- Catizen (CATI) price has surged in 24 hours with its market cap nearing $100 million.

- Increased investor interest in low-cap tokens has driven up CATI’s trading volume.

- CATI’s future growth depends on circulating supply and its role as a memecoin or utility token.

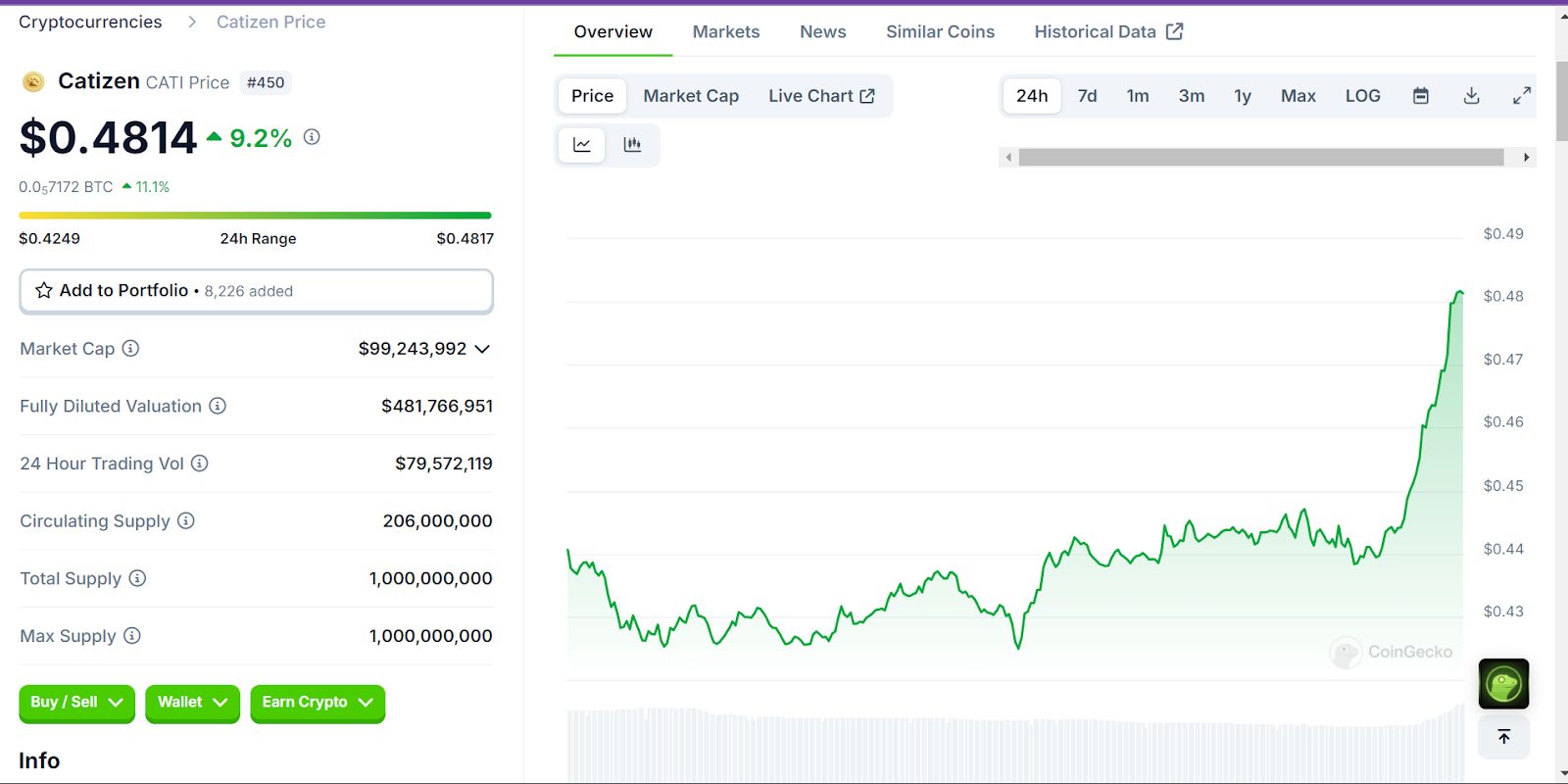

Catizen (CATI) has seen its price jump by over 9.2% in the past 24 hours. With a market cap just under $100 million, the surge has put CATI in the spotlight as a low-cap cryptocurrency to watch. Investors are increasingly interested in the token, leading to a rise in trading volume.

CATI is currently priced at $0.4814 , with a 24-hour range of $0.4249 to $0.4817. Its 24-hour trading volume is $79.5 million. These figures show growing activity around the token, which has a circulating supply of 206 million tokens. The total supply is 1 billion tokens.

Source: Coingecko

Source: Coingecko

CATI’s fully diluted valuation is $481.7 million. This represents the potential market value if all 1 billion tokens were in circulation. Currently, only 20.6% of the total supply is circulating. As more tokens enter the market, it could affect CATI’s price.

Several factors may be driving CATI’s recent price increase. Investors are looking for low-cap tokens, which often offer greater growth opportunities. CATI’s market cap, being under $100 million, has attracted traders seeking potential quick gains.

The crypto market has shown a growing interest in smaller-cap tokens, and CATI may be benefiting from this trend. The speculative nature of the market has encouraged many traders to buy CATI in hopes of further price increases.

Another factor in CATI’s growth is its potential as both a utility and a memecoin. Investors are determining whether it has a specific use case or if it’s gaining traction as a speculative asset. Memecoins have previously generated significant interest because of their viral nature and community support.

With rising investor interest, CATI’s market performance is being closely watched. The token’s growth comes at a time when the broader cryptocurrency market is seeing a mix of consolidation yet speculation. Traders looking for quick returns may be contributing to CATI’s recent gains.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.