Newmark (NMRK) Shares Rise: Key Information You Should Be Aware Of

Recent Developments

Newmark (NASDAQ:NMRK), a real estate services provider, saw its stock price climb by 4.4% during the afternoon after facilitating the $425 million sale of The Shops at Skyview, a major retail complex located in Queens, New York.

In this significant transaction, Newmark acted as the representative for the seller, Perform Properties. The company not only managed the sale but also arranged a $289 million loan for the buyer to complete the purchase. The retail center, spanning 555,000 square feet and featuring prominent tenants such as BJ’s Wholesale Club, Target, and Nordstrom Rack, was 97% leased when the deal closed. Newmark’s involvement in both the sale and financing likely contributed to increased investor optimism regarding the company’s prospects.

Following the initial surge, Newmark’s shares settled at $17.52, reflecting a 4.4% gain compared to the previous closing price.

Market Perspective

Newmark’s stock has shown a degree of volatility, experiencing 13 separate movements exceeding 5% over the past year. Today’s price action suggests that investors view the recent news as important, though not transformative for the company’s overall outlook.

One of the most notable surges in the past year occurred 11 months ago, when shares jumped 12.1% after the company reported robust fourth quarter 2024 results, surpassing analyst revenue forecasts thanks to strong performance from its Investment Sales segment. Earnings per share and EBITDA also exceeded expectations, though full-year EBITDA guidance fell short. Despite this, the quarter delivered several positive highlights.

Since the start of the year, Newmark’s stock has risen by 3.3%. At $17.52 per share, it remains 10.5% below its 52-week peak of $19.58, reached in September 2025. An investor who purchased $1,000 of Newmark shares five years ago would now see that investment grow to $2,471.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

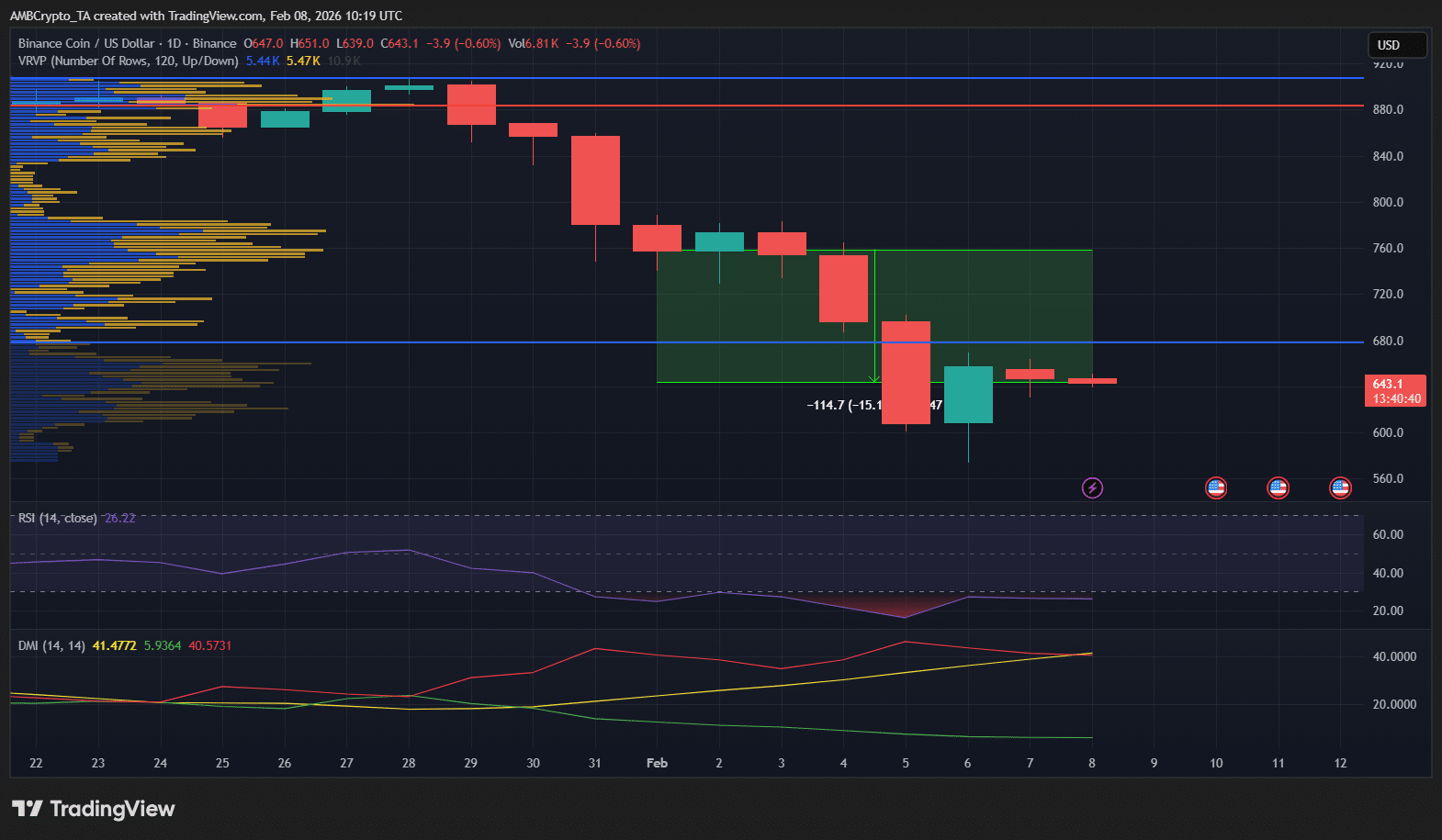

Crypto market’s weekly winners and losers – M, MYX, BNB, XMR, and more!

BNB Trading Heats Up, ADA Slips Toward Breakdown, While ZKP’s $5M Giveaway and 20% Referral Dominate

Quantum Computing’s Surprising Impact on Bitcoin’s Future

Goldman analysts caution that the wave of stock sell-offs may not be finished amid ongoing market volatility