BitMine Acquires 67,000 ETH, Boosting Holdings

- BitMine raises ETH holdings to 3.5 million tokens.

- Led by Chairman Thomas Lee, BitMine’s strategy emphasizes ETH accumulation.

- Immediate market reactions reflect the impact on ETH’s scarcity.

BitMine Immersion Technologies, led by Thomas Lee, expanded its Ethereum holdings by 67,000 ETH, enhancing its total to over 3.5 million tokens. This acquisition positions BitMine as the largest single ETH holder, influencing Ethereum’s ecosystem.

BitMine Immersion Technologies increased its Ethereum holdings by adding 67,000 ETH worth over $234 million last week, cementing its status as the largest single ETH treasury holder.

The acquisition by BitMine could reshape perceptions of ETH scarcity and spur investor interest in Ethereum as a strategic digital asset.

BitMine Immersion Technologies has expanded its Ethereum holdings significantly, acquiring 67,000 ETH valued at over $234 million. This purchase increases BitMine’s total ETH position to over 3.5 million tokens. The company, led by Chairman Thomas Lee, aims to control a larger share of ETH’s total supply.

The acquisition by BitMine has pushed our ETH holdings to 3.5 million, or 2.9% of the supply of ETH… “We are now more than halfway towards our initial pursuit of the ‘alchemy of 5%’ of ETH.” — Thomas Lee, Chairman, BitMine Immersion Technologies

The strategic move by BitMine, in acquiring more than 2.9% of ETH’s total supply , pushes its presence as a market-moving “whale.” Institutional backing from major investors provides additional strength to this strategy.

The acquisition has immediate effects on Ethereum markets, affecting ETH’s potential scarcity. Despite recent market fluctuations, BitMine shares rose 4%, indicating investor confidence. The accumulation also triggers comparisons with other treasury holdings.

The move by BitMine invites financial anticipation and market analysis over Ethereum’s market dynamics . If BitMine’s ETH accumulation persists, changes in liquidity flow and market reactions could follow.

BitMine’s actions mirror those of corporations like MicroStrategy, emphasizing long-term strategic crypto ownership. As BitMine continues its accumulation, Ethereum markets may see shifts in investor behavior and sentiment toward digital asset treasury strategies.

BitMine’s strategy could prompt further regulatory scrutiny or technological advancements in asset management. Institutional interest in ETH highlights potential for legislative or innovation impacts within crypto spheres.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

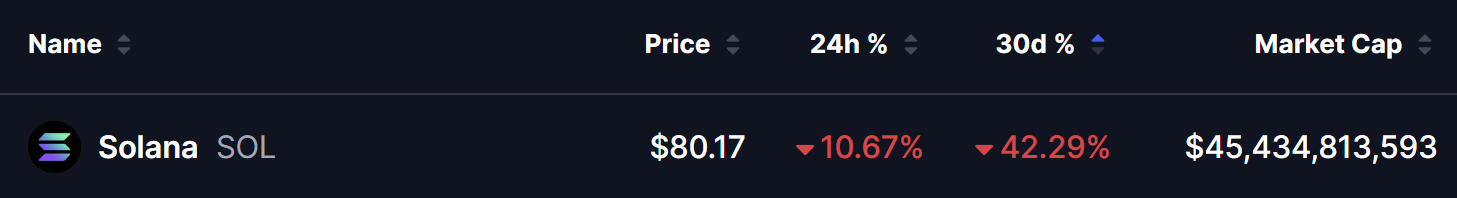

Solana Drops to Two-Year Lows — What Can NVIDIA’s 2008 Fractal Tell Us?

German output for December 2025: down 1.9% from the month before

PlayZap Games Joins GENCY AI to Revolutionize AI-Led Advertising in GameFi Sector

Shiba Inu Jumps 10% as Market Interest Picks Up — What Next for SHIB?