The Growing Enthusiasm for Hyperliquid and Cryptocurrency Derivatives

- Hyperliquid leads crypto derivatives shift via stablecoin integration and retail-friendly infrastructure, expanding access for SMBs and individual traders. - U.S. and India drive retail adoption with regulatory clarity and grassroots participation, as stablecoins dominate 93% of market liquidity. - Speculative trading risks rise amid 2025 market corrections and regulatory crackdowns, linking crypto behavior to gambling-like financial distress patterns. - Exchange innovation and academic interest in block

The Evolving Landscape of Crypto Derivatives

The world of crypto derivatives is experiencing dramatic changes, fueled by a mix of increased retail participation, shifting regulations, and rapid technological progress. Innovative platforms such as Hyperliquid are leading this evolution, making it easier for users to access markets and engage in speculative trading. As more individuals and institutions become involved, and academic programs related to blockchain expand, investors are positioning themselves to benefit from the infrastructure supporting this transformation.

Retail Participation and Accessible Entry Points

In 2025, individual investors have flocked to crypto derivatives, thanks in large part to the widespread availability of affordable entry methods like stablecoins. These digital assets have opened global markets to a broader audience, empowering small and medium-sized enterprises to protect themselves from inflation and diversify their assets with minimal hassle. The United States and India stand out in this movement: the U.S. has gained from clearer regulations and the launch of spot Bitcoin ETFs, while India’s momentum is driven by widespread grassroots involvement.

Stablecoins such as Tether (USDT) and Circle’s USDC now account for the vast majority of market activity, serving as essential sources of liquidity for exchanges during turbulent periods. This robust infrastructure has made it easier for everyday traders to participate in the market, eliminating many of the costs and barriers associated with traditional currency exchanges. The integration of stablecoins into hybrid trading platforms has also enabled these venues to provide advanced features—like sophisticated order types and margin trading—to retail users, narrowing the gap between individual and institutional trading experiences.

Speculation and Behavioral Risks

While easier access has broadened the market, it has also intensified speculative activity. In recent months, cryptocurrencies have seen significant price drops—Bitcoin and Ethereum both declined by over 20% in November 2025, with trading volumes falling to their lowest levels since June of that year. Regulatory authorities, especially in China, have responded by cracking down on illegal uses of stablecoins, including money laundering and unauthorized currency exchanges.

Trading behavior in the crypto space is increasingly resembling gambling, with impulsive decisions often influenced by social media and prevailing market sentiment. Research published in the Journal of Behavioral Finance has linked these patterns to financial hardship and mental health concerns, drawing comparisons to compulsive gambling. These findings raise concerns about the long-term sustainability of retail-driven growth, especially as global economic conditions tighten and regulatory uncertainty persists.

Innovation in Exchanges and Investment Opportunities

Despite these obstacles, ongoing innovation among crypto exchanges continues to drive industry expansion. The global market for crypto exchanges is expected to more than double, growing from $63 billion in 2025 to over $137 billion by 2029. This growth is propelled by the rise of decentralized finance, hybrid exchange models, and the integration of stablecoins. Platforms like Hyperliquid are seizing this opportunity by delivering high-speed trading systems, real-time order books, and low-latency execution, catering to both individual and institutional traders.

Greater institutional involvement is helping to legitimize crypto within mainstream finance, particularly in North America and Europe, where regulatory frameworks are clearer and regulated products are more widely available. This trend is creating a positive feedback loop: as more institutional capital enters the market, exchanges improve liquidity and user experience, which in turn attracts even more participants.

Academic and Professional Trends as Indicators

The surge in academic interest in blockchain and related fields serves as a strong signal of future demand. For instance, Farmingdale State College’s Computer Security Technology program has seen enrollment soar by nearly 250% over the past decade, with courses in cryptography and cybersecurity law drawing students eager to gain expertise in digital asset management. Although the college does not yet offer classes specifically focused on crypto derivatives, its AI Management program—designed to develop both technical and leadership skills—has also experienced significant growth. These educational trends suggest that a new generation of professionals is preparing to contribute to the ongoing innovation within crypto exchanges.

