News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily Report | US-Japan-EU-Mexico Collaborate on Key Minerals Development; Nasdaq Introduces Fast Inclusion Rules; Software Stocks Continue Under Pressure (February 5, 2026)2Hyperliquid treasury seeks revenue boost using HYPE holdings as options collateral3Bitcoin drops following Treasury Secretary Bessent's statement that the US government cannot require banks to rescue crypto

Analysis-'Software-mageddon' leaves investors bargain-hunting but wary

101 finance·2026/02/05 06:12

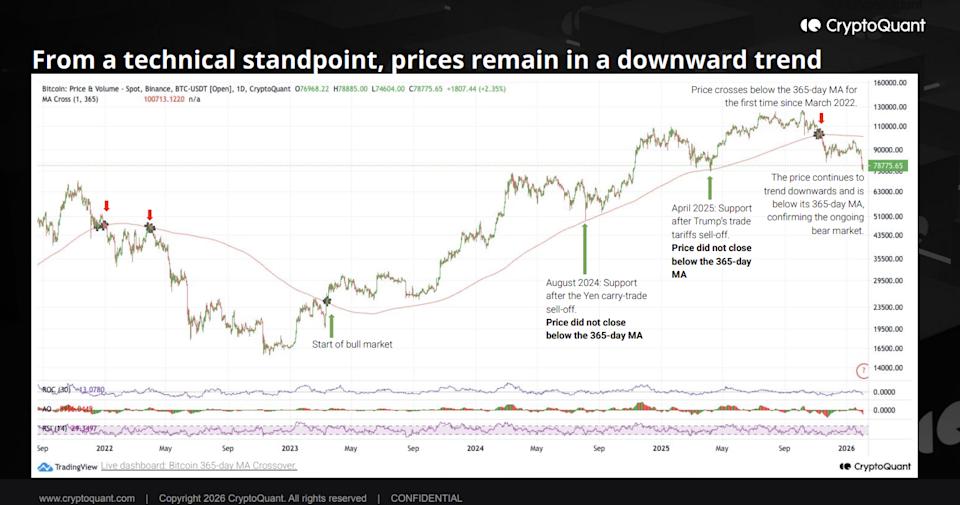

Bitcoin Drops: Compare Today to Past Markets Now!

