Analysis: Bizarre divergence in US economic data leaves the Federal Reserve in a policy dilemma.

On November 24, it was reported that the U.S. economy is showing puzzling anomalies, causing concern for policymakers tasked with curbing inflation and maintaining the labor market. Labor Department data shows a reduction in jobs in June and August, with the three-month average of new jobs added as of September being only about 62,000. However, worker productivity, a key driver of economic output, remains high. The gross domestic product (GDP), which measures the output of all goods and services in the economy, also remains strong. This contradictory phenomenon of economic expansion coexisting with a weak labor market presents a dilemma for Federal Reserve policymakers, making it difficult for them to determine whether the economy needs cooling down or stimulus. Economists believe it is still uncertain whether rate cuts can ultimately offset the erosion effect of significant policy changes on hiring. Ryan Sweet, Chief U.S. Economist at Oxford Economics, stated, "Fortunately, we have not yet seen large-scale layoffs, otherwise no employment expansion would turn into an economic recession. The economy can grow without creating a large number of jobs, but the premise is that productivity must maintain good growth." No employment expansion could quickly evolve into an economic recession.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Japan’s Nikkei surpasses 56,000 for the first time. Authorities issue caution over possible yen intervention.

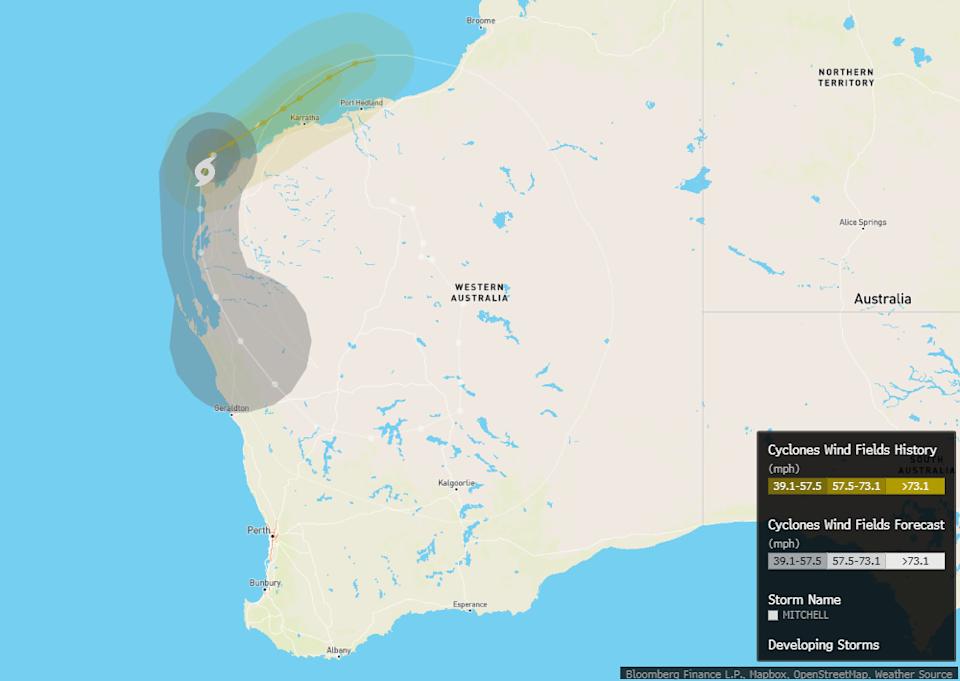

Major Australian iron ore port resumes operations as cyclone threat diminishes

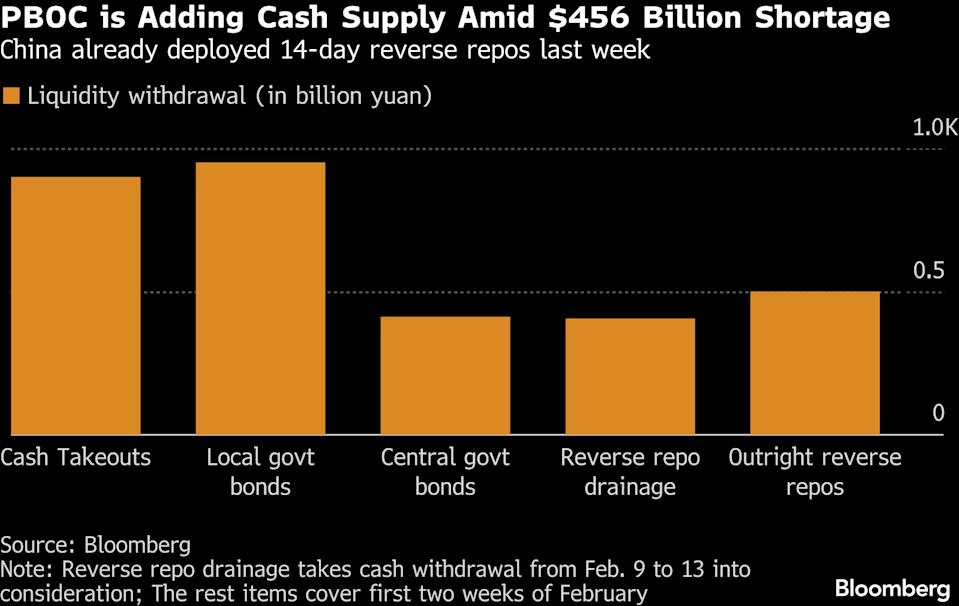

China Injects Funds to Address a $456 Billion Liquidity Gap

Oil Prices Fall as Lower Supply Threats Follow Eased Middle East Tensions