Valour launches Sky ETP in Europe, hitting the 100 milestone

Sky is the latest cryptocurrency to have an exchange-traded product in Europe, thanks to Valour Inc., a subsidiary of publicly traded DeFi Technologies.

- A Sky exchange-traded product has launched on Swedish exchange Spotlight.

- It’s the 100th ETP by Valour Inc., a subsidiary of DeFi Technologies.

Valour announced the launch of its new exchange-traded product tracking the governance token of decentralized finance protocol Sky on Wednesday, Oct. 22. The product, Valour Sky ( SKY ) SEK ETP is live on Sweden’s Spotlight Stock Market.

With this launch, Valour has hit the milestone of listing 100 ETPs across Europe.

“Valour Sky (SKY), being our 100th product, says a lot about where finance is headed. We’re turning DeFi’s most powerful ideas into something anyone can hold in their portfolio: regulated, intuitive, and ready for scale,” said Elaine Buehler, head of products at Valour.

What is an ETP?

In the crypto market, an ETP is a financial security instrument pegged on a given cryptocurrency.

It allows market participants to benefit from the opportunity of accessing assets such as Bitcoin, Ethereum or any other listed token via standard brokerage accounts. Investing in ETPs does not require one to own or store the particular digital asset. Trading of these products occurs on traditional stock exchanges.

“SKY is part of a new financial network that cuts across borders and legacy systems. This is what the next era of investing looks like,” Buehler added.

SKY ETP on European exchanges

Sky, formerly MakerDAO, is a stablecoin and collateralized lending protocol, with SKY as the governance token that allows holders to vote on key ecosystem parameters and decisions. Valour’s SKY ETP will offer investors regulated access to the DeFi token and its ecosystem.

SKY marks the latest digital asset exchange-traded product that the DeFi Technologies subsidiary has listed on exchanges and trading venues in Europe.

Apart from Spotlight, the firm has assets listed on exchanges such as Börse Frankfurt, SIX Swiss Exchange, the London Stock Exchange, and Euronext.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

After BitGo, Ledger tries its luck on the New York Stock Exchange

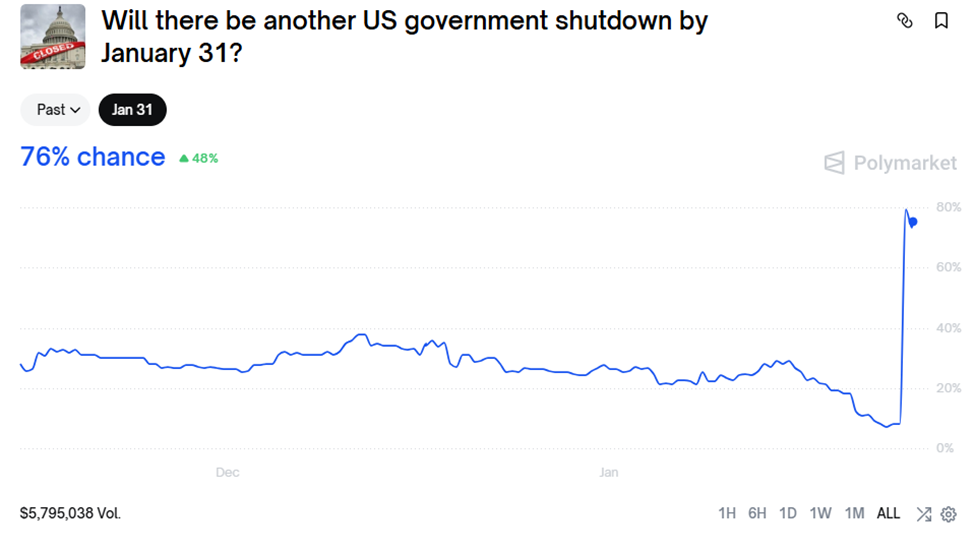

US Government Shutdown Risk Reignites, Crashes Crypto Market Sentiment