Concern among Gen Z drives surge in savings

Younger Generations Boost Savings After Economic Turmoil

Recent economic instability has prompted younger people, particularly those in Generation Z, to increase their savings at a faster rate than older age groups. Concerns about a growing youth unemployment crisis have led many to prioritize building financial reserves.

Analysis by Oxford Economics reveals that, following a period of high inflation and a challenging job market, savings rates have risen most sharply among Gen Z and younger millennials. In 2023, individuals aged 18 to 24 saved 10.4% of their income, up from 7.6% in 2019. This increase outpaces the overall population, whose savings rate grew from 7.5% to 9.4% over the same period.

The shift is largely attributed to the impact of economic shocks and heightened financial uncertainty, which have encouraged more young people to set aside funds for emergencies.

“The recent years of upheaval make up a larger portion of young people’s life experience, so they may be more inclined to see such volatility as normal going forward,” explained Michael Saunders, senior advisor at Oxford Economics.

Saunders also noted that older generations, who lived through the relatively stable 1990s and 2000s, are less likely to expect ongoing economic turbulence. He added that the “scarring effects” of recent crises are more pronounced among young people and renters, whose finances were hit hardest by pandemic lockdowns and energy price spikes.

“Young people and renters generally have less in savings compared to older adults and homeowners, making them more vulnerable to financial shocks,” Saunders said.

Challenging Job Prospects for Young Adults

The trend of increased saving among Gen Z coincides with a surge in youth unemployment, which has risen more rapidly in the UK than in any other G7 country, according to a recent PwC report. Approximately 15% of people under 25 are currently unemployed, up from just under 11% three years ago. The UK’s overall unemployment rate reached 5.1% in October, the highest since January 2021.

Meanwhile, those aged 25 to 34 are now saving a greater share of their income than any other age group, marking a significant shift in their financial habits. Their savings rate jumped to 12.45% last year, compared to 7.14% before the onset of pandemic-related lockdowns.

Reduced Spending and Slower Consumption Growth

As households work to rebuild their finances after years of high inflation, many Britons have cut back on non-essential spending. Data from the Office for National Statistics shows that the UK household saving ratio reached 9.5% in the third quarter of 2025, up from 5.5% during the same period in 2019.

This increased focus on saving has led to lower consumption levels in the UK compared to the US and eurozone. The Office for Budget Responsibility reported that real consumption in the UK declined by an average of 0.25% per year in 2023 and 2024, as more households prioritized saving for the future.

Economic Outlook and Expert Concerns

Economists closely monitor shifts in saving and spending, since consumer activity accounts for nearly two-thirds of the UK’s GDP and is a major driver of economic growth. However, with the OBR predicting just 1% growth in consumption this year, a surge in spending-led economic expansion appears unlikely as Britons continue to save at elevated levels.

Members of the Bank of England’s Monetary Policy Committee have expressed concern about these changes, noting that households are spending less even as their incomes rise. Megan Greene recently highlighted that the “scarring” effects of economic shocks and persistent inflation have led many to increase their savings as a precaution.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

PENGU Price Stalls Under Pressure — Is a Rebound Brewing?

