, Nasdaq-listed bitcoin mining company Bitfarms has announced that it will move its headquarters registration from Canada to the United States and will also change its name to Keel Infrastructure. These matters are subject to approval by shareholders, a certain exchange, and the court. It is reported that Keel Infrastructure will be a company incorporated under the laws of Delaware, and after the change of registration is completed, its common stock will be traded on Nasdaq and a certain exchange under the updated name.

13:54

Opinion: The current crypto bear market is not caused by a single factor; instead, a combination of 15 major factors has driven the market to plunge sharply.BlockBeats News, on February 7, renowned Argentine economist and veteran crypto trader Alex Krüger posted on social media that the current crypto bear market is not caused by a single factor. He summarized 15 major factors that have driven the market to plunge, mainly including: "1011" major liquidation, treasury company stock downturn, quantum threat, AI substitution effect (capital, talent, and mining companies shifting to AI), Trump political risk, lack of innovation in the crypto industry, excessive incremental token supply, and Waller being nominated as the new Federal Reserve chairman, among others. The above views were retweeted and supported by the father of smart contracts and Castle Island Ventures co-founder Nic Carter. Nic Carter believes that this crypto bear turn should not be blamed on a single event, and that many of the issues among the 15 major factors are quite tricky.

News