Bitcoin News Today: Spot ETFs See $2.3B Outflow as Bitcoin Faces Potential Fresh Lows

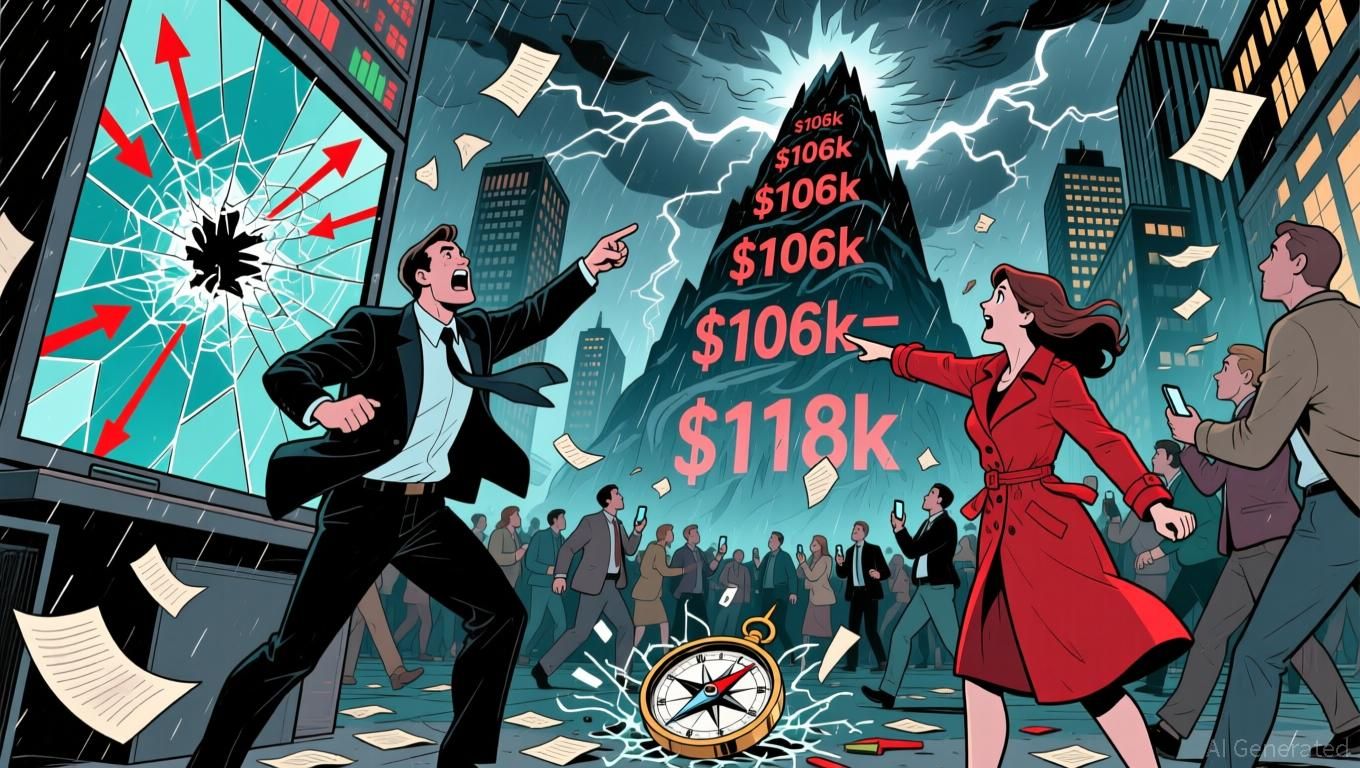

- Cryptocurrency markets plunged in late 2025 as Bitcoin (BTC) and Ethereum (ETH) hit six-month lows amid $2.3B ETF outflows. - Analysts warn BTC could test new price floors, with consolidation resistance between $106,000-$118,000 hindering recovery. - XRP's ETF saw record inflows contrasting BTC/ETH trends, but smaller coins struggle to offset top-tier liquidity drains. - Market capitalization fell to $3.57T with 80/100 cryptos declining, raising concerns about deeper corrections amid weak investor sentim

Bitcoin,

The crypto market faced heightened volatility in late November 2025, as

Spot Bitcoin ETFs, once a major driver for institutional investment in crypto, have seen outflows exceeding $2.33 billion just in November. This month is shaping up to be the worst on record for these funds, with $1.6 billion withdrawn over three straight days.

Blockchain analytics provider Glassnode described Bitcoin as currently "trapped in a consolidation phase." Although prices briefly rebounded to $106,000 and drew renewed buying interest,

On the other hand, XRP has demonstrated strength. Its spot ETF, managed by Canary Capital, saw a record $243 million in inflows on its debut day—standing in sharp contrast to the outflows from BTC and ETH. Still, XRP and smaller ETFs for

The difficulties across the market are clear: 80 of the top 100 cryptocurrencies declined in the last 24 hours,

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

History Rhymes Again: 5 Altcoins to Watch as Total 3 Targets a 40% Upside Leg

Ivanhoe Mines Ltd. (IVPAF) Q4 Earnings Match Estimates

Guyana Stands Out as the Main Beneficiary in Venezuela’s Oil Transformation

Analyzing The Q4 Earnings Season Scorecard