Bitcoin Updates: Bitcoin Approaches $90k Amidst Economic Challenges as Institutions Seek Protection and Projects Drive Innovation

- Bitcoin surged past $90,000 in Nov 2025 amid JPMorgan's Bitcoin-backed structured notes tied to BlackRock's ETF, signaling institutional adoption. - Bitcoin Munari's $0.10-$3.00 presale with 21M fixed supply and Solana deployment highlights innovation in digital asset scarcity models. - Analysts remain divided on Bitcoin's trajectory, with $80,000 support level critical for avoiding further declines toward $75,000. - JPMorgan's leveraged ETF-linked notes (up to 16% returns) demonstrate institutional risk

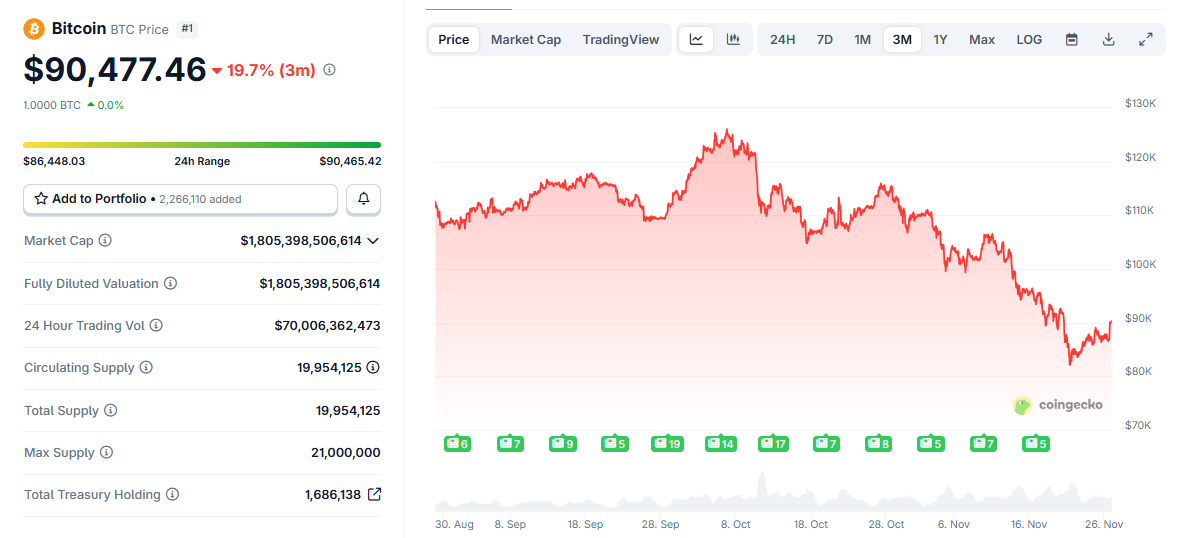

In late November 2025, Bitcoin's value climbed above $90,000, fueled by renewed interest from major institutions and strategic moves in the market, even as the broader trend remained bearish and the cryptocurrency had previously lost its gains from earlier in the year. This upward movement happened alongside

The latest price movements highlight a complex mix of macroeconomic influences and project-driven events.

Experts remain split on Bitcoin's short-term outlook. Some, such as Nicholas Roberts-Huntley from Blueprint Finance, expect the price to stabilize between $95,000 and $110,000 by the end of the year, while

Looking forward, Bitcoin's capacity to maintain key support levels, such as $80,000, will be crucial.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Are Digital Asset Treasuries (DATs) Just a Fading Fad?

