Radiant Capital Hacker Turns $53 Million Heist Into $95 Million

- Radiant Capital Hacker Increases Stolen Funds with Ethereum

- Profits surge to 56% after strategic ETH trading

- Criminal controls 17 ETH and $25 million in DAI

The hacker responsible for the attack on the Radiant Capital protocol in October 2024 was able to significantly increase his profits by adopting a smart trading strategy with Ethereum (ETH). The attack, which affected BNB Chain and Arbitrum, initially resulted in the theft of approximately $53 million in digital assets.

According to on-chain analysts, the attacker compromised developers' hardware wallets, taking control of tokens such as WETH, WBTC, USDC, USDT, and Arbitrum, which were later consolidated onto the Ethereum network.

According to analyst EmberCN, on August 20th, the hacker began liquidating part of the ETH they had obtained. 9.631 ETH were sold at an average price of $4.562, raising approximately $43,94 million in DAI. The operation occurred during a period of ETH appreciation, which was once again approaching its all-time high of $5.000.

啊,好家伙,这 Radiant Capital 黑客竟然玩起波段来了😂:

$4,562 for $9,631 for $4393.7 for DAI for $XNUMX for DAI.

这几天 ETH 回调了,他在过去 1 小时里又用 $864 万 DAI 以 $4,096 的价格重新买回了 2109.5 枚 ETH…现在 Radiant Capital 黑客持有 14,436 枚 ETH+3529 万… https://t.co/hO4MbNPrjd pic.twitter.com/ihLYhpmNAV

— 余烬 (@EmberCN) August 20, 2025

However, the attacker also took advantage of the asset's recent drop to buy back. In a single transaction, he reacquired 2.109,5 ETH for approximately $8,64 million in DAI, paying an average price of $4.096 per coin.

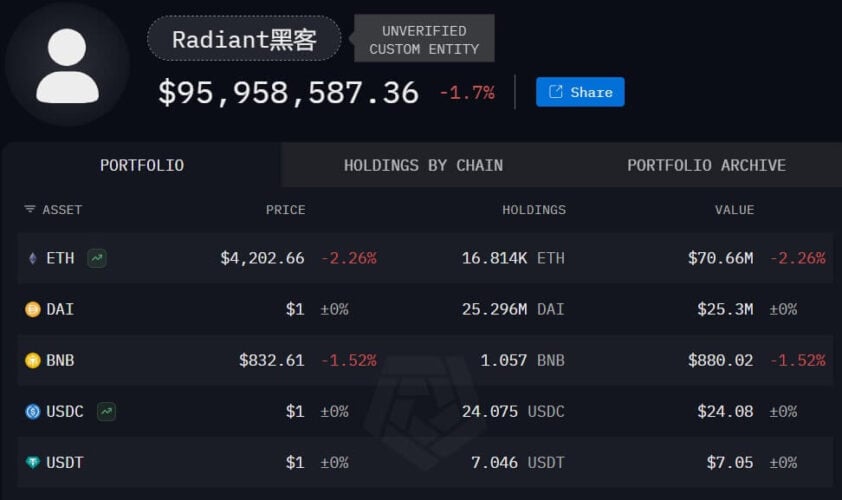

This strategy of selling high and buying low allowed the hacker to reduce his exposure to market fluctuations while simultaneously expanding his ETH position. As a result, he currently controls approximately 17.000 ETH and $25,29 million in DAI, totaling approximately $96 million in assets, according to data from Arkham Intelligence.

Source: Arkham Intelligence

Source: Arkham Intelligence

The increase represents a 56% increase over the original amount stolen, equating to over $42 million in additional earnings.

The Radiant Capital case remains one of the most notorious attacks against DeFi protocols in recent years, not only due to the magnitude of the initial theft, but also due to the hacker's ability to leverage the funds through strategic trading in the cryptocurrency market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Staking Weekly Report December 1, 2025

🌟🌟Core Data on ETH Staking🌟🌟 1️⃣ Ebunker ETH staking yield: 3.27% 2️⃣ stETH...

The Blood and Tears Files of Crypto Veterans: Collapses, Hacks, and Insider Schemes—No One Can Escape

The article describes the loss experiences of several cryptocurrency investors, including exchange exits, failed insider information, hacker attacks, contract liquidations, and scams by acquaintances. It shares their lessons learned and investment strategies. Summary generated by Mars AI This summary was produced by the Mars AI model, and the accuracy and completeness of its generated content are still in the process of iterative improvement.

Mars Morning News | Federal Reserve officials to advance stablecoin regulatory framework; US SEC Chairman to deliver a speech at the New York Stock Exchange tonight

Federal Reserve officials plan to advance the formulation of stablecoin regulatory rules. The SEC Chair will deliver a speech on the future vision of capital markets. Grayscale will launch the first Chainlink spot ETF. A Coinbase executive has been sued by shareholders for alleged insider trading. The cryptocurrency market fear index has dropped to 23. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative updates.

OECD's latest forecast: The global interest rate cut cycle will end in 2026!

According to the latest forecast from the OECD, major central banks such as the Federal Reserve and the European Central Bank may have few "bullets" left under the dual pressures of high debt and inflation.