The Hong Kong Securities and Futures Commission plans to expand the range of products and custody services offered by licensed virtual asset trading platforms, and relax the 12-month track record requirement.

PANews, November 3 – The Hong Kong Securities and Futures Commission (SFC) has issued two circulars to facilitate licensed virtual asset trading platform operators in accessing global liquidity and expanding the range of products and services offered. The "Circular on Expanding the Products and Services of Virtual Asset Trading Platforms" proposes to broaden the products and services of licensed virtual asset trading platforms: First, it revises the token inclusion requirements, so that virtual assets (including stablecoins) offered to professional investors will no longer require a 12-month track record; licensed stablecoins may be offered to retail investors and are exempt from this requirement. Second, it clarifies that platforms may distribute digital asset-related products and tokenized securities, and may open trust/client accounts with custodians on behalf of clients. Third, it allows the custody of digital assets not traded on the platform through affiliated entities, provided existing guidelines and risk controls are followed; case-by-case exemptions from the second-stage assessment may be granted for the custody of tokenized securities.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

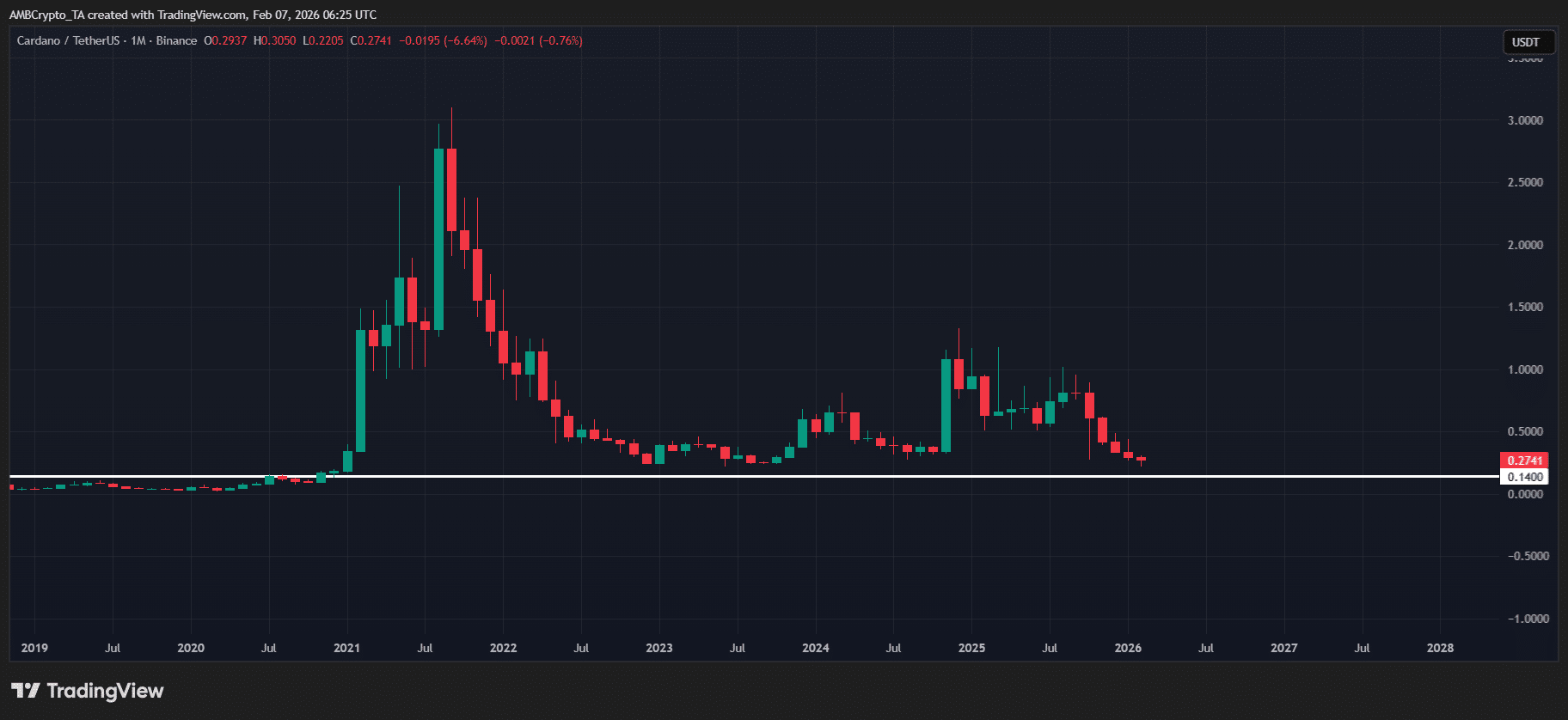

Cardano hits 2023 lows: How $3B loss fuels fear over ADA

Immutable (IMX) Price Prediction 2026-2030: Unveiling the Gaming Token’s Remarkable Potential

AIOZ Network Price Prediction: The Ultimate 2026-2030 Investment Guide for Web3’s Rising Star

XRP Investors’ Critical Mistake: The Devastating Cycle of Buying High and Selling Low