Market dynamics on July 17: The market continues to rise, Trump intends to cut interest rates again after the election and retain Powell's position

I. Market Dynamics

1. The market continues to rise, and the compensation for Mentougou will be credited after 7 days.

2. U.S stocks are rising, with June economic data better than expected. Trump hopes to cut interest rates again after the November election and will retain Powell's position at that time.

II. Market Focus

1. AI's WLD and AR rebounded. The lock-up period of some tokens from the WLD team has been extended, reducing the unlock volume by 40%. Yesterday, WLD had an annualized short-selling fee rate of 125%.

2. Bankruptcy series FTT, LUNC, USTC bounced back. FTX reached a settlement with the US government; subsequent FTX compensation will improve SOL counterfeit liquidity.

3. The Cosmos ecosystem’s DYM, SAGA, INJ have overcorrected and rebounded.COSMOS is one of this year's worst-performing ecosystems.

4. Political coin FIGHT surged 200 times in three days; its market value on Gate exchange reached $70 million USD.Ethereum coins still have more affection than Solana coins.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Oracle's Emotion-Driven Sell-Off Sets Up Generational Opportunity

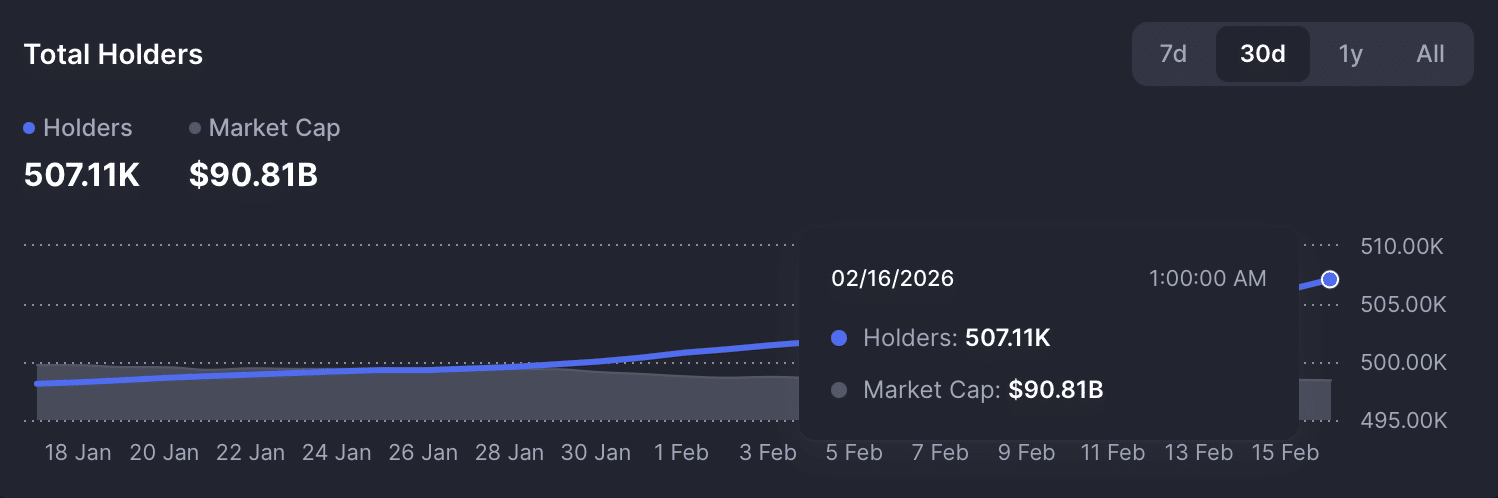

XRP holders hit new high, but THIS keeps pressure on price

Germany‘s central bank president touts stablecoin and CBDC benefits for EU

Simon Property Shares: Does Wall Street Have an Optimistic or Pessimistic Outlook?