Cointurk·2026/02/05 06:09

Sony Stock Rises 6% Following Upgraded Outlook and Strong Sales

101 finance·2026/02/05 04:30

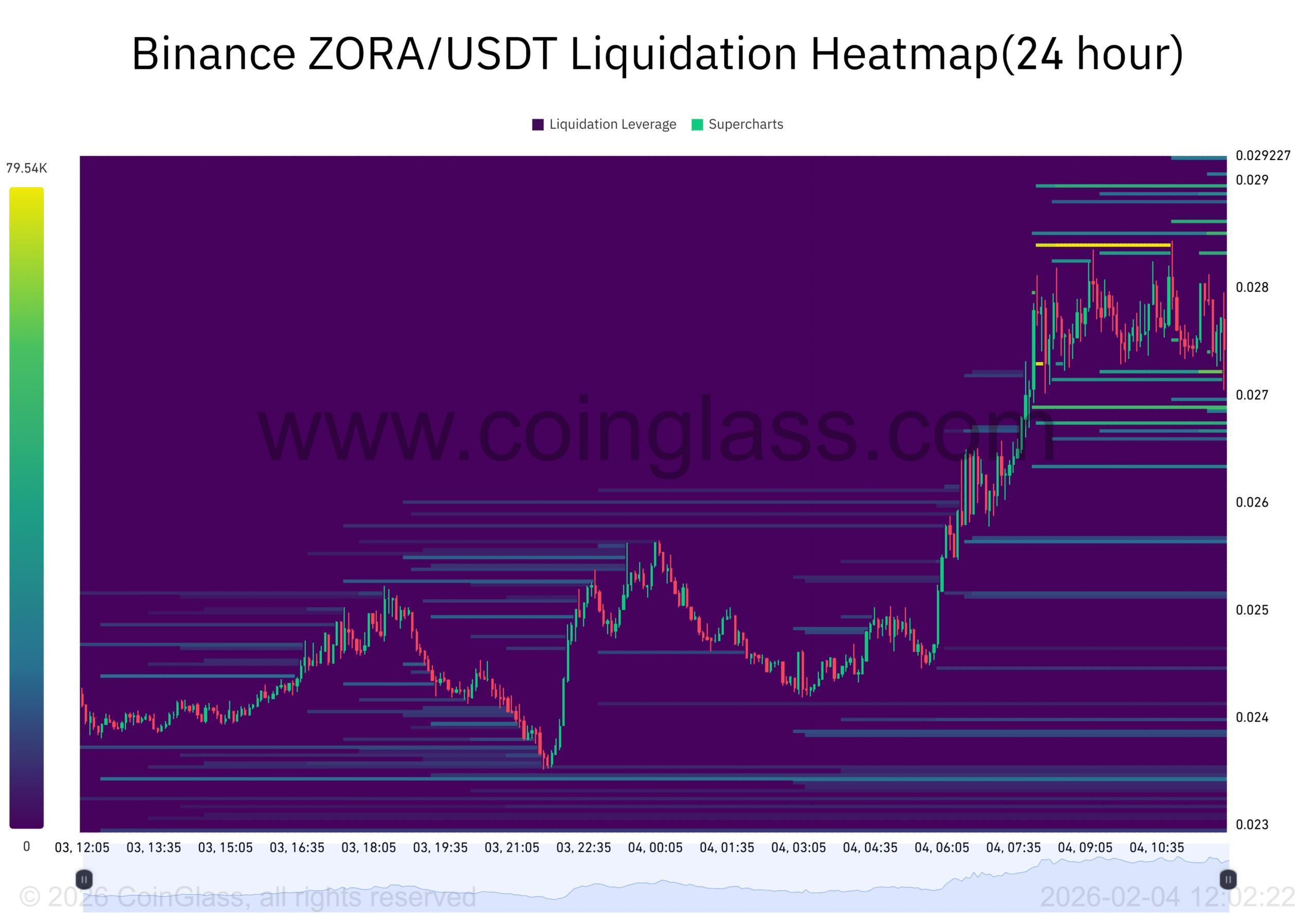

ZORA rebounds from multi-month lows: Early trend reversal or short squeeze?

AMBCrypto·2026/02/05 03:33

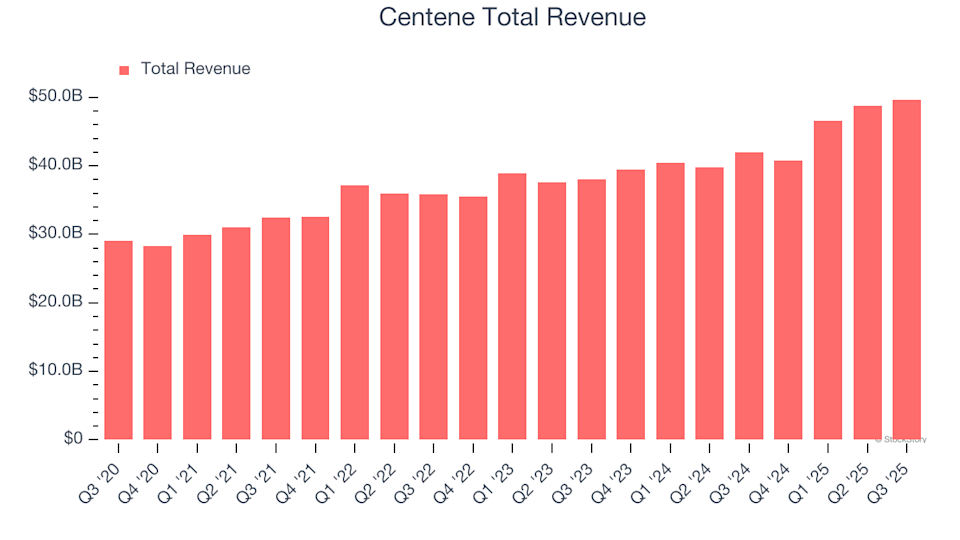

Centene (CNC) Q4 Results: Anticipated Highlights

101 finance·2026/02/05 03:15

Flash

06:22

The leading altcoin short seller achieved a monthly profit of $11.78 million, with a significant decrease in position size.On February 5th, Coinbob's popular address monitoring showed that the whale "Altcoin Short Army Leader" holds short positions in 21 cryptocurrencies, with today's unrealized profits expanding to $7.9 million and monthly profits reaching $11.78 million. The top three short positions by holding size are: LIT, approximately $4.4 million, with an unrealized profit of $3.08 million; ASTER, approximately $2.33 million, with an unrealized profit of $2.88 million; and PUMP, approximately $1.96 million, with an unrealized profit of $490,000. Over the past month, through closing and hedging operations, the total position size of this address has decreased from nearly $50 million to the current $12 million.

06:20

「Bootleg Air Force Frontman」 Holds Complete Set of Short Positions, Continuous Expansion of Unrealized Gain, Monthly Profit Reaches $11.78 MillionBlockBeats News, February 5: According to Coinbob Popular Address Monitor, the "Meme Coin Short Whale" whale currently holds short positions in 21 cryptocurrencies, with today's unrealized gains expanding to $7.9 million and monthly profits reaching $11.78 million. The top three short positions are as follows:

5x LIT: With a position size of approximately $4.4 million, an average price of $2.61, a liquidation price of $2.67, and unrealized gains of around $3.08 million (+77).

5x ASTER: With a position size of approximately $2.33 million, an average price of $1.191, a liquidation price of $1.272, and unrealized gains of around $2.88 million (+619).

10x PUMP: With a position size of approximately $1.96 million, an average price of $0.0027, a liquidation price of $0.0059, and unrealized gains of around $0.49 million (+250).

The address has recently been continuously realizing profits, closing short positions in various coins such as LIT and hedging spot contracts in HYPE over the past month, reducing the total position size from nearly $50 million to the current $12 million.

06:19

Analysts Warn of Lagging Tariff Effects, Long-Term U.S. Treasury Yields Likely to Remain ElevatedAccording to the latest report by analysts from Odaily, inflation factors may cause the yield on long-term U.S. Treasury bonds to remain high in 2026. The report points out that the situation in 2025 is clearly better than expected: the inflationary impact of U.S. tariff policies is milder than anticipated, and the positive surprise has overshadowed negative factors. However, analysts believe that this lagging effect will become apparent in 2026, when the degree of surprise in inflation data may no longer be as strong as before.

News