News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Spot Gold & Silver Continue to Drop, Bitcoin Crashes; Amazon’s $200 B Capital Expenditure Raises Concerns; U.S. Job Openings Fall to 2020 Lows — Feb 6, 2026 (English Translation)2Weekend Trading Playbook: High-Impact Macro Events & Earnings for Feb 9-15, 2026 – Tech & Crypto Volatility Plays3 Is the “Perfect Storm” Here? Liquidations Explode as Bitcoin Bleeds Below $70K & DXY Rises

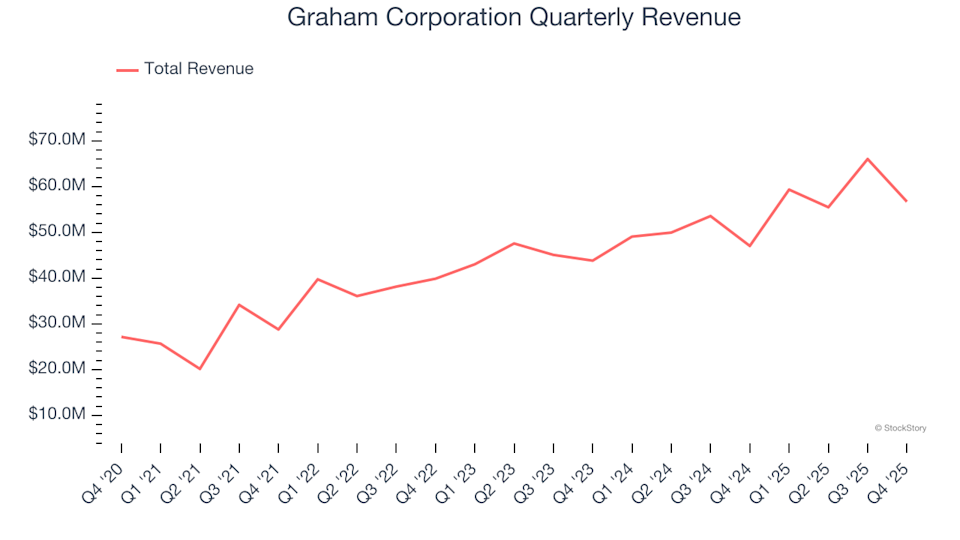

Graham Corporation (NYSE:GHM) Announces Strong Fourth Quarter Results for Fiscal Year 2025

101 finance·2026/02/06 13:00

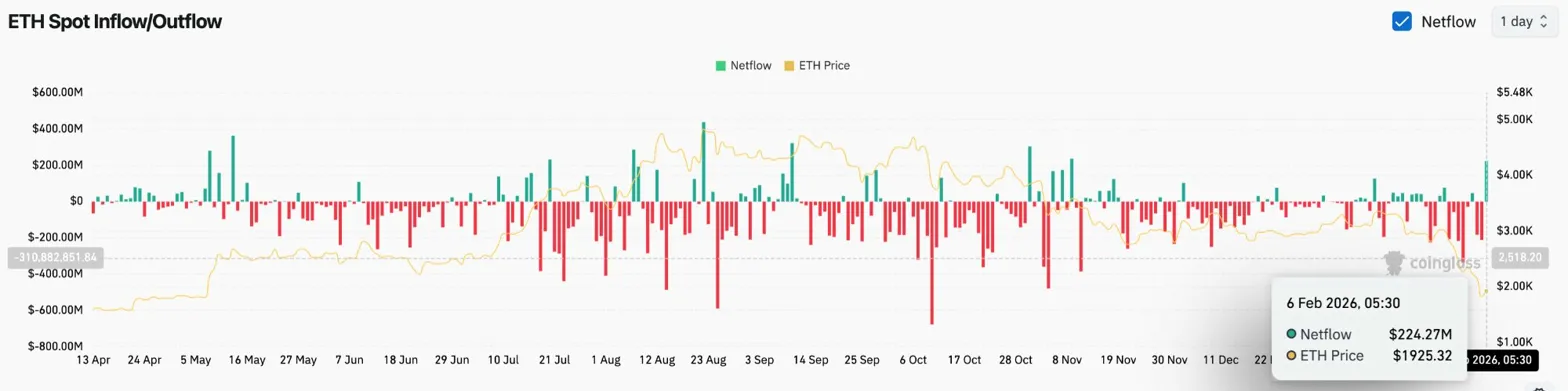

Ethereum Price Prediction: ETH Bounces 10% As Massive Inflows Clash With Insider Selling