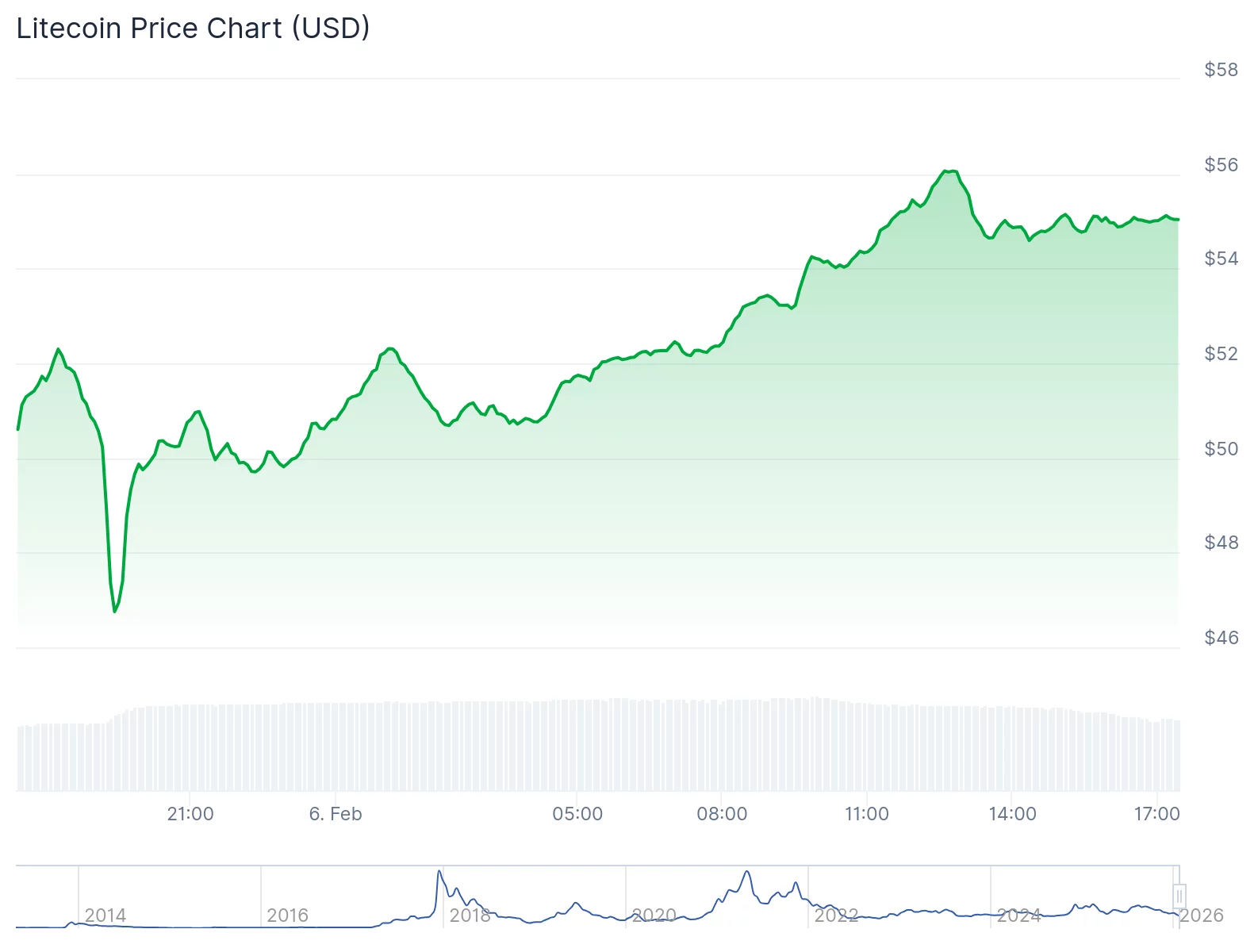

What’s surging Friday? Bitcoin, Litecoin lead the crypto rebound

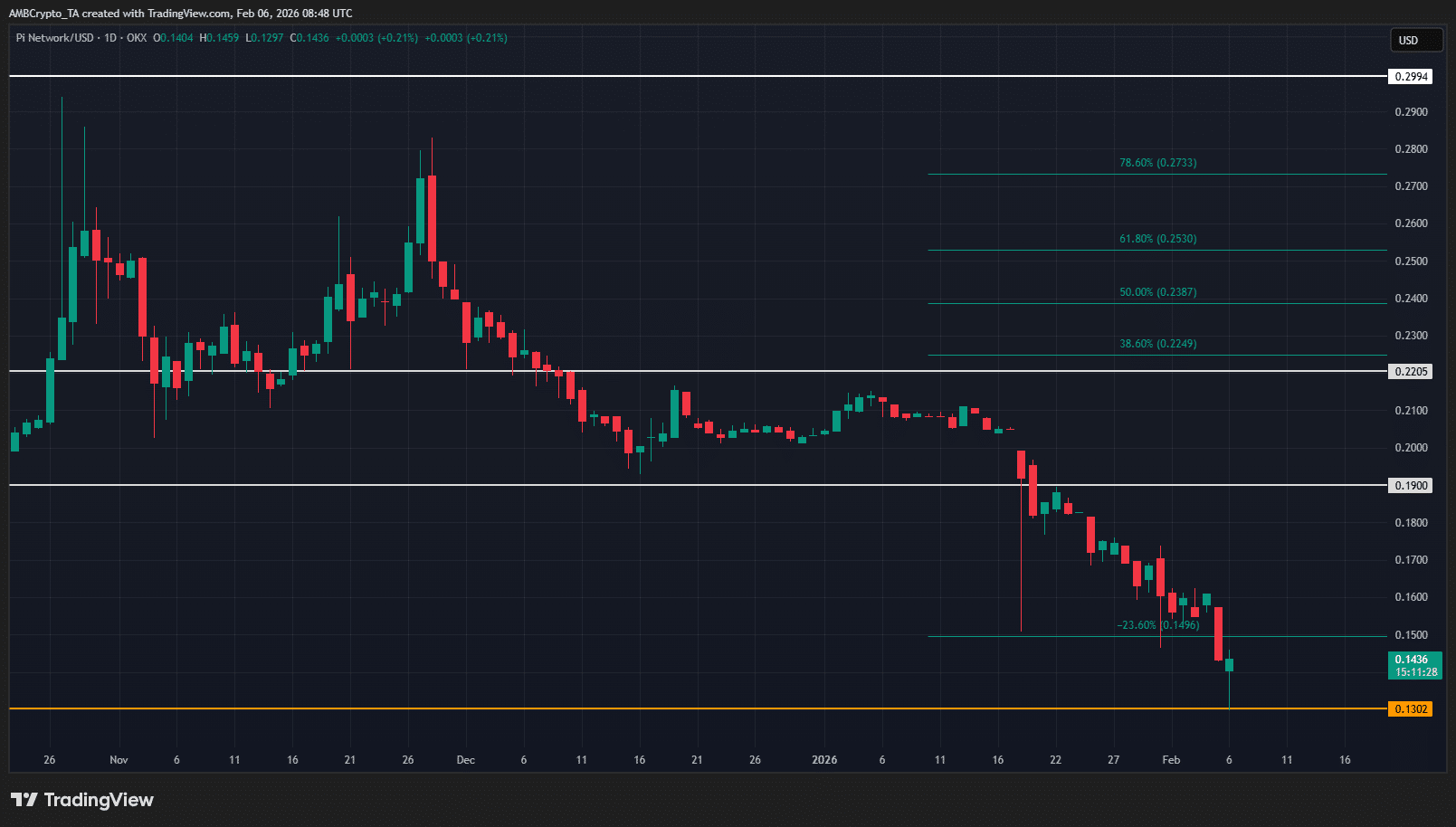

Pi coin price prediction – What next after altcoin rejects $0.190 retest?

XRP Will Rise as Alleged Bitcoin–Epstein Links Spark Sell-Off: Pundit