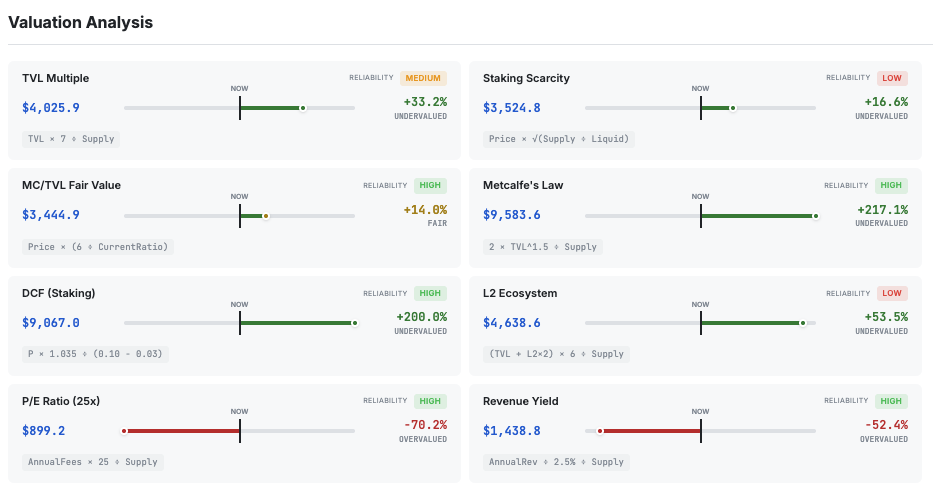

Hashed’s Simon Kim Says Ethereum Is 57% Undervalued

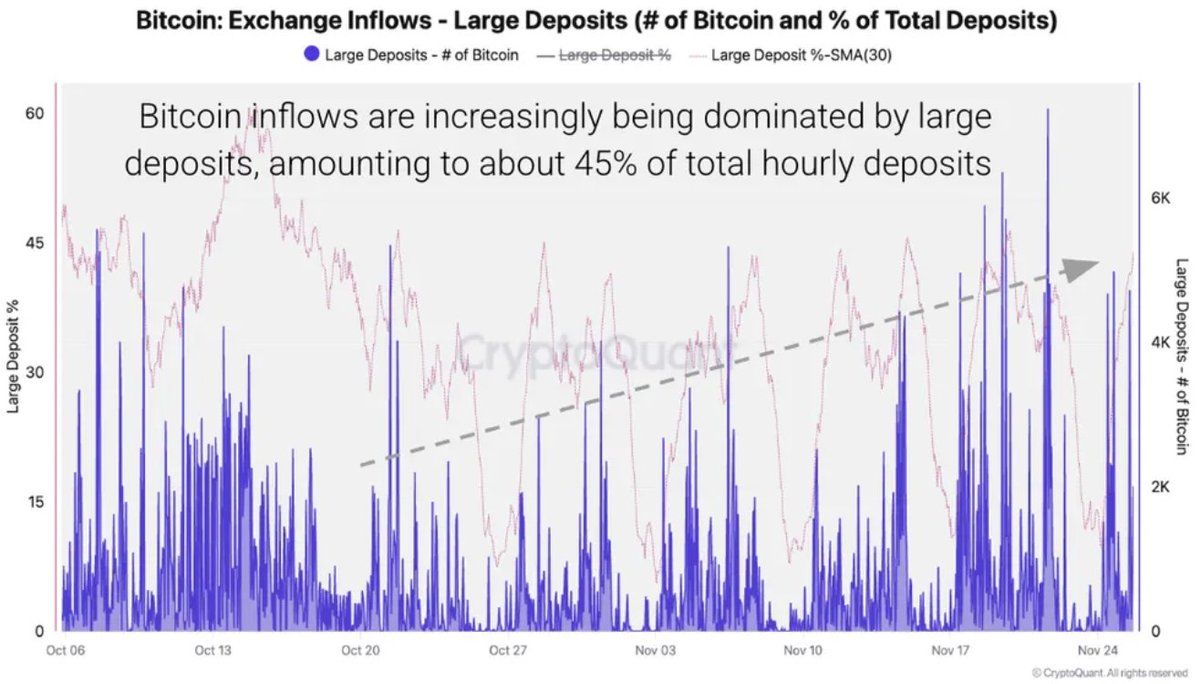

Bitcoin Breaks $90K but Exchange Data Shows Rising Selling Pressure

Global Exchanges Urge SEC to Curb Broad Crypto Exemptions, Warn on Tokenized Stock Risks