CoinEdition·2026/02/06 12:54

CBOE: Fourth Quarter Earnings Overview

101 finance·2026/02/06 12:54

3 Best Bitcoin ETFs with High Volumes for Risk-Taking Investors

Tipranks·2026/02/06 12:36

Under Armour: Fiscal Third Quarter Earnings Overview

101 finance·2026/02/06 12:21

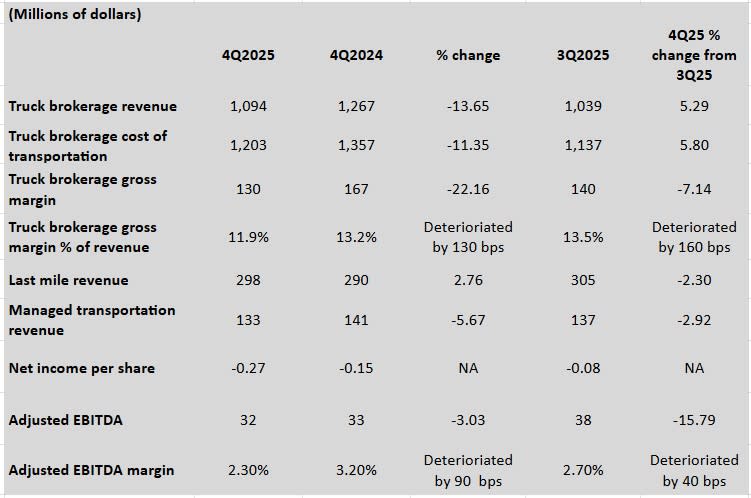

First impression: Challenging conditions for brokers reflected in RXO's fourth quarter financial results

101 finance·2026/02/06 11:51

Bitcoin Institutional Selling Warning: CryptoQuant CEO Reveals Critical One-Month Rebound Threshold

Bitcoinworld·2026/02/06 11:51

XRP Holds Near $1.12 After Sharp February Drop Shakes Market

Cryptotale·2026/02/06 11:36

Tesla Considers Increasing Solar Cell Production in New York, Arizona, and Idaho

101 finance·2026/02/06 11:30

What Price Targets Have Wall Street Analysts Set for KKR & Co. Shares?

101 finance·2026/02/06 11:30

Flash

13:05

Analysis: Strategy holdings are at a floating loss but face no liquidity pressure; BTC decline is not a “crypto endgame”According to Odaily, Sean Stein Smith, a member of the Wall Street Blockchain Alliance Advisory Board, published an article in Forbes titled "Bitcoin's Decline Is Not the End of Cryptocurrency." He pointed out that although bitcoin has significantly retreated from its historical highs at the end of 2025 and market pessimism is rising, the prevailing view is that this downturn does not signify the cyclical end of the crypto industry. The industry's fundamentals and institutional participation are still strengthening, and the long-term development logic remains fundamentally intact. Institutional adoption continues to advance, with traditional financial institutions increasing their involvement in the on-chain asset ecosystem. This includes the New York Stock Exchange exploring blockchain exchange initiatives and Fidelity planning to launch the Fidelity Digital Dollar (FIDD), a stablecoin based on the Ethereum network. Although Strategy's bitcoin holdings are currently showing a book loss at present prices, market analysis suggests that its financial structure remains robust. Most of the company's bitcoin assets are not pledged, and the convertible bond maturities are relatively long, so there is no short-term liquidity pressure or risk of forced liquidation. The company continues to maintain a long-term bullish strategic position on bitcoin.

12:54

Bloomberg Analyst: Both Bitcoin and US Stocks Have Historically Rebounded to New Highs After CrashesJinse Finance reported that Eric Balchunas, Senior ETF Analyst at Bloomberg, stated on the X platform that a fact that bears or pessimistic market views are often reluctant to accept is that, whether in traditional stock markets or bitcoin, there is a historical record of recovering from major drawdowns and eventually reaching new all-time highs. This is almost a "100% perfect record." Perhaps this time may be different, but for now, this is indeed an indisputable fact, which is also why he tends to avoid blindly following the crowd during market downturns.

12:53

Opinion: The Altcoin Downtrend Is Still in Its Early Stages, Investors Should Be PreparedBlockBeats News, February 6, analyst @alicharts posted that although the market saw a brief rebound, some altcoins did not experience a significant rebound along with bitcoin. From the chart performance, many altcoins are likely to face a deeper decline (such as THETA, FIL, DOT, AVAX, etc.). @alicharts believes that the decline in altcoins is still in its early stages. The overall market structure indicates that there will be more downward trends in the future, and for traders who are well-prepared, there are still many opportunities to profit from this market environment. @alicharts is skilled at analyzing the market using charts and historical trends, and has shifted from a bullish to a bearish outlook on the crypto market since October last year.

News