XRP ETFs Near 1B AUM as Over 400M XRP Lock Into Institutions

XRP ETFs are quickly becoming a major force in the market. As of December 4, five spot XRP ETFs now manage over $909 million in total assets. Together, they hold more than 400 million XRP, which equals about 0.4% of the total 100 billion XRP supply. Canary Capital leads the race with $351 million in assets and over 162 million XRP locked.

It is followed by Bitwise with $188 million, Grayscale with $139 million, Franklin Templeton with $123 million and REX-Osprey with $108 million. This buildup happened within weeks of trading. That speed reflects rising institutional appetite after regulatory clarity around Ripple and XRP in the United States. For many funds and advisors, the green light finally arrived. Now, capital is moving fast.

Over 400 Million XRP Now Locked in Institutional Vaults

On-chain custody data shows that 400.01 million XRP now sit inside verified ETF vaults. These are real tokens pulled from circulation and held under institutional custody models. Canary Capital alone controls over 162 million XRP. Bitwise follows with 87 million XRP, while Grayscale and Franklin Templeton each hold over 60 million XRP. REX-Osprey rounds out the list near 29 million XRP.

The #XRP #ETF story is just getting started.

— Neil (@NeilTolbert) December 4, 2025

5 spot XRP ETFs now trading with $909M+ AUM combined:

• Canary Capital (XRPC): $351M – leading the pack

• Bitwise (XRP): $188M

• Grayscale (GXRP): $139M

• Franklin Templeton (XRPZ): $123M

• REX-Osprey (XRPR): $108M…

This lockup reduces liquid supply across exchanges. Even while Ripple released 1 billion XRP from escrow on December 1, most of it returned to escrow. Meanwhile, exchange balances remain near 2.2 billion XRP. Which signals a limited free float. The supply picture is tightening. At the same time, ETF demand keeps rising. That mix creates steady pressure under price action, even during slow trading sessions.

Daily ETF Flows Show Active Institutional Trading

Trading activity across XRP ETFs remains steady. In fact, on the latest session, the combined daily volume reached nearly $35 million. For example, Franklin Templeton led the day with around $12 million in volume, followed by Bitwise and Canary Capital. Each fund targets a different investor base. Indeed, some appeal to cost-sensitive traders with lower fees; meanwhile, others attract institutions through brand reach and custody structure. Nevertheless, all of them drive the same effect: they absorb XRP from the open market and push it into long-term holding vehicles. This flow pattern mirrors early Bitcoin ETF behavior. First comes the slow build. Then come larger block allocations. After that, treasury-style positions often follow.

The Race to 1 Billion XRP Locked Has Begun

With 400 million XRP already locked, the next visible milestone is 1 billion XRP in ETF vaults. In fact, at the current pace, that target no longer sounds distant. Regulatory pressure around Ripple has eased, and this shift changed the mood inside traditional finance. What started as caution has turned into structured exposure. Consequently, XRP now sits alongside Bitcoin, Ethereum, and Solana in regulated products.

XRP trades near $2.18 as this institutional build-out continues. The price has stayed stable, even as large quantities move off open exchanges and into long-term custody. That balance between flow and price signals controlled accumulation rather than speculative spikes. The bridge between crypto and Wall Street is no longer a theory. Indeed, with nearly $1 billion in XRP ETF assets already deployed, that bridge is now active, and XRP is moving across it in real time.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Leverage Heats Up as Traders Bet on Price Rebound

Best Income Stocks to Buy for February 16th

Crypto ETF Flows Shift as SOL and XRP Gain

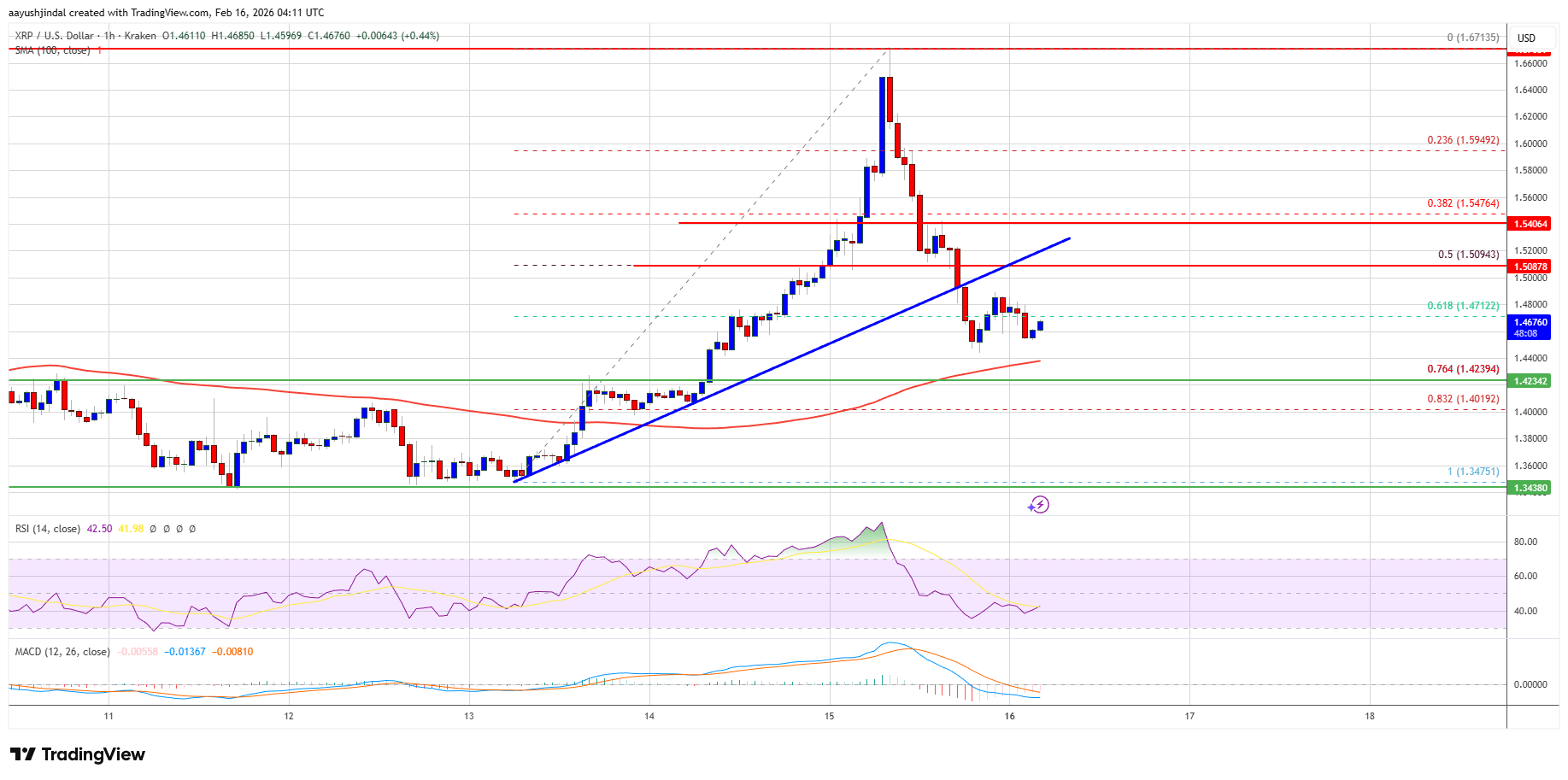

XRP Price Trims Gains After Explosive Rally, Momentum Cools