Bitcoin News Update: Bitcoin’s Reign as Digital King Wavers While Gold’s Appeal as a Safe Haven Strengthens

- Investors withdrew $3.1B from U.S. Bitcoin ETFs in November, with BlackRock's IBIT losing $523M in a single day. - Bitcoin fell below $90,000 after a 29% correction, eroding $1.1T in market cap amid deepening bearish momentum. - Mubadala tripled Bitcoin holdings and invested $2B in Binance, signaling institutional crypto bets despite ETF outflows. - Regulatory fragmentation and volatility challenge Bitcoin's "digital gold" narrative, though proposed IRS crypto tax payments could reshape adoption. - HashS

Bitcoin’s Pursuit of Digital Gold Status Faces 2025 Test as ETF Withdrawals and Market Swings Escalate

In November, investors withdrew a record-setting $3.1 billion from 12 U.S. spot

The wave of ETF withdrawals highlights a shift in investor attitudes.

Regulatory and structural issues add further complexity to Bitcoin’s “digital gold” story.

Despite the current instability, some organizations are adjusting.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Oil market pessimists are seriously overlooking the impact of geopolitical threats

Chevron Acquires Offshore Leases in Greece as Part of Mediterranean Growth Strategy

Goldman Sachs plans to drop diversity factors from board candidate criteria, WSJ reports

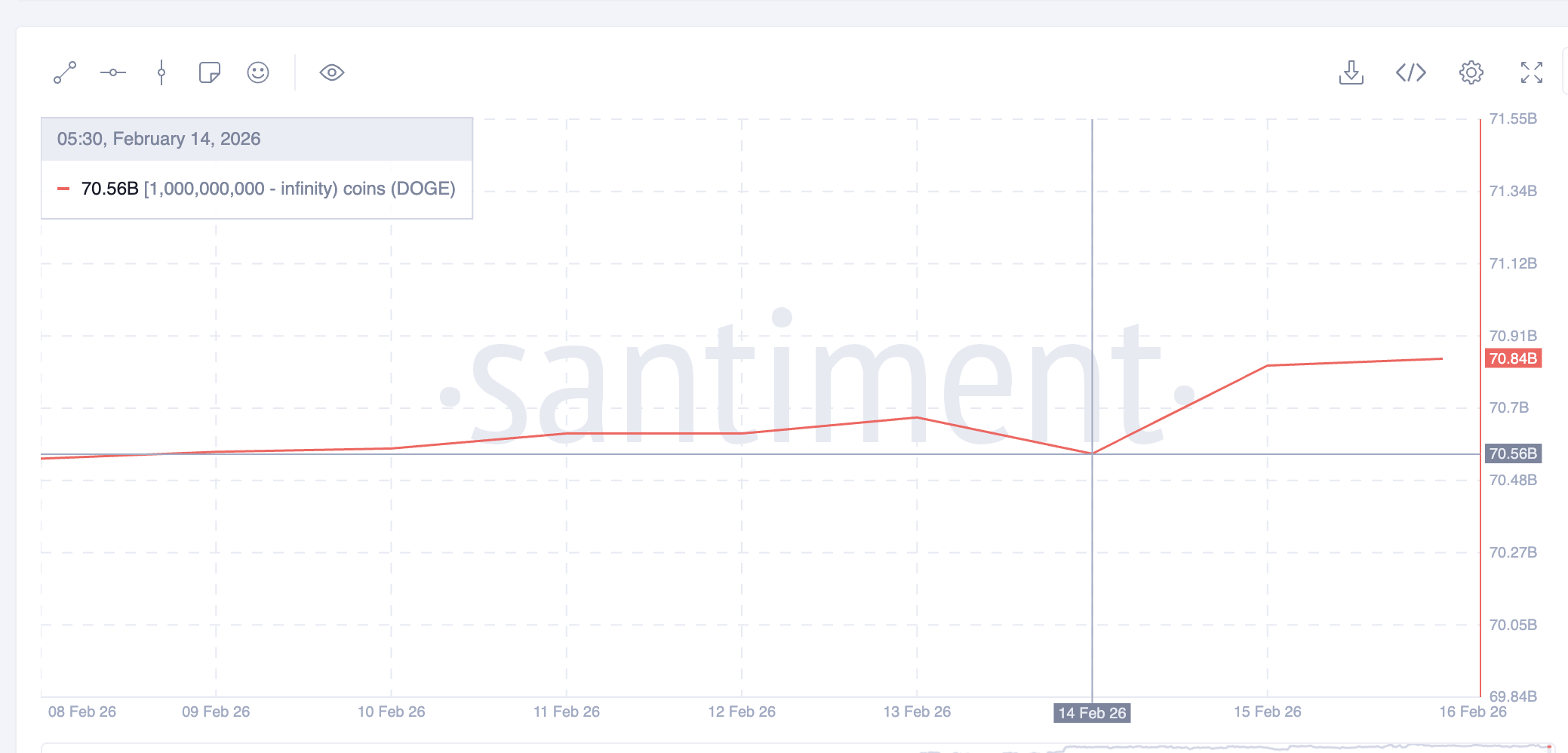

Dogecoin and Two Other Tokens Spark Meme Coin Season Hopes