Gold remains steady around $4,770 as Trump eases position on Greenland

Gold Holds Steady After Pullback From Record Highs

Gold (XAU/USD) edged higher by 0.25% during Wednesday’s North American session, stabilizing after touching a new record peak of $4,888 earlier in the day. The precious metal’s rally cooled as US President Donald Trump softened his stance on Greenland, clarifying that military intervention was not being considered. At the latest update, gold was trading at $4,772.

Geopolitical Tensions Ease, But Safe-Haven Demand Persists

Speaking at the World Economic Forum in Davos, President Trump avoided references to tariffs or military action regarding Greenland. However, he did caution that if no agreement was reached, he would evaluate Europe’s reaction to his proposals.

Meanwhile, the US Supreme Court did not issue a decision on Trump’s attempt to dismiss Federal Reserve Governor Lisa Cook. According to Bloomberg, the justices appeared cautious about supporting Trump’s efforts to remove Cook over alleged mortgage fraud.

Recently, President Trump reversed course on tariffs targeting eight European nations over Greenland, which were previously set to begin on February 1. He indicated that a framework for a future agreement with NATO had been established.

On the economic front, December’s US Pending Home Sales fell short of expectations, with the supply of existing homes dropping to its lowest level in five months, as reported by the National Association of Realtors.

Upcoming US Economic Data

Looking ahead to Thursday, key US economic releases include Gross Domestic Product (GDP) figures, Initial Jobless Claims, and the Federal Reserve’s preferred inflation measure, the Core Personal Consumption Expenditures (PCE) Price Index.

Market Highlights: Gold’s Rally Pauses Amid Shifting Trade Rhetoric

- A Reuters survey suggests the Federal Reserve is likely to keep interest rates unchanged at its January 27-28 meeting, with most economists predicting no rate cut until Chair Jerome Powell’s term concludes in May.

- Expectations are for continued robust economic growth, signaling that inflation may remain above the Fed’s 2% target. Despite this, money markets are pricing in at least two rate reductions.

- Concerns over the Fed’s independence have grown as the White House continues its investigation into the central bank’s building renovations, putting pressure on Powell.

- Pending Home Sales in the US dropped by 9.3% in December, marking the lowest level since July. The limited supply is attributed to homeowners holding mortgages below 5%, making them less likely to sell.

- US Treasury yields declined on Tuesday, providing support for gold prices. The yield on the 10-year Treasury note fell by nearly three and a half basis points to 4.261%. Meanwhile, the US Dollar Index (DXY) rebounded 0.27% to 98.82, which limited gold’s upward movement.

Technical Outlook: Gold Maintains Bullish Momentum

After reaching a historic high of $4,888, gold prices have pulled back but the overall upward trend remains strong. The Relative Strength Index (RSI) shows bullish momentum, with its upward slope indicating continued strength even as it remains in overbought territory.

If XAU/USD closes above $4,800, it could pave the way for a move toward $4,900, and a break above that level may set the stage for a test of the $5,000 mark. Conversely, a drop below $4,800 would bring the January 20 high at $4,766 into focus as the first support, followed by $4,700 if selling pressure persists.

Gold Daily Chart

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Shiba Inu Price Outlook As SHIB Burn Rate Explodes 2800% in 24 Hours

Fed day could lift the euro to 1.20 for the first time since 2021

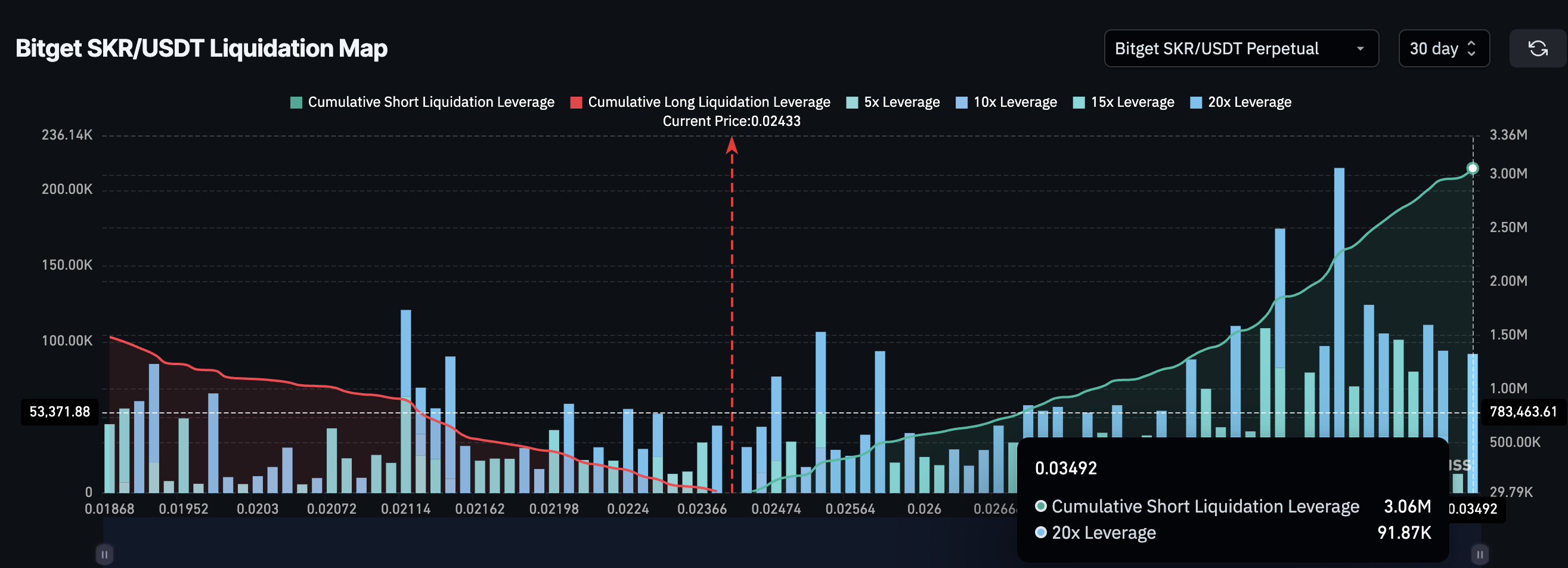

Why Solana’s Seeker (SKR) Now Depends on Bears to Avoid a 17% Price Crash

Two Analysts Claim Secret Connection Between Ripple and Major Institutions: Here’s What You Need to Know