Crypto December Fed Signals Possible Rebound in Digital Assets

Coinbase, one of the biggest cryptocurrency exchanges, says that the market could turn around in December. This depends on whether the Federal Reserve (Fed) decides to cut interest rates. A rate cut could bring new money into crypto and give the market a boost, potentially encouraging both retail and institutional investors to re-enter the market after months of caution and uncertainty.

Why Coinbase Sees a Potential Reversal

The Coinbase team says that the crypto market has been weak for a while. Prices have fallen, and many investors have been careful. But if the Fed lowers rates, confidence could return. Even a small cut might encourage people to buy again.

Institutional investors, who deal with huge amounts of money, may be waiting for better conditions. A rate cut could make them more willing to invest in digital assets.

How Fed Rate Cuts Affect Crypto

Lower interest rates usually mean it is cheaper to borrow money. More money in the system can lead to higher investment in riskier assets like cryptocurrencies.

Right now, some market analysts believe the crypto December fed cut will happen Estimates put the chance of a cut at around 70%. If this happens, digital assets could see new money flowing in.

Coinbase suggests that this could help reverse recent losses. It may not guarantee a huge rally, but it could stabilize the market and restore some investor confidence.

Current Crypto Trends

This year has been tough for many cryptocurrencies. Selling pressure, economic worries and earlier rate hikes have caused prices to fall.

However, some data shows that the selling pressure is easing. If liquidity returns and confidence improves, crypto markets could bounce back. December could mark the start of this change.

What Investors Should Watch

- Fed announcements or signals about rate cuts.

- Fund flows into major cryptocurrencies like Bitcoin and Ethereum.

- Market stability and reduced volatility.

- Moves by institutional investors, who can impact the market more than retail buyers.

Navigating December’s Crypto Market

Coinbase sees a chance for the market to recover if the crypto December fed cuts happen. Investors should watch the macroeconomic news closely and track market trends carefully. While a rebound is possible, it is not guaranteed. Patience, caution and thoughtful decision-making are still key for anyone planning to invest or trade in cryptocurrencies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

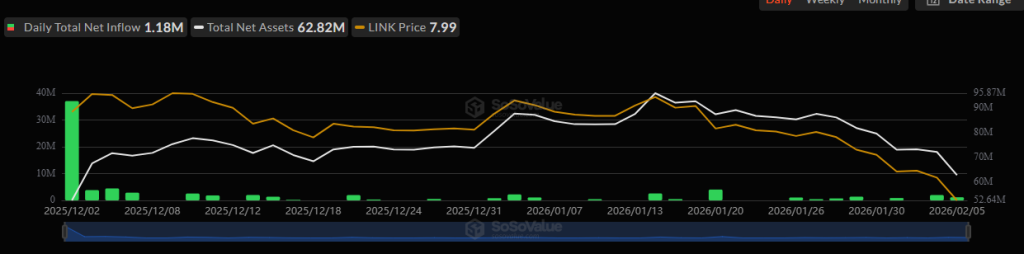

LINK Price Struggles Near $8.60 as Reserves Grow and ETF Inflows Diverge From Market Weakness

LIVE Crypto Market Today: XRP Suddenly Jumps 10% in Sharp Reversal After Market Crash

Solana Spot ETFs See $2.82M Inflows as SOL Trades at $79 Amid Broader Market Stress

Stocks rebound after a dramatic week sparked by ongoing AI uncertainty