Gen Z in the US Places Greater Confidence in Cryptocurrency Over Traditional Banks, Desiring More ‘Autonomy and Empowerment’

Young Americans Show Greater Confidence in Crypto Over Traditional Finance

In the United States, younger adults are increasingly turning to cryptocurrencies, expressing more trust in digital assets than in conventional financial systems. Their financial behaviors are influenced by a desire for greater access, personal control, and flexible asset management.

According to research from Protocol Theory, a firm specializing in consumer crypto trends, Generation Z values the ability to monitor their holdings, maintain authority over their assets, and decide between self-custody or using regulated services.

The findings reveal a clear preference: nearly half of Gen Z respondents have used a crypto exchange, and over a third currently hold or use cryptocurrencies.

Gen Z’s approach to asset management is diverse. While 56% prefer to manage their crypto independently, 51% are also comfortable entrusting their assets to banks or regulated entities.

Jonathan Inglis, CEO of Protocol Theory, explained to Decrypt that these choices are shaped by economic realities, particularly as younger people feel excluded from traditional financial opportunities. He emphasized that “agency and control” are key motivators for this demographic.

Inglis also noted a generational divide in trust: 22% of Gen Z and 24% of Millennials have more faith in crypto than in banks to protect their wealth, compared to just 13% of Gen X and 5% of Boomers. This means Gen Z is nearly twice as likely as Gen X, and over five times as likely as Boomers, to trust crypto above banks.

Despite these trends, skepticism about cryptocurrencies remains widespread among the general public.

Data from the Pew Research Center in 2024 highlights that Americans’ confidence in the safety and reliability of crypto varies significantly by age. Adults over 50 are more likely to express doubts, while overall adoption remains modest—only 17% of U.S. adults have invested in, traded, or used crypto, with younger individuals making up the majority of users.

Pew’s research also indicates that crypto adoption rates have stayed consistent over the past three years. Among adults aged 18 to 29, 29% have engaged with crypto, compared to just 8% of those over 50—a disparity of more than threefold.

Crypto’s Growing Role in Home Financing

The influence of younger generations is beginning to reshape the housing finance sector, as crypto assets gain recognition in mortgage considerations.

Newrez, a major U.S. mortgage lender managing approximately $778 billion in loans, announced to Decrypt that it will start including Bitcoin and Ethereum holdings when evaluating certain mortgage applications.

Baron Silverstein, president of Newrez, stated that this initiative is aimed at younger buyers, noting that future homeowners are increasingly holding crypto compared to older generations.

Shifting Policies and the American Dream

In June of last year, Bill Pulte, director at the U.S. Federal Housing Finance Agency, confirmed that the agency would review how crypto assets should be factored into mortgage risk assessments.

Recently, President Donald Trump signed an executive order limiting large Wall Street firms from purchasing single-family homes, urging Congress to prioritize related legislation. “Homes are built for people, not for corporations,” Trump stated in a public announcement.

Trust and Control: The Future of Finance

Insights from consumer research, as well as developments in housing and regulation, suggest that issues of trust and autonomy are extending beyond everyday transactions to influence long-term financial planning.

Inglis remarked, “Trust is maintained when individuals can verify activity and maintain control, but it erodes when people feel solely responsible without adequate safeguards, clear solutions, or reliable access.”

A recent OKX crypto exchange survey supports these findings, showing that adults under 45 are more likely to trust crypto platforms than those aged 50 and above.

An OKX spokesperson told Decrypt that Gen Z and younger Millennials, having grown up in a digital environment, place a premium on security, transparency, and control—qualities they expect from financial platforms.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

UNH Q4 Analysis: Profit Squeeze, Shrinking Membership, and Medicare Challenges Influence Future Prospects

