News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Macro headwinds test Bitcoin price as $70K crumbles amid US market volatility2Trump filling Democratic seats at SEC, CFTC could advance crypto bill talks, TD Cowen says3Bitcoin price ignores $168M Strategy buy, and falls as Iran tensions escalate

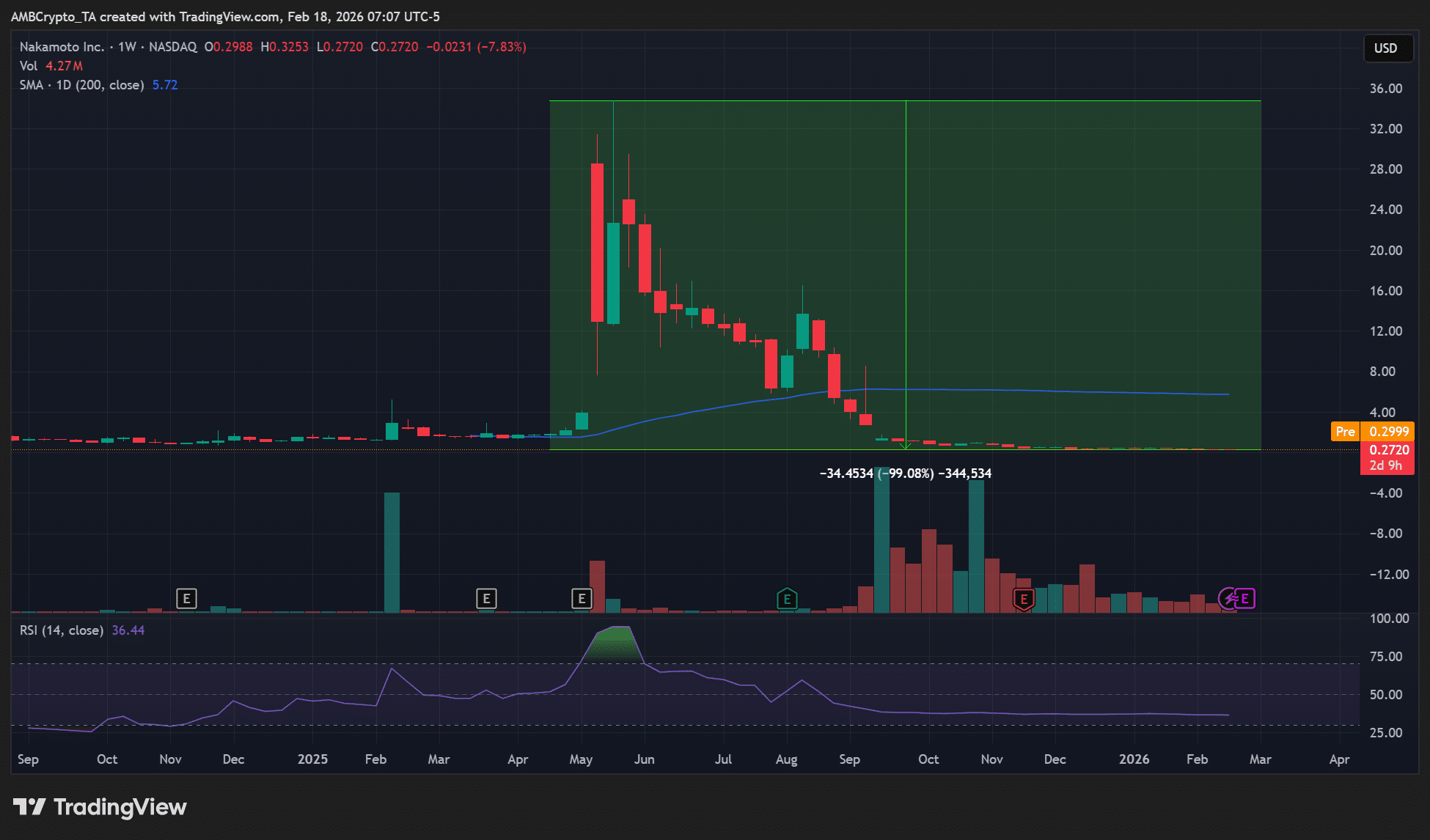

‘Noise on Twitter’ – David Bailey denies scam claims after Bitcoin treasury Nakamoto falls 99%

AMBCrypto·2026/02/19 06:33

Helium (HNT) Price Prediction 2026, 2027 – 2030: Evaluating HNT’s Long-Term Potential Ahead

Coinpedia·2026/02/19 06:30

Bitcoin Could Drop to $55K Before Recovery, Says CryptoQuant CEO

CoinEdition·2026/02/19 05:51

Samsung and SK Hynix "Adjust Strategy": New Memory Factory Production Schedule Moved Up

华尔街见闻·2026/02/19 05:32

Why Wall Street Is Watching Manhattan Associates, Inc. (MANH)' Cloud Expansion Closely

Finviz·2026/02/19 05:03

Analysts Bullish On AppLovin Corporation (APP) Outlook Following Impressive Results

Finviz·2026/02/19 05:03

Brevan Howard, Which Manages $40 Billion, Announces Major Sale of Bitcoin (BTC) Assets

BitcoinSistemi·2026/02/19 05:01

What are the reasons behind the recent significant changes in gold prices?

101 finance·2026/02/19 05:00

PINDex and Cache Wallet Form Strategic Alliance to Revolutionize AI-Driven On-Chain Trading

BlockchainReporter·2026/02/19 05:00

Ethereum Foundation Unveils Ambitious 2026 Protocol Roadmap: Scaling, Security, and Quantum Readiness

Bitcoinworld·2026/02/19 04:36

Flash

07:03

A whale deposited 1.765 million USDC into HyperLiquid to open long positions in ETH and BTC. according to Onchain Lens monitoring, a certain whale deposited 1.765 million USDC to HyperLiquid to open 20x leveraged long positions on ETH and BTC, with the ETH position currently at 9,411.33 coins and the BTC position at 260.11 coins.

06:52

$40,000 Bitcoin put options become the second largest position, expiring on February 27Bitcoin $40,000 put options have become the second largest open interest, with a total notional value of approximately $490 million, indicating an increased demand for downside protection in the market. Around $566 million in positions are concentrated at the $75,000 strike price, representing the maximum pain level. Overall, the number of call options still exceeds put options, suggesting that traders are balancing expectations of a rebound with hedging against downside risks.

06:48

A whale deposited $8.58 million USDC and opened a $671,200 BTC long position.On-chain data shows that three days ago, a whale deposited $8.58 million USDC into Lighter_xyz. Yesterday, this whale opened a BTC long position with 20x leverage, totaling 1,000 BTC, with a total value of $671,200. The entry price was $67,096, and the liquidation price was $58,409.82. (Onchain Lens)

News