Key Takeaways for Investors

For those looking to invest, it is wise to focus on platforms that combine user-friendly access with advanced trading infrastructure. Hyperliquid’s emphasis on high-performance tools and stablecoin support aligns well with the current drivers of market adoption and speculative interest. The growing number of students pursuing studies in blockchain, cryptography, and artificial intelligence also points to a deepening talent pool that will further accelerate progress in this sector.

Nevertheless, recent market swings and increased regulatory scrutiny highlight the importance of a cautious approach. Investors should consider diversifying across both established and emerging platforms, while keeping a close eye on broader economic and regulatory developments to successfully navigate this rapidly changing environment.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto retail investors are trying to 'meta-analyze' crypto crash: Santiment

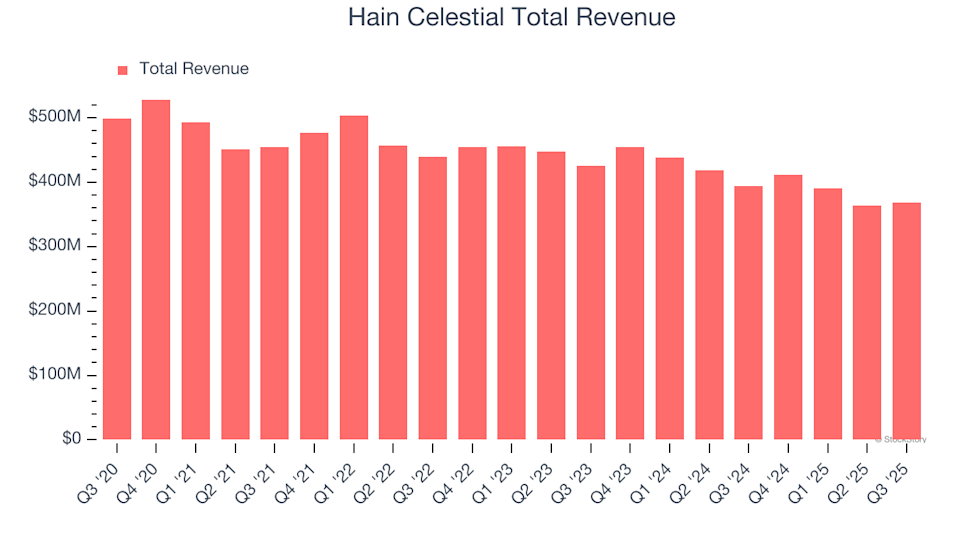

Hain Celestial (HAIN) Q4 Results Preview: Key Points to Watch

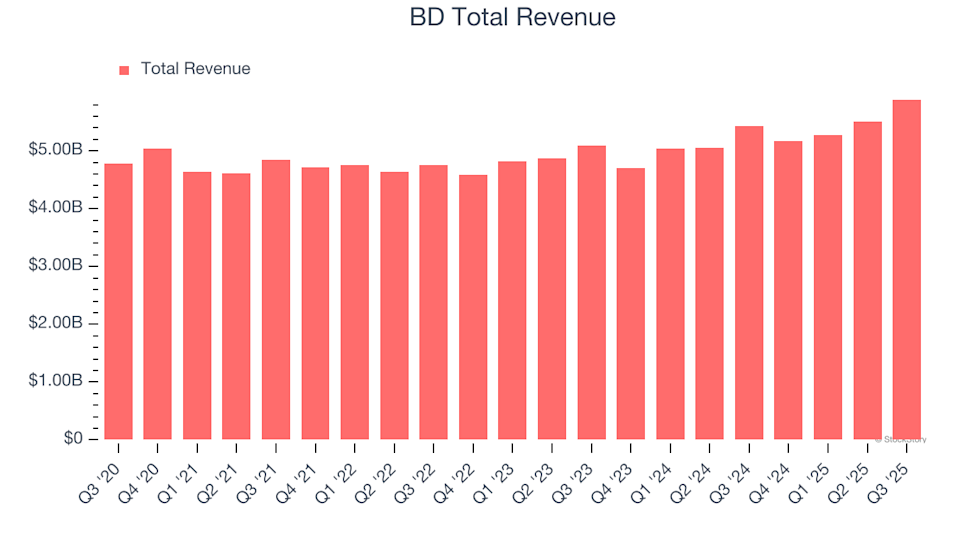

BD Earnings: Key Points To Watch For With BDX