Intel’s upcoming earnings will challenge the recent stock surge as investors on Wall Street become increasingly optimistic about the company’s standing in the AI sector

Intel's Upcoming Earnings: What Investors Should Watch

Intel (INTC) is scheduled to announce its earnings after markets close on Thursday. The results could either reinforce or challenge the chipmaker’s impressive 47% stock surge over the past month, which has been fueled by renewed optimism on Wall Street regarding Intel’s much-anticipated turnaround.

Demand for Intel’s core CPUs, especially from data centers embracing advanced AI technologies, has been on the rise. The introduction of Intel’s Panther Lake chips for AI-powered PCs has prompted several investment firms, such as HSBC and KeyBanc, to upgrade their outlook on Intel in recent weeks. These upgrades, along with public backing from President Trump, have helped propel Intel shares nearly 12% higher in a single day, reaching their highest point in four years.

Key Areas of Focus for Analysts

- Fourth-quarter financial performance

- Guidance for the upcoming quarter

- Management’s insights on data center growth, AI PC adoption, and manufacturing progress through Intel Foundry Services

Despite the recent wave of positive analyst sentiment, forecasts compiled by Bloomberg suggest Intel’s earnings per share will drop 33% year-over-year to $0.09, with revenue expected to decline 6% to $13.4 billion. According to Morningstar analyst Brian Colello, the recent rally in Intel’s stock price, despite these muted expectations, indicates that investors are hoping the results will be “less disappointing than feared.”

Competitive Pressures and Manufacturing Challenges

Intel remains the only major U.S. chipmaker operating at the cutting edge of manufacturing, with support from both the federal government and Nvidia (NVDA). However, the company faces stiff competition from AMD and Arm, intensifying the pressure on Intel’s product and manufacturing divisions as they work to recover from previous setbacks.

One immediate hurdle is the significant investment required for developing the 18A and future manufacturing nodes, which is expected to impact profit margins.

“Much of the optimism around Intel’s stock isn’t tied to this quarter’s earnings per share, but rather whether the company is positioning itself for long-term sustainability,” Colello observed. “The recent stock movement suggests there’s growing confidence in that direction.”

Another risk is that rising memory and storage costs—essential components used with Intel CPUs in servers and PCs—could dampen demand for systems built with Intel chips, ultimately affecting the company’s profitability.

Industry Perspectives and Future Outlook

TECHnalysis chief analyst Bob O’Donnell commented, “If not for ongoing DRAM shortages and related issues, sentiment would be even more positive. The big question is whether higher DRAM prices will discourage companies from purchasing new PCs.”

If Intel can demonstrate robust AI-driven demand for its server CPUs and secure major customers for its foundry services, the stock’s upward trend could continue.

HSBC analyst Frank Lee recently upgraded Intel to Hold, noting that the company’s manufacturing arm is attracting more external clients. Meanwhile, KeyBanc’s John Vinh predicts that Apple (AAPL) could utilize Intel’s forthcoming 14A process for lower-end iPhone chips as early as 2029.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Altcoins Show Resilience Despite BTC’s Downturn

Why is GameStop stock rallying today?

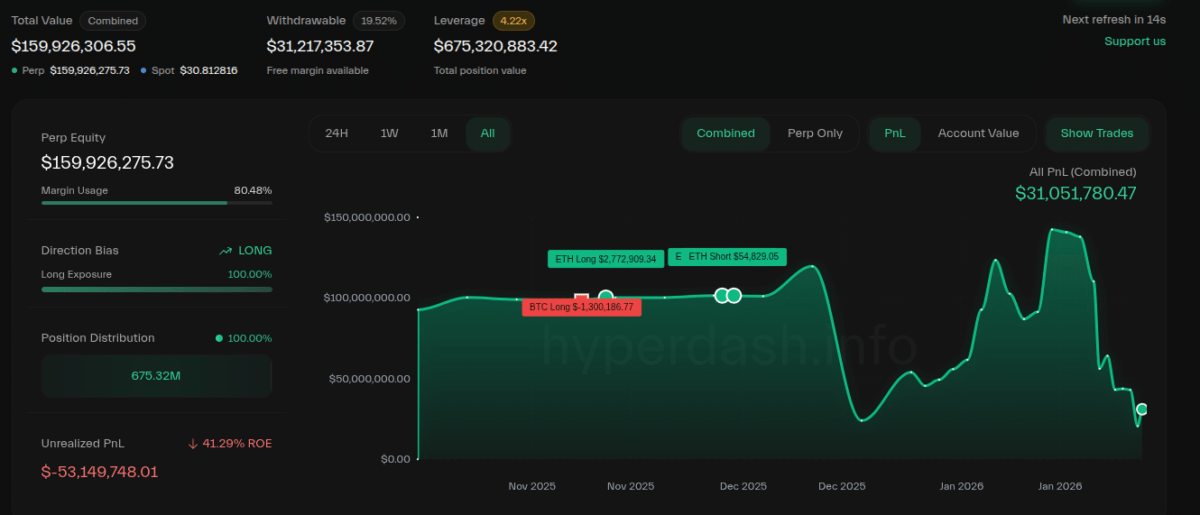

“Trump Insider Whale” Turns Bearish, Closes BTC, ETH Long Positions at $10M Losses

Nvidia unveils AI models for faster, cheaper weather forecasts