James Wynn dives into XRP with a significant investment

Crypto analyst James Wynn has announced a significant investment in XRP after spending 24 hours researching the digital asset.

- Analyst James Wynn announced a major XRP investment after 24 hours of research.

- Ripple completed its Hidden Road acquisition, rebranding it as Ripple Prime.

- Ripple’s growing institutional reach strengthens confidence in XRP’s future.

The analyst revealed he plans to invest “a significant portion” into XRP ( XRP ) and cited its potential to change banking systems.

Wynn acknowledged the investment carries risk but asked his followers to educate him on the pros and cons of XRP.

The announcement comes as Ripple, the company behind XRP, completed several significant acquisitions to expand its institutional services.

Ripple closes Hidden Road acquisition

Ripple has officially completed its acquisition of Hidden Road. Hidden Road is now rebranded as Ripple Prime. Ripple Prime will serve institutional customers looking to access digital assets at scale.

The acquisition is part of Ripple’s strategy to build infrastructure for what CEO Brad Garlinghouse calls an “Internet of Value.”

Garlinghouse highlighted that Ripple has announced five major acquisitions in approximately two years:

- GTreasury (closed last week)

- Hidden Road/Ripple Prime (just completed)

- Rail (August acquisition)

- Standard Custody (2024)

- Metaco (2023)

The CEO reminded investors that “XRP sits at the center of everything Ripple does.”

Analysts connect Ripple growth to XRP price

Crypto analyst CrediBULL Crypto explained why Ripple has strong incentives to drive XRP adoption. The company holds approximately 100 billion XRP tokens, which will be slowly released from automated escrow over the next decade.

“They will do everything in their power to make that crypto asset a success — they are hands down the biggest beneficiary of a higher-priced $XRP,” the analyst wrote on X.

XRP price has jumped 5% in the last 24 hours. The token traded between $2.44 and $2.57 during this period.

The combination of institutional expansion through Ripple Prime and growing retail interest from analysts like Wynn has fueled recent price action.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Tokenized Real Estate Hits $392M in 2025

Bitcoin Must Fall 90% For Years To Pressure Strategy’s Debt, CEO Says

PENGU Price Stalls Under Pressure — Is a Rebound Brewing?

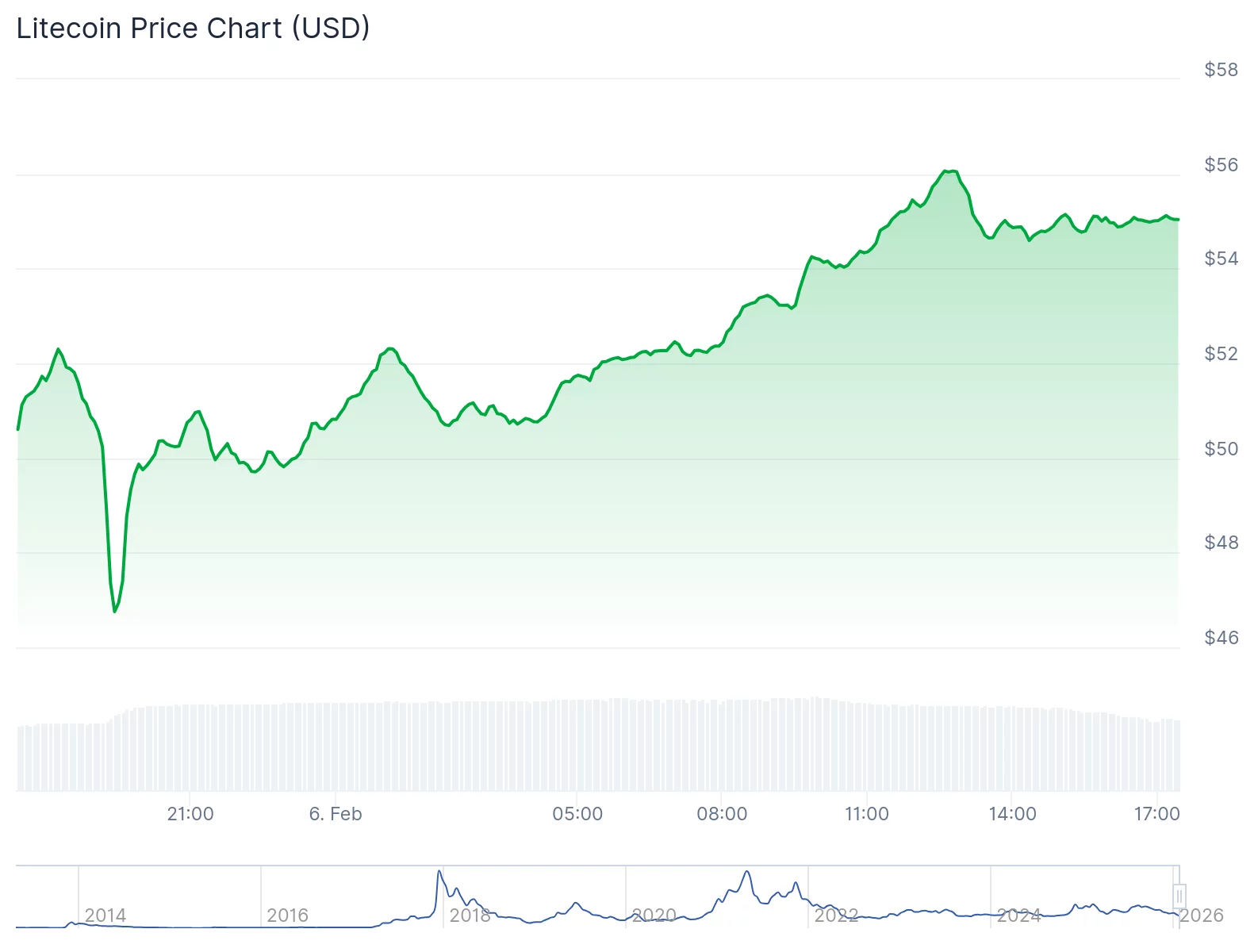

What’s surging Friday? Bitcoin, Litecoin lead the crypto rebound