USD/JPY advances to near 157.00 on BoJ's cautious tightening

The USD/JPY pair trades in positive territory for the fourth consecutive day around 157.00 during the early European session on Friday. The cautious pace of the Bank of Japan’s (BoJ) monetary tightening weighs on the Japanese Yen (JPY) against the Greenback. Traders will take more cues from the US Nonfarm Payrolls (NFP) report for December, which is due next week.

The BoJ raised its key interest rate to 0.75% from 0.50% in December, its second hike of the year, to help curb inflation. However, the cautious pace of tightening and the lack of a clear timeline for future hikes have disappointed markets, dragging the JPY lower and acting as a tailwind for the pair.

Nonetheless, some intervention from Japanese authorities might help limit the JPY’s losses. Finance Minister Satsuki Katayama emphasized the official is monitoring foreign exchange (FX) movements with a "high sense of urgency" and is prepared to take "appropriate action" against excessive and one-sided moves.

The prospect of a US interest rate cut this year and renewed concerns over the Federal Reserve’s (Fed) independence could exert some selling pressure on the USD. US President Donald Trump said that he expects the next Fed Chairman to keep interest rates low and never “disagree” with him. Traders are pricing in two rate reductions in the year compared to one predicted by a divided Fed.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

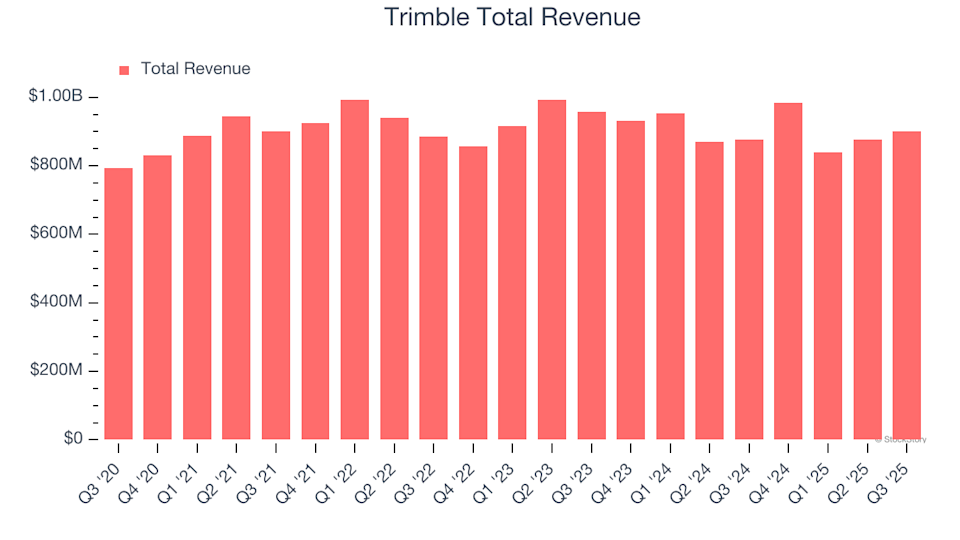

Trimble (TRMB) Set to Announce Earnings Tomorrow: What You Should Know

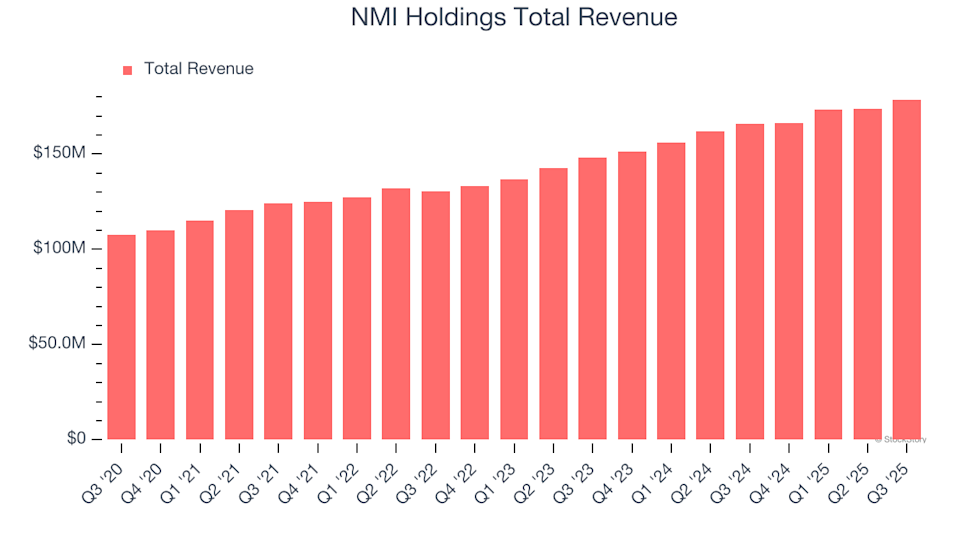

NMI Holdings (NMIH) Q4 Earnings Preview: Key Points to Watch

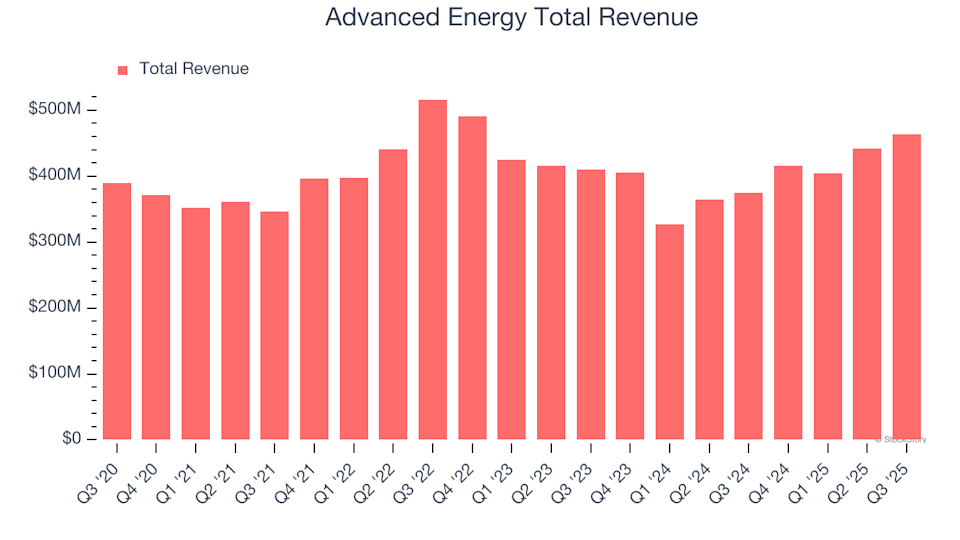

Earnings To Watch: Advanced Energy (AEIS) Will Announce Q4 Results Tomorrow

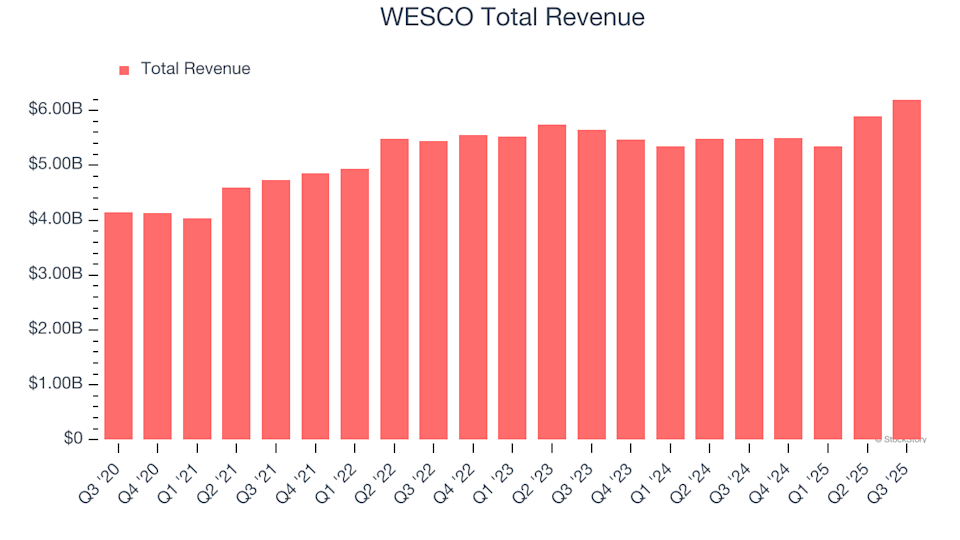

WESCO Earnings: Key Points to Watch for WCC