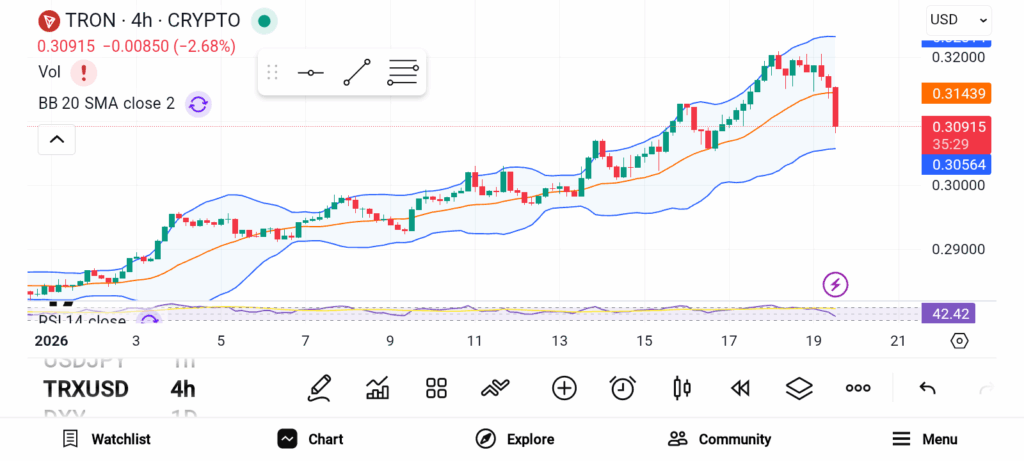

3 Altcoins to Invest in February 2026 — ADA, TRX, and HYPE

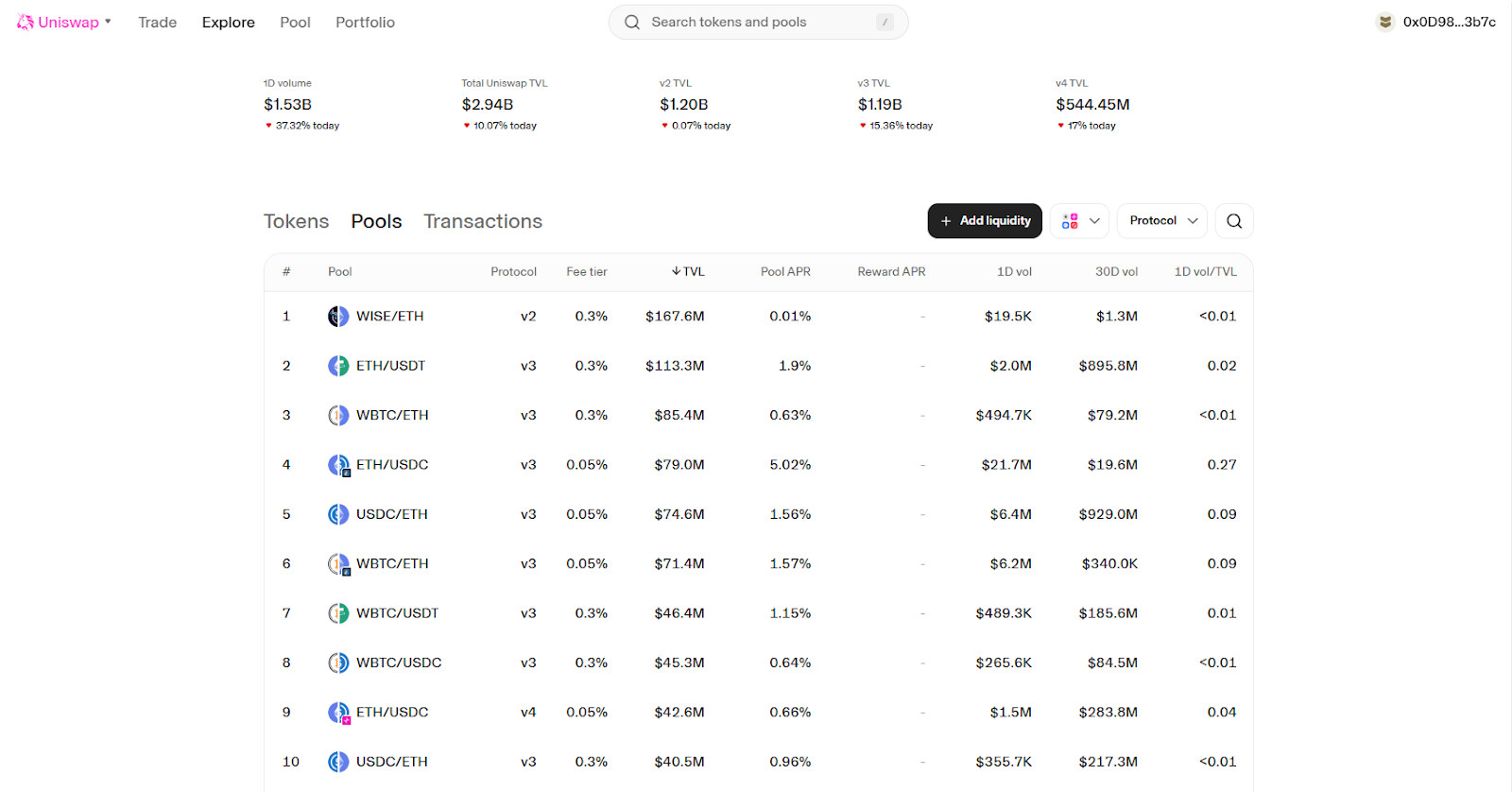

How Crypto Market Liquidity Actually Works

Ethereum Makes Progress Toward Quantum Resilience