Bitcoin Latest Updates: Crypto Market Sees Intense Battle Between Bulls and Bears as Fear Index Drops to Lowest Point in Six Months

- Crypto fear index hit 21 (six-month low) on Nov 4, 2025, driven by volatility, volume spikes, and social sentiment, per CoinMarketCap. - Bitcoin fell below $100,000 amid $2B liquidations and $137M ETF outflows, while 45,700 BTC ($5B) were panic-sold to exchanges. - Regulatory pressures (Australia sanctions, UK stablecoin rules) and bearish leveraged trades ($140M short positions) deepened selloff. - Market remains divided: CZ and AI models signal accumulation, but Galaxy cuts Bitcoin target to $120K amid

The cryptocurrency sector is currently experiencing heightened anxiety, with the CoinMarketCap Crypto Fear & Greed Index dropping to 21 on November 4, 2025. This marks its lowest point since April 2025 and represents a six-month low, as noted by

Changpeng Zhao (CZ), co-founder of Binance, challenged the prevailing pessimism, pointing to previous recoveries from similar fear levels, as reported by CoinEdition. Wintermute, a leading trading company, commented, "The broader market environment remains robust, as shown by equity market strength," but noted that crypto is still lagging in liquidity amid global interest rate cuts, a trend CoinEdition also discussed. On-chain analytics from CryptoQuant showed significant panic selling, with 45,700 BTC—valued at over $5 billion—moved to exchanges by short-term holders at a loss, according to the same report.

Institutional withdrawals intensified the market decline. On November 3, U.S. Bitcoin ETFs saw $137 million in outflows, with BlackRock's IBIT accounting for the largest share, according to

Regulatory actions have added to the downward pressure. Australia has sanctioned North Korean hackers tied to $1.645 billion in crypto thefts, as reported by

Technical signals suggest possible support ahead. Bitcoin's RSI is approaching oversold levels, and closing above the 200-day SMA at $109,000 could shift

Opinions among market players are mixed. While CZ's recent

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

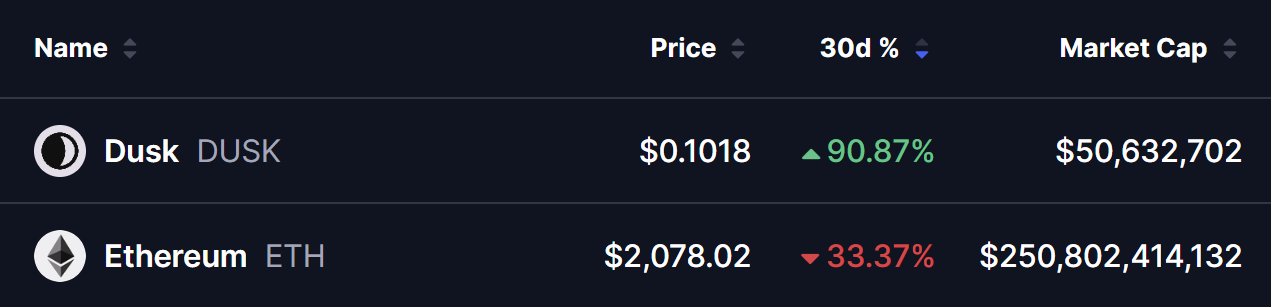

Dusk (DUSK) Testing Key Resistance — Is an Upside Breakout on Horizon?

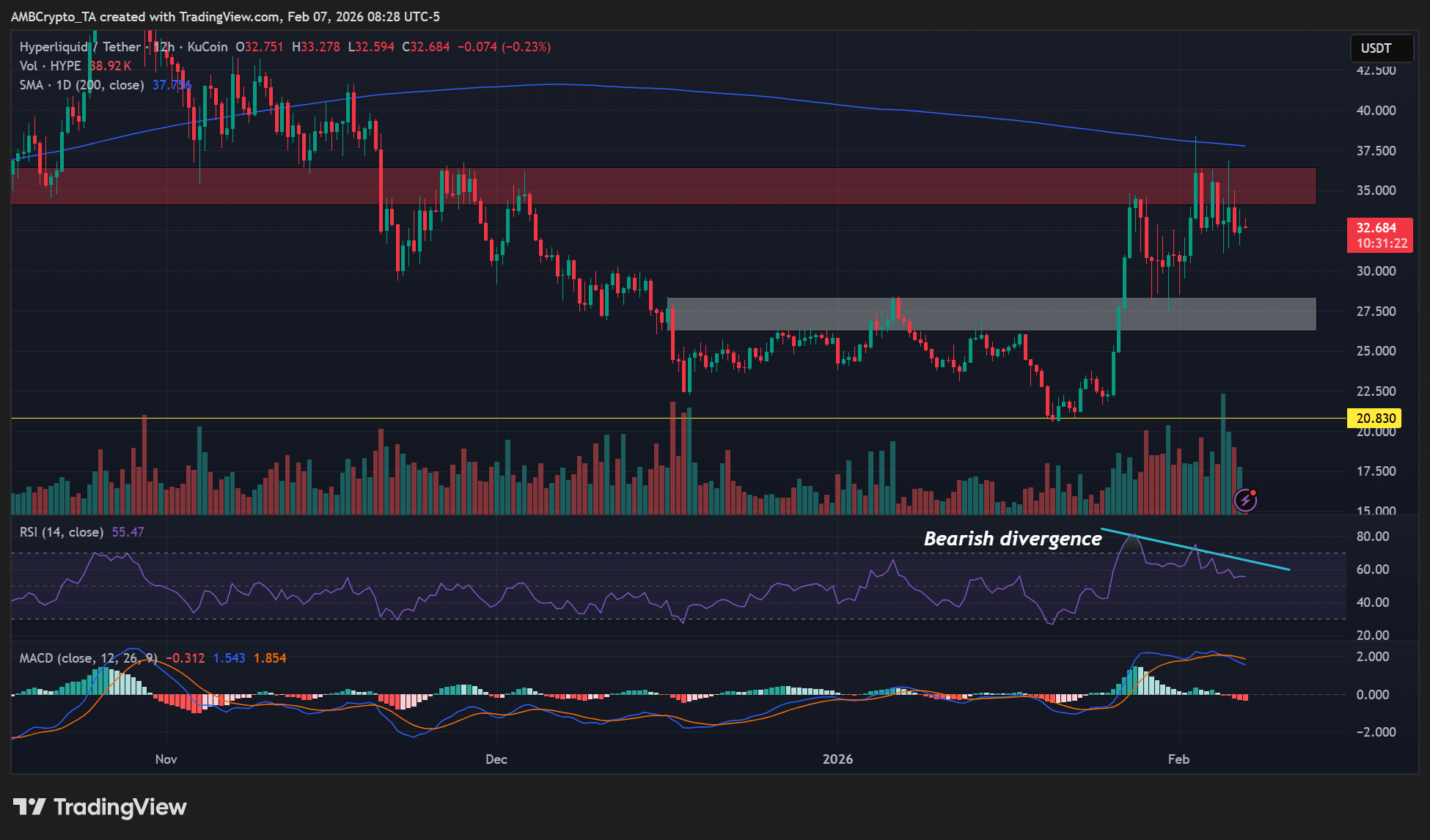

Hyperliquid – Record daily revenue of $6.84M, but HYPE hits the brakes

Jim Cramer Claims Donald Trump Has Begun Buying Bitcoin for the U.S. Treasury – Here Are the Details

Reputed Analysts and Ripple Enthusiasts Come Together to Discuss Next Possible Parabolic XRP Moves