Crypto VC Funding: Real Finance and LI.FI each secure $29m, TenX bags $22m

The week of December 7-13, 2025, recorded $191.3 million in crypto VC funding across 17 projects.

- Crypto VC funding reached $191.3M across 17 projects during the week of Dec 7–13.

- Real Finance and LI.FI led the week, each raising $29M in major funding rounds.

- Infrastructure and interoperability projects dominated crypto VC investment activity.

As per the data, Real Finance and Li.Fi both raised $29 million each during this period.

Infrastructure and interoperability solutions dominated the investment sector this week. Here’s a complete breakdown of this week’s crypto funding activity as per Cryptofundraising data :

Real Finance

- Raised $29 million in an unknown round

- The project is an institutional-grade Layer-1 blockchain

- The investment was backed by Nimbus Capital, Magnus Capital, and Frekaz

LI.FI

- LI.FI secured $29 million in a Series A round

- Investors include Multichain Capital and CoinFund

- LI.FI is a cross‑chain liquidity aggregation protocol

- The project has raised $52 million so far

TenX Protocols

- Raised $22 million in an unknown round

- TNX token categories include Asset Management, DeFi, and Staking

- Backed by Borderless, DeFi, and Hive

- Gained +1 new investor

MetaComp

- MetaComp gathered $22 million in a Series A round

- Investors include Eastern Bell Capital, Sky9, and Noah

- MetaComp is a Singapore-licensed digital asset financial service platform

Surf

- Raised $15 million in an unknown round

- Backed by Pantera, Coinbase Ventures, and Digital Currency Group

- Surf is an AI-powered crypto command hub

Helios

- Helios secured $15 million in an unknown round

- Investment was backed by Capital

- Helios is a modular, ETF‑native Layer‑1 blockchain

Cascade

- Raised $15 million in an unknown round

- Cascade is a neo‑brokerage platform

- Investors include Polychain Capital, Variant, and Coinbase Ventures

Funding under $15 million

- Crown (BRL), $13.50 million in a Series A round with $90 million fully diluted valuation

- Testmachine, $6.5 million in an unknown round

- Magma Finance, $6 million in a strategic round

- AllScale, $5 million in a seed round

- Pye Finance, $5 million in a seed round

- Superform Labs, $3 million in a public sale

- Ezeebit, $2.05 million in a seed round

- Pheasant Network, $2 million in a seed round

- Goblin Finance, $1 million in a strategic round

- Space raised $250,000 in a public sale

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

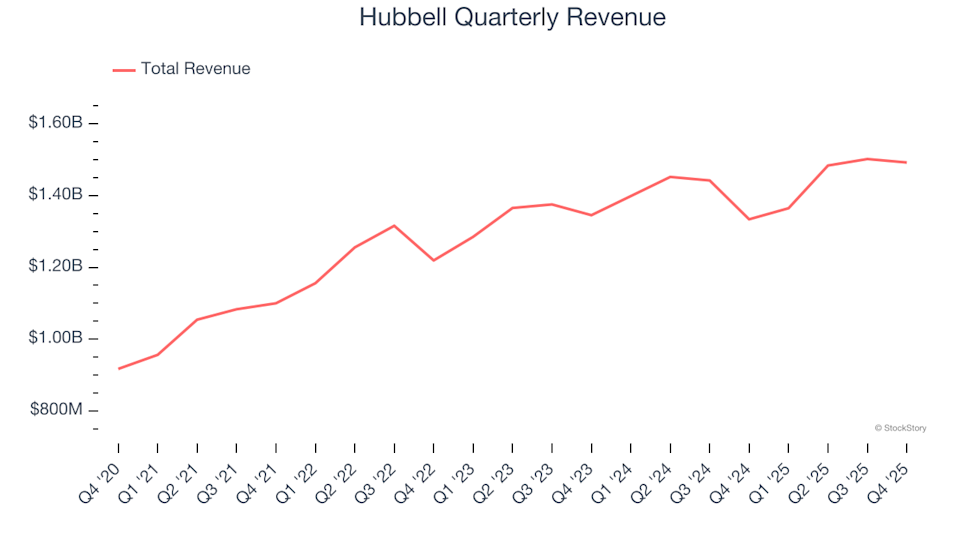

Hubbell (NYSE:HUBB) Reports Fourth Quarter 2025 Revenue Matching Projections

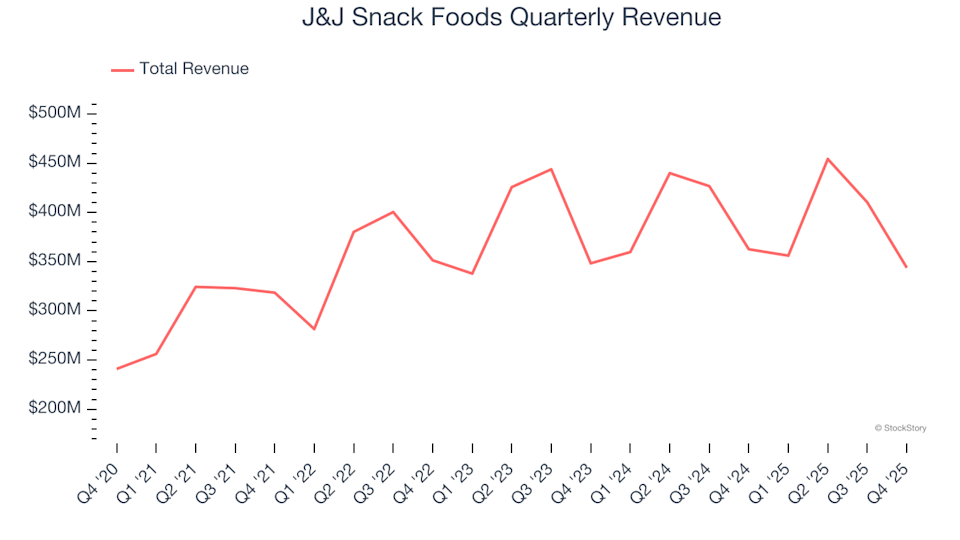

J&J Snack Foods (NASDAQ:JJSF) Posts Q4 CY2025 Revenue That Falls Short of Analyst Projections

Mesa Labs: Fiscal Third Quarter Earnings Overview

Gartner forecasts downbeat annual results on slowing demand at consulting unit