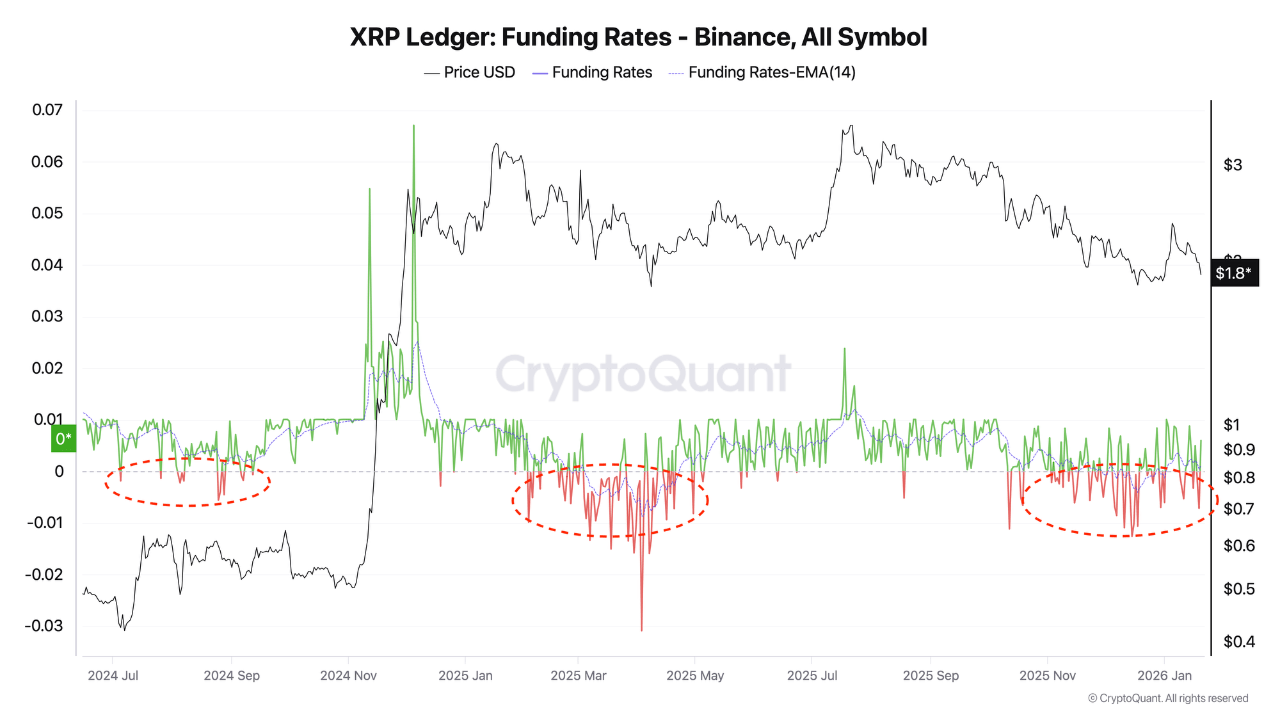

XRP Distribution Phase Continues, But Funding Rates Suggest Shorts Are Overextended

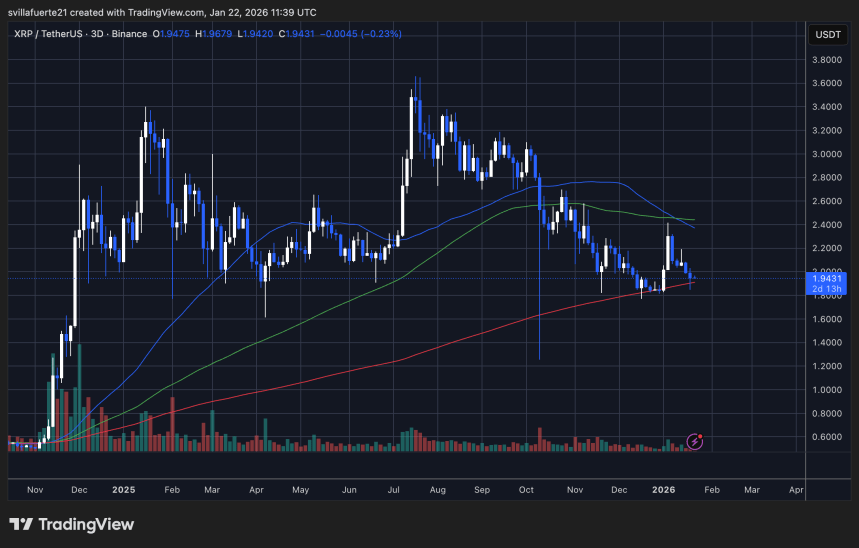

XRP is testing demand below the $2 mark as the crypto market struggles to find stability amid rising uncertainty. After weeks of choppy price action and failed recovery attempts, traders are watching whether buyers can defend this zone or if another wave of selling pressure will push XRP into a deeper pullback. The broader market environment remains fragile, and risk appetite has weakened, keeping volatility elevated across major altcoins.

XRP is currently trading around 47% below its last all-time high from July 2025, highlighting how far the price has retraced since peak bullish momentum. However, this move is not necessarily abnormal. After an exceptional rally of more than 600% since November 2024, the market has naturally shifted into a phase of distribution and correction, as early buyers take profits and late entrants are forced to de-risk. This type of cooldown is often needed to reset positioning and rebuild a healthier structure for the next trend.

The current range suggests XRP is transitioning into a more balanced market where demand and supply are attempting to re-align. If buyers continue to step in near key support levels, the correction could evolve into a longer phase.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP Price Prediction as Ripple Scores Big Partnership in Cash-Rich Saudi Arabia

The Untapped Potential of Thermal Batteries in Advancing the Energy Transition

XRP price ‘liftoff’ to $10 will take time, traders say

Macro Shocks Hit Crypto as Liquidations Top $550 Million

XRP Ledger Funding Rates | Source:

XRP Ledger Funding Rates | Source:

XRP testing critical demand level | Source:

XRP testing critical demand level | Source: