News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Macro headwinds test Bitcoin price as $70K crumbles amid US market volatility2Trump filling Democratic seats at SEC, CFTC could advance crypto bill talks, TD Cowen says3Bitcoin price ignores $168M Strategy buy, and falls as Iran tensions escalate

Alamos Gold Increases Dividend by 60% to an Annual Rate of $0.16 Per Share

Finviz·2026/02/18 22:03

Bitcoin Miner Riot Must Embrace $21 Billion AI Opportunity, Says Activist Investor

Decrypt·2026/02/18 22:03

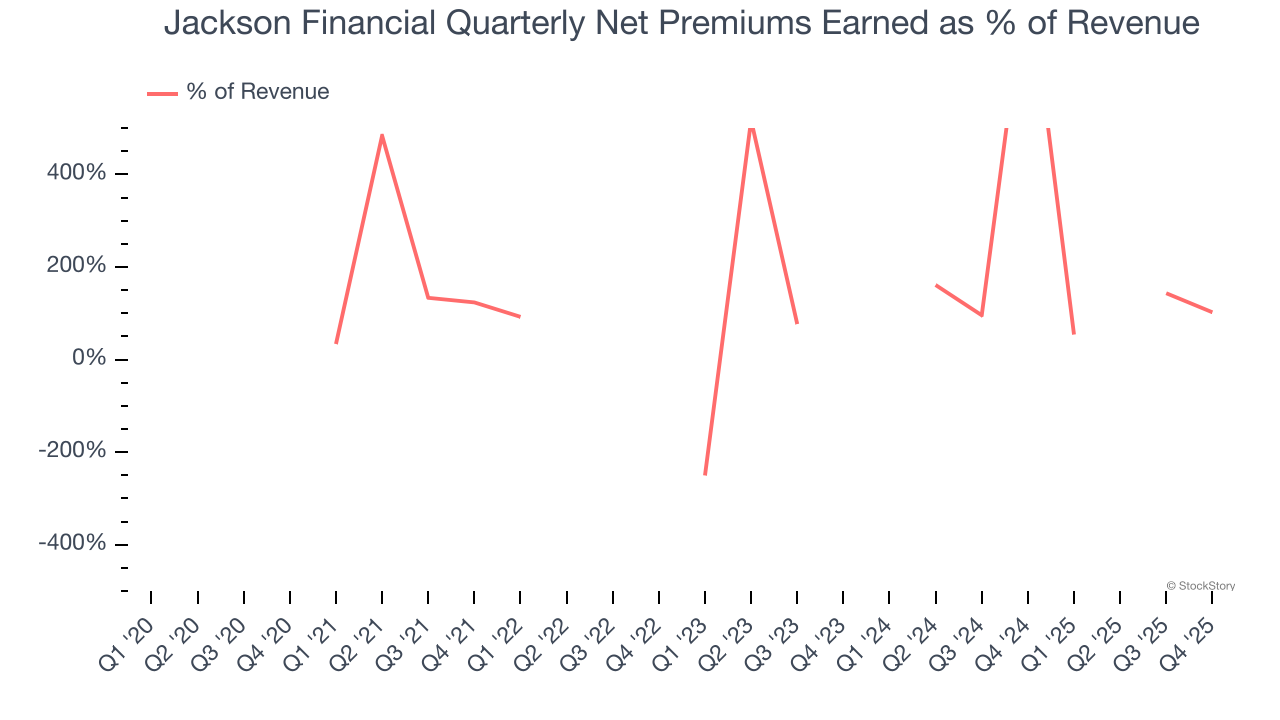

Jackson Financial (NYSE:JXN) Delivers Impressive Q4 CY2025

Finviz·2026/02/18 21:57

Meta CEO Mark Zuckerberg appears in court over lawsuit on teen social media dependency

101 finance·2026/02/18 21:55

Berkshire & AI Hyperscalers: Buffett Holds GOOGL, Dumps AMZN

Finviz·2026/02/18 21:54

DoorDash (NASDAQ:DASH) Misses Q4 CY2025 Revenue Estimates

Finviz·2026/02/18 21:51

SOL’s path of least resistance tilts toward $50 but onchain data hints at a bottom

Cointelegraph·2026/02/18 21:48

Nordson: Fiscal First Quarter Earnings Overview

101 finance·2026/02/18 21:48

Flash

21:56

In relatively light after-hours trading, Blue Owl Capital Inc. (ticker: OWL) shares edged down 0.97%, closing at $12.19.The company announced at the same time that it will initiate an asset sale plan for its three credit funds. This asset disposal decision comes at a time when market trading activity appears somewhat sluggish. The moderate fluctuation in the stock price coincided with the announcement of the fund asset adjustment, drawing market attention to Blue Owl's capital allocation strategy. The specific asset scale and sale timetable for the three credit funds involved have not yet been disclosed, but this move will undoubtedly impact the company's liquidity management and income structure. Market analysts point out that, against the backdrop of a complex and volatile interest rate environment, Blue Owl's asset sale may be aimed at optimizing portfolio risk exposure or freeing up capital for new investment opportunities. The subsequent developments are worth close attention.

21:56

On February 13, 2026, Turbo Energy SA (TURB) announced that the company's Chief Financial Officer, Lucia Tamarit, has officially resigned from her position.This personnel change marks a significant adjustment in the company's senior management team.

21:56

Jackson Financial Inc (JXN) recently announced its 2026 capital return plan, aiming to return $900 millions to $1.1 billions to common shareholders by 2026.This move demonstrates the company's confidence in its future cash flow and capital management capabilities. The plan aims to efficiently return capital to shareholders through dividends or share buybacks. The company stated that this goal is based on its robust financial performance and continued business growth expectations. Jackson Financial Inc emphasized that it will balance business investment and shareholder returns through prudent capital allocation strategies to achieve long-term value maximization.

News