Solana ETFs Outperform Bitcoin and Ethereum Amid Market Crash

By:BeInCrypto

Solanas latest price action killed any near-term shot at a run toward and through the $150 handle. SOL sold off hard in line with broader risk assets as macro uncertainty picked up. Even with that drawdown, holder behavior suggests conviction hasnt cracked. SOL investors largely kept a bullish bias, signaling confidence that goes beyond short-term price noise. Solana Sees Relatively Strong Investor Interest Solana spot ETFs printed a surprise $3.08 million in net inflows during a period of heavy market stress. Those flows came in as global equities were getting hit, and the broader crypto market saw more than $120 billion wiped off total capitalization. That divergence highlights SOLs ability to pull capital even in risk-off conditions. The contrast with other crypto products was clear. Bitcoin ETFs saw $483 million in net outflows on Monday as investors de-risked. Most major assets followed the same exit trend. Solana, however, bucked the flow, reinforcing a bullish narrative that could support a rebound.

Solana ETF Flows.

On-chain data tells a similar story. New address growth on Solana stayed relatively steady despite negative sentiment across markets. The network added roughly 8.6 million new addresses on Monday, followed by 8.4 million on Tuesday just a 2.38% drop. That level of consistency suggests demand hasnt materially rolled over. New address creation tends to reflect real usage and incoming interest rather than short-term speculation. Holding up through a drawdown points to underlying support that could help fuel a recovery once conditions improve.

Solana New Addresses.

Will SOL Price Heal Its Wounds? SOL is trading around $127 at the time of writing, down 12.8% on the week. Price defended the $125 support zone, preventing a deeper flush. That area is shaping up as a key near-term floor, with buyers stepping in to absorb supply. Relative strength still favors SOL versus other large caps. ETF inflows and steady network activity argue for a quicker bounce. A reclaim of $132 as support would open the door for a push through $136 and a partial retrace of recent losses. Solana Price Analysis.

The setup flips bearish if momentum stalls. A clean break below $125 would invalidate current support and shift sentiment lower. In that case, SOL could slide toward $119, extending the correction and sidelining the bullish case.

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

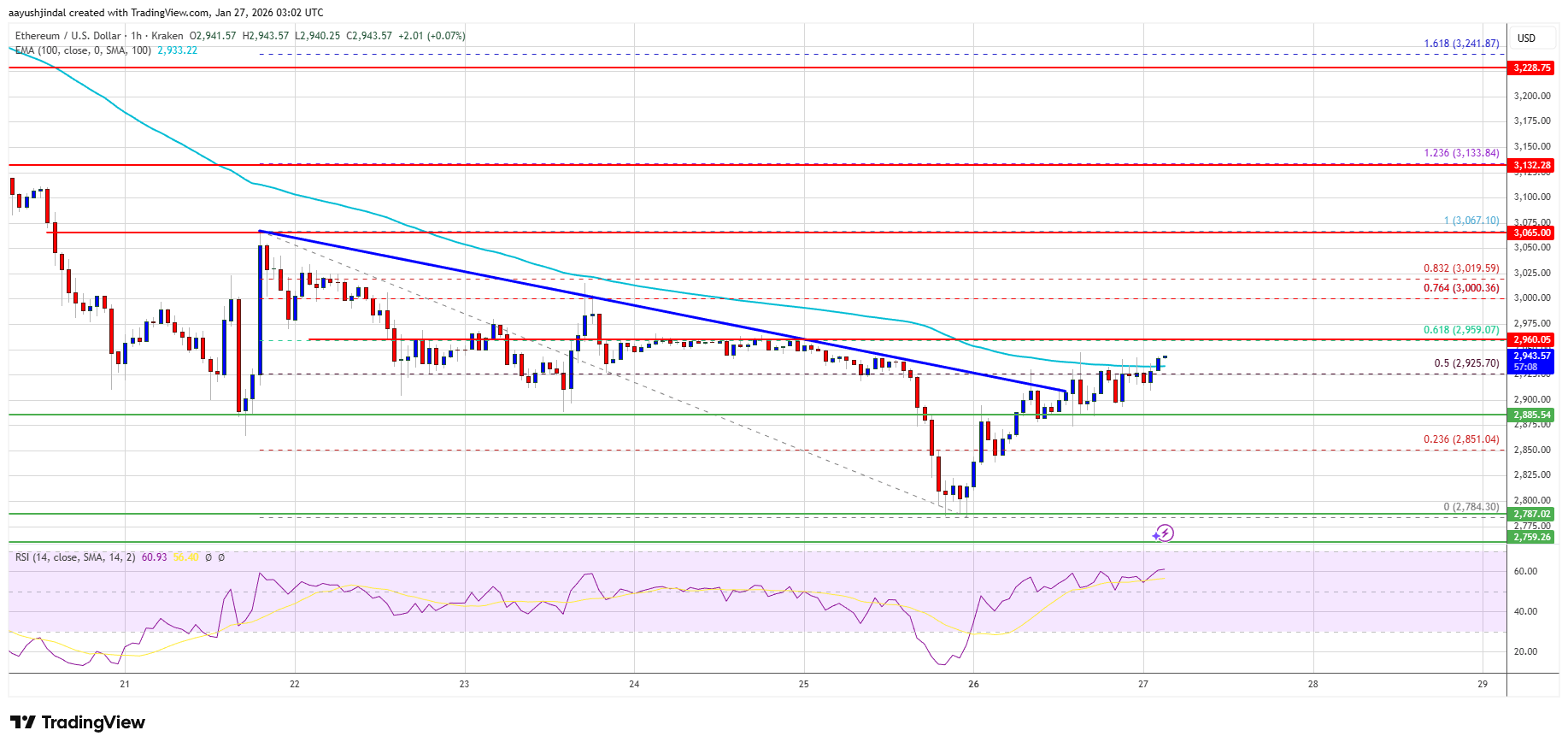

Ethereum Price Rebounds, Yet $3K Remains A Brutal Resistance Test

Newsbtc•2026/01/27 03:39

Stablecoin Withdrawals Indicate Capital Leaving While Bitcoin Remains Steady

101 finance•2026/01/27 03:36

North Korea–Linked Hackers Use Deepfake Video Calls to Target Crypto Workers

Decrypt•2026/01/27 03:29

Navient Earnings: Key Points to Watch for NAVI

101 finance•2026/01/27 03:21

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$88,680.38

+1.67%

Ethereum

ETH

$2,940.33

+3.43%

Tether USDt

USDT

$0.9987

+0.00%

BNB

BNB

$884.39

+1.96%

XRP

XRP

$1.91

+2.21%

USDC

USDC

$0.9997

+0.00%

Solana

SOL

$124.52

+2.58%

TRON

TRX

$0.2958

-0.12%

Dogecoin

DOGE

$0.1228

+1.14%

Cardano

ADA

$0.3531

+2